This Year’s Securities Firms Financial Accident Losses Reach 66.8 Billion KRW, Record High

Meritz Securities Employee Misuses Internal Information, Kiwoom Securities Faces Uncollected Funds Incident

FSS Selects Enhancing Securities Firms’ Internal Control Effectiveness as Key Task for Next Year

Securities Industry to Reassess and Supplement Systems from Ground Up... Focus on Risk Management

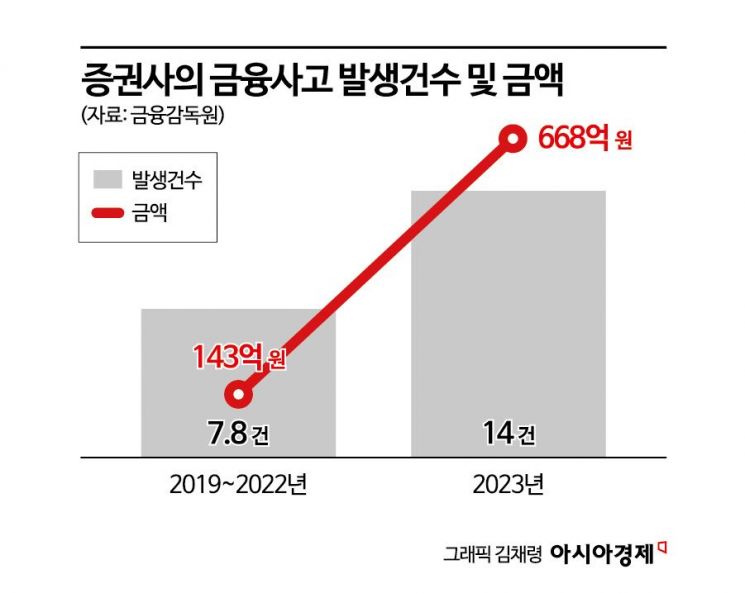

#1. 66.8 billion KRW (14 cases). This is the scale of losses from financial accidents at securities firms that occurred this year. It is at an all-time high level. Compared to an average of 7.8 cases and 14.3 billion KRW in losses annually from 2019 to 2022, this is a significant increase.

#2. Last month, the Yeongpung Paper stock manipulation incident caused 494.3 billion KRW in unpaid balances at Kiwoom Securities. Excluding 61 billion KRW recovered through forced sales, Kiwoom Securities' loss amounts to 433.3 billion KRW, exceeding its net profit for the first half of the year. On the 9th, Hwang Hyun-soon, CEO of Kiwoom Securities, conveyed to the board his intention to resign, taking moral responsibility for the unpaid balance crisis.

#3. The Financial Supervisory Service (FSS) announced last month that its planned inspection of Meritz Securities uncovered allegations that some employees in the Investment Banking (IB) division created a separate corporation (SPC) to exploit advance information on KOSDAQ companies for personal gain. It was found that profits from direct investments in convertible bonds (CBs) and bonds with warrants (BWs), or investments made under the names of family and relatives, amounted to tens of billions of KRW. Meritz Securities explained that it recommended the resignation of 6 to 7 related employees at once, attributing the issue to individual misconduct. However, the FSS criticized this as a failure of the company's internal controls.

The Background of Repeated Incidents in the Capital Market: Insufficient Internal Controls

Next year, 'internal control' is expected to become the biggest issue in the capital market. Financial and supervisory authorities have warned that they will not tolerate 'illegal' activities occurring in the domestic capital market. They view the unhealthy practices of securities firm employees not as 'individual misconduct' but as 'insufficient internal controls.' They have taken a tough stance, stating that if internal control systems are not reviewed and improved from the ground up to eradicate illegal activities, responsibility will be held. The FSS announced, "Enhancing the effectiveness of securities firms' internal controls" will be selected as a major task for next year. As a result, tension in the securities industry is rising.

The FSS sees the recent series of problems in the capital market, such as the stock price crash caused by Contracts for Difference (CFD) in April and the stock manipulation incidents involving Yeongpung Paper and Daeyang Metal in October, as stemming from insufficient internal controls.

According to the FSS, between 2019 and 2022, the average annual number of financial accidents was 7.8 cases, with losses around 14.3 billion KRW. However, this year, the number of financial accidents doubled to 14 cases, and the amount of losses increased 4.7 times to 66.8 billion KRW. Types of incidents included employees arranging private loans, forging private documents, misappropriating customer funds, and embezzlement.

