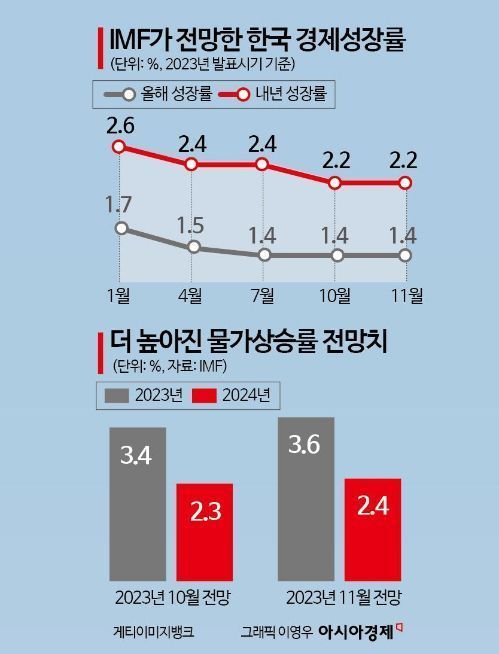

The International Monetary Fund (IMF) has revised upward its inflation rate forecasts for South Korea to 3.6% for this year and 2.4% for next year. It expects that the government’s inflation target of 2% will be achievable by the end of next year. To stabilize prices, the IMF recommended maintaining the current high interest rate stance for a considerable period and cautioned against prematurely easing monetary policy, given the persistent potential risks such as high household and corporate debt.

According to the Ministry of Economy and Finance on the 17th, the IMF released the "2023 Korea Article IV Consultation Report" containing these details. In the report, the IMF projected South Korea’s inflation rate at 3.6% for this year, which is 0.2 percentage points higher than the 3.4% forecast presented in the October World Economic Outlook. The inflation forecast for next year was also raised by 0.1 percentage points from 2.3% to 2.4%. This matches the Korea Development Institute (KDI)’s inflation forecast for this year (3.6%) announced on the 9th, but is 0.2 percentage points lower than KDI’s projection for next year (2.6%). The IMF stated, “It is important to maintain the current high interest rate stance for a considerable period to stabilize prices,” and assessed that “South Korea’s current monetary policy is being pursued in an appropriate direction.”

Regarding the South Korean government’s policy direction, the IMF judged that it largely aligns with its policy recommendations. It positively evaluated the government’s efforts to tighten the belt in next year’s budget and to normalize fiscal policy through the introduction of fiscal rules. In particular, it analyzed that “since the fiscal rules have appropriately set management indicators and limits, they will help address South Korea’s long-term challenges such as rapid population aging.”

The IMF forecast South Korea’s economic growth rate at 1.4% for this year and 2.2% for next year, which is consistent with the previous World Economic Outlook projections. Earlier, the IMF had revised South Korea’s growth rate downward from 1.7% in January to 1.5% in April, then to 1.4% in July and October. However, it expects the Korean economy to gradually rebound from the second half of this year, supported by improvements in semiconductor exports and recovery in the tourism industry. The current account surplus is projected to remain at about 1.3% of GDP this year due to weak demand from major trading partners, but it is expected to improve gradually and recover to around 4.0% in the medium to long term.

South Korea: High Household and Corporate Debt Pose Risks

The IMF warned that South Korea’s financial sector faces potential risks from high household and corporate debt and project financing (PF) loans by non-bank financial institutions. However, it assessed that these risks are manageable, considering the sufficient financial assets held by households and corporations and strict macroprudential regulations, which lower the likelihood of systemic financial market risks. Regarding financial support, the IMF advised that it should be temporary and targeted toward vulnerable households and firms. It also emphasized the need to strengthen prudential regulations and establish monitoring systems for non-bank financial institutions.

The IMF particularly stressed that South Korea must continue to implement structural reforms to raise potential growth and respond to demographic changes. It explained that labor-related systems such as employment types, working hours, and wage structures need to be made more flexible to improve productivity. It also called for efforts to reduce gender gaps in the labor market. The IMF recommended that “pension reform should be pursued by balancing medium- to long-term fiscal sustainability and the high elderly poverty rate, and more ambitious climate change policies are necessary from the South Korean government to achieve the 2030 greenhouse gas reduction targets.”

Meanwhile, the IMF announced that starting this year, it will evaluate the adequacy of South Korea’s foreign exchange reserves solely through qualitative assessments, excluding the previous quantitative evaluation, aligning with the approach used for other advanced economies. Based on qualitative assessments including stress tests, the IMF explained that South Korea’s foreign exchange reserves are sufficient to respond to external shocks. This report was prepared based on interviews conducted by a six-member IMF mission team, led by Mission Chief Herald Finger, with government ministries and related agencies such as the Ministry of Economy and Finance and the Bank of Korea from August 24 to September 6.

Last month, the price of milk rose by 14.3%, reaching the highest level in 14 years, as major food prices closely monitored by the government showed a significant increase compared to last year. On the 14th, a citizen visiting a large supermarket in Seoul is selecting milk. Photo by Kang Jin-hyung aymsdream@

Last month, the price of milk rose by 14.3%, reaching the highest level in 14 years, as major food prices closely monitored by the government showed a significant increase compared to last year. On the 14th, a citizen visiting a large supermarket in Seoul is selecting milk. Photo by Kang Jin-hyung aymsdream@

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.