Sanrio Reduces Dependence on Hello Kitty Strategy

Shows Third Highest Preference Domestically

Accelerates Settlement with Detailed Character Branding

Sseuji President "Considered Consumer Contact from Development Stage"

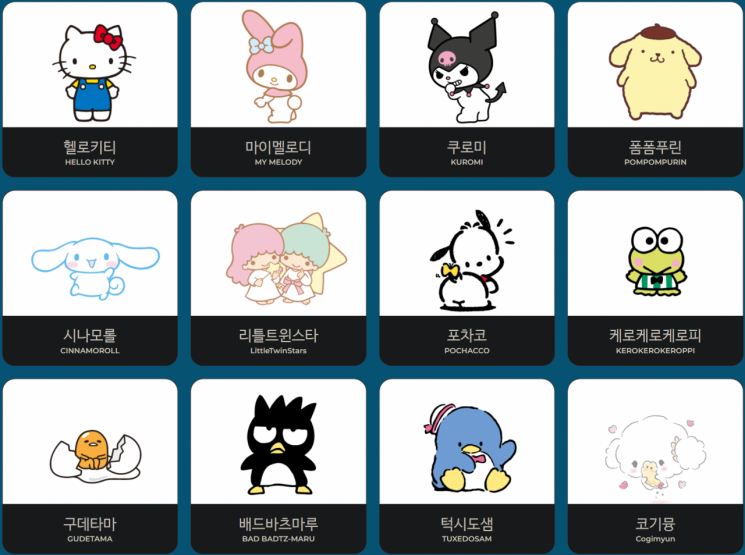

Hello Kitty, My Melody, Kuromi, Pompompurin, Gudetama, Cinnamoroll, Pochacco... Sanrio characters have surged in popularity domestically this year. According to the report '2023 Character User Survey' published by the Ministry of Culture, Sports and Tourism and the Korea Creative Content Agency, they ranked third (9.4%) in preference following 'Porong Porong Pororo (14.4%)' and 'Kakao Friends (12.6%)'. Considering that Hello Kitty, a representative character last year, ranked tenth (2.2%), this is a noteworthy development.

The secret lies in effective licensing business operations. Tsutsui Tomokuni, president of Sanrio, stated in his keynote speech at the opening ceremony of 'Content IP Market 2023' held on the 28th at COEX in Gangnam-gu, Seoul, "Our characters do not have fixed stories or personalities," adding, "Each can be given their own story or personality, allowing for diverse licensing businesses." Sanrio has been collaborating with numerous companies by promoting characters without fixed roles, including Nike, Adidas, Chlo?, and Taiwan's Grand Hi-Lai Hotel.

It has not always been a smooth journey. Sanrio overly relied on Hello Kitty in product planning and brand collaborations, accounting for 99% of North American sales in 2017. Last year, the proportions changed: Hello Kitty accounted for 40%, Kuromi 13%, and My Melody 11%. As multiple characters gained popularity, opportunities for business diversification opened up.

The same applies domestically. Among women in their teens to thirties this year, Cinnamoroll, My Melody, and Kuromi received great love. Jeon Jiho, senior researcher of the Industry Information Team at the Korea Creative Content Agency, who oversaw the '2023 Character User Survey,' analyzed, "The significant rise in preference for Sanrio characters is largely thanks to the popularity of sub-characters," adding, "There is a tendency to welcome new characters rather than Hello Kitty, which they have been exposed to since childhood."

This is not unique to Sanrio. Porong Porong Pororo's top preference this year is largely due to Janmalu Pi. Iconix reinterpreted familiar sub-characters to fit the latest trends, creating a fresh breeze. Senior researcher Jeon explained, "This is a case where the success process and system of the main character were actively introduced to sub-characters," adding, "The generation that grew up watching Pororo accepted it as an extension of the content they experienced in childhood, gaining great popularity." He further noted, "It can also be interpreted as a new spin-off character developed with a separate worldview and brand."

The establishment of sub-characters depends on how character branding is handled. In the past, Sanrio focused on increasing character utilization on items sold in stores. Now, they consider consumer touchpoints from the character development stage. The 'Kawaii Project' launched in March is a representative example. They conducted voting on social networking services (SNS) to select a character to debut. President Tsutsui explained, "Hanamaru, a ghost that draws flowers, was launched in March after voting," adding, "It received over 3.9 million votes."

Sanrio also targeted idol fandoms through collaborations with K-pop groups. In June last year, they created characters highlighting the features of NCT members in partnership with SM Entertainment. They planned and sold products using these characters, achieving considerable sales. An SM Entertainment official commented, "Fans lined up daily in front of the pop-up store, showing a hot response," and praised it as "a good collaboration case utilizing artist IP." President Tsutsui also said, "NCT members revealed the character creation process on YouTube, attracting idol fandom," and added, "We plan to increase collaborations with K-pop groups."

The structure to generate related revenue is already established. They are applying the business strategies accumulated through merchandising, licensing, and distribution in Japan directly to the domestic market. Using character IP, they plan and sell various products and operate attractions such as Hello Kitty Island Jeju to provide experiences. According to the '2023 Character User Survey,' among products utilizing character IP, Sanrio sold the most in stationery & fancy goods (31.%), miscellaneous goods & accessories (28.8%), fashion apparel (19.8%), and beauty & cosmetic products (18.3%).

President Tsutsui said, "Thanks to the know-how accumulated from conducting over 1,000 licensing deals in more than 100 countries," adding, "We now want to grow beyond character-centered business into a comprehensive entertainment company." He stated, "We will produce various contents with multiple partners, including Korean companies, and aim for sales of 1 trillion yen (approximately 8.7361 trillion KRW) and operating profit of 50 billion yen (approximately 436.8 billion KRW)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.