The FSS has completely reorganized its financial investment inspection organization to respond swiftly and systematically to unfair and unhealthy business practices. It plans to focus inspection capabilities on sectors where unhealthy practices frequently occur, such as private convertible bonds (CBs) and real estate project financing (PF), and will continue inspections in these areas next year. The FSS also warned that if financial accidents are concealed through non-reporting or delayed reporting, or if internal control duties are neglected, auditors, compliance officers, and Chief Risk Officers (CROs) will be held accountable.

Hwang Sun-oh, Deputy Director of Financial Investment at the FSS, pointed out, "Several cases were confirmed during FSS inspections where the details of financial accidents were not accurately communicated to top management or audit committees and were lightly punished and closed at the operational level. This is not individual misconduct but an issue that should be prevented and managed through internal controls."

The FSS has urged securities firms to review and supplement their internal control systems from the ground up. It criticized the repeated behavior where the entire IB division at Meritz Securities was involved in illegal acts such as misuse of job information and embezzlement, but the company failed to recognize the facts and ultimately blamed it on individual misconduct. FSS Governor Lee Bok-hyun said, "This is the result of the comprehensive failure of normal corporate ethics and control systems within the company," adding, "An inspection of the investment process itself is necessary."

Focused Investigation on Securities Firms' Potential Abuse of Short Selling

Following the recent announcement of improvements to the short selling system, the Financial Services Commission and the FSS emphasized that securities firms must also enhance their internal control functions to eradicate illegal short selling. The FSS plans to investigate not only global investment banks (IBs) that engage in illegal short selling but also domestic custodian securities firms. They will check whether domestic securities firms fulfill their obligations to accept short selling orders from global IBs. The FSS explained, "We plan to focus on the short selling order acceptance process and the ability to detect illegal short selling orders," and "Additionally, during investigations into illegal short selling, we will closely examine the potential abuse of short selling through insider trading and market manipulation." Currently, sanction procedures are underway for malicious naked short selling using block deal information. An FSS official said, "We will maintain close communication with the industry and actively cooperate to explore improvement measures for strengthening internal controls."

Lee Bok-hyun, Governor of the Financial Supervisory Service, is speaking at the Financial Supervisory Service Governor-Accounting Firm CEO Meeting held at the Korean Institute of Certified Public Accountants in Seodaemun-gu, Seoul, on the morning of the 6th.

Lee Bok-hyun, Governor of the Financial Supervisory Service, is speaking at the Financial Supervisory Service Governor-Accounting Firm CEO Meeting held at the Korean Institute of Certified Public Accountants in Seodaemun-gu, Seoul, on the morning of the 6th. [Image source=Yonhap News]

Orders to Strengthen Internal Controls in Accounting Firms

The authorities have also ordered accounting firms to strengthen internal controls. Since fraudulent and illegal acts by listed companies are closely related to accounting work, this means urging accounting firms and their certified public accountants to enhance internal controls to eradicate fraudulent acts. On the 6th, FSS Governor Lee Bok-hyun met with CEOs of accounting firms and urged them to improve audit capabilities to maintain a high level of audit quality and to strengthen internal controls within accounting firms to enhance the social trust of certified public accountants. He also emphasized the need to carefully monitor companies' internal controls as the increase in companies at risk has raised incentives for earnings manipulation. Governor Lee said, "Recent fraudulent acts such as false hiring of family members of certified public accountants, involvement in stock manipulation, and leakage of audit information can instantly destroy trust in the accounting industry," and stressed, "Accounting firms must strengthen internal controls themselves and make efforts to raise the ethical awareness of their members."

This stance from the authorities has heightened tension in both the securities and accounting industries. Choi Hee-moon, Vice Chairman of Meritz Securities, said, "Since there are concerns related to private CBs, we will focus on reviewing investment processes and strengthening internal controls," adding, "We are currently reviewing all internal control tasks and will immediately improve any deficiencies found." Kiwoom Securities is discussing the appointment of a successor to CEO Hwang Hyun-soon, who has expressed his intention to resign to the board. A senior official in the financial investment industry said, "Since the authorities have ordered strengthened risk management for retail customers in unpaid transactions, credit loans, and CFDs, the entire industry will have no choice but to tighten the reins." Professor Jang Jeong-ae of Ajou University Law School advised, "When violations are discovered, an internal control system should be established and operated in a way that allows immediate reporting or notification to seek corrective actions, thereby fulfilling the duty of supervision."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.