FSS Develops Measures to Strengthen Internal Controls in Insurance Companies

"Overheating Competition in Insurance Products Also Due to Internal Controls"

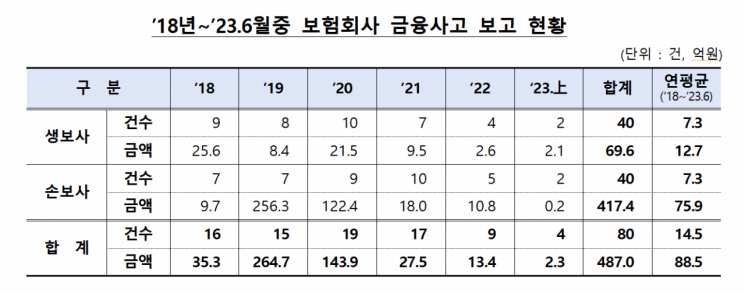

It has been revealed that insurance companies have experienced financial incidents such as embezzlement averaging 8.9 billion KRW annually since 2018. Since there were no specific and agreed-upon standards, financial authorities have decided to organize and strengthen related measures.

On the 28th, the Financial Supervisory Service (FSS) held a meeting with internal control officers such as auditors and compliance officers from 41 insurance companies at the Life Insurance Association Education and Culture Center in Jongno-gu, Seoul, to discuss ways to strengthen internal controls.

According to the FSS, from 2018 to June of last year, insurance companies reported an average of 14.5 financial incidents per year, amounting to 8.85 billion KRW. Small-scale financial incidents involving insurance planners or employees embezzling or misappropriating insurance premiums or insurance contract loans have been continuously occurring every year.

The FSS confirmed that compliance personnel accounted for 0.8% of total employees in insurance companies, with about 72.0% of them being specialists. Some companies did not monitor self-inspections of internal controls by operational departments or failed to take proper actions on deficiencies found during inspections.

Internal financial incident prevention systems such as job rotation, mandatory leave, and whistleblowing systems were also not properly operated in insurance companies. Due to the lack of specific and agreed-upon guidelines, internal regulations of each company were insufficient or lacked effectiveness.

In the case of job rotation, exceptions were arbitrarily allowed, and there were no grounds for measures in case of non-compliance, resulting in a high proportion of long-term assignments. Regarding mandatory leave, where companies order sudden leave and audit work contents for employees handling high-risk tasks with a high probability of financial incidents, cases were found where those responsible for managing high-risk assets such as real estate project financing (PF) loans were excluded.

The whistleblowing system also lacked detailed compensation standards or procedures, resulting in inadequate implementation, and financial incident prevention guidelines were often limited to general and declarative content.

Accordingly, the FSS has instructed insurance companies to enhance the expertise and roles of compliance personnel and to establish detailed operational standards for job rotation, mandatory leave, whistleblowing, and incident prevention measures. Immediately actionable items were recommended to be reflected in personnel management and next year’s business plans for implementation.

Additionally, next month, an internal control workshop for insurance company audit departments will be held to disseminate these measures, and in the first half of next year, a task force (TF) will be formed with the Life and Non-life Insurance Associations and the insurance industry to develop model guidelines for preventing financial incidents.

Cha Suhwan, Deputy Director of Insurance at the FSS, said, "We hope that these strengthened measures will be properly implemented by organizing the system and fostering an internal control culture. Also, recently, reckless competition in insurance products has been repeated, which reflects a failure of internal control functions related to product screening. We ask audit and compliance departments to take responsible roles."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)