Kiwoom Securities Leads... Repayment of Acquisition Financing, Large-Scale Dividend Planned

'Dividend→IPO→Management Rights Sale' Stepwise Investment Recovery Strategy

Institutional Investor Pressure Due to Delay in YogiYogeo Sale

British private equity firm CVC Capital, which owns the accommodation and leisure platform "Yogi-ottae," has raised 315 billion KRW in funding. It is reported that they plan to conduct a large-scale dividend payout through recapitalization by repaying the acquisition financing borrowed to acquire the controlling stake in Yogi-ottae and increasing the loan size.

According to the investment banking (IB) industry, CVC Capital raised 315 billion KRW through Vacance Company Limited. Vacance Company is a special purpose company (SPC) established by CVC Capital to acquire the controlling stake in Yogi-ottae. Kiwoom Securities acted as the financial advisor.

CVC Capital put up the Yogi-ottae shares held by Vacance Company as collateral. The loan was executed in two parts according to collateral rights and repayment priority: a 215 billion KRW loan agreement A (Facility A) and a 100 billion KRW revolving credit facility (Facility B). The loan maturity is five years, with an interest rate exceeding 6% for the senior tranche.

Vacance Company primarily uses the raised funds to repay the existing acquisition financing. Additionally, by increasing the loan size beyond the previous acquisition financing, it is expected to pay large dividends to the investors (LPs) who invested in Vacance Company. This is interpreted as pressure from institutional investors seeking to recover at least part of their investment due to delays in the sale of Yogi-ottae.

Yanolja's competitor and the second-largest domestic accommodation platform, Yogi-ottae, was founded in 2014 by former CEO Shim Myeong-seop, who sold the controlling stake to CVC Capital in 2019. At the time of sale, the company was valued at 300 billion KRW. During the process of receiving new investments last year, it was valued at over 1.2 trillion KRW, growing its corporate value to four times that at acquisition.

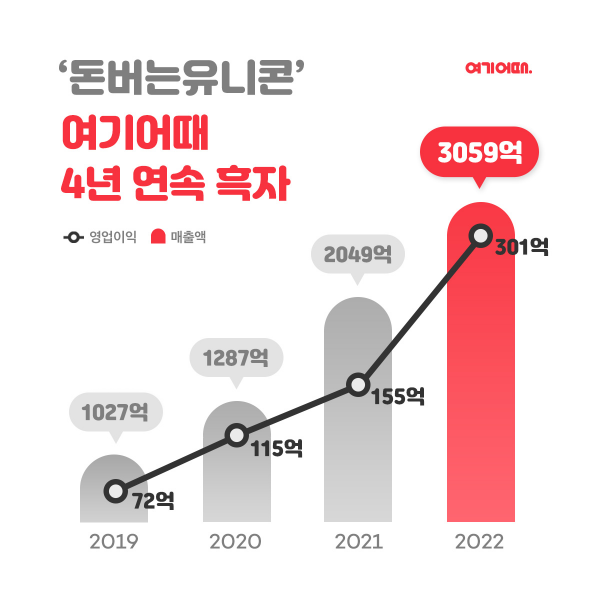

Despite the decline in travel demand due to COVID-19, Yogi-ottae showed steep performance growth. Recently, fueled by revenge travel and other factors, its performance growth has been significant. Last year, annual sales and operating profit reached 305.9 billion KRW and 30.1 billion KRW, respectively, marking growth of 49.3% and 94.2% compared to the previous year.

CVC Capital has been pursuing the sale of Yogi-ottae since early this year, the fourth year of its investment. They have contacted potential domestic and international buyers to explore mergers and acquisitions (M&A), but no sale has been finalized yet. If an immediate sale is difficult, it is expected that an IPO will be pursued to exit part of the stake. After listing, they are likely to sell some shares and then proceed with the sale of the controlling stake.

Some in the industry predict that if Yogi-ottae goes public, its corporate value could approach 2 trillion KRW. An IB industry insider said, "As pressure from institutional investors to recover funds increases, it appears they are taking a stepwise approach to capital recovery through recapitalization and listing," adding, "With rapidly increasing performance, they are expected to demonstrate successful investment results."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.