Underperformance Compared to Expected Results at IPO... Current Stock Price Plummets Compared to IPO Price

Watchlist: CJtronics, CUBox, Vernect, BioInfra, and Others

Fadoo, a semiconductor design company that went public last August, has been embroiled in a controversy over 'earnings inflation' after posting disappointing results just three months after its IPO. However, Fadoo is not the only rookie stock facing such criticism. Among the newly listed companies debuting on the stock market this year, many have seen their stock prices plunge nearly by half compared to their initial public offering (IPO) prices due to poor earnings. This situation has increased investor distrust, casting a chill over the IPO market, which had been gradually reviving mainly with small and mid-cap stocks.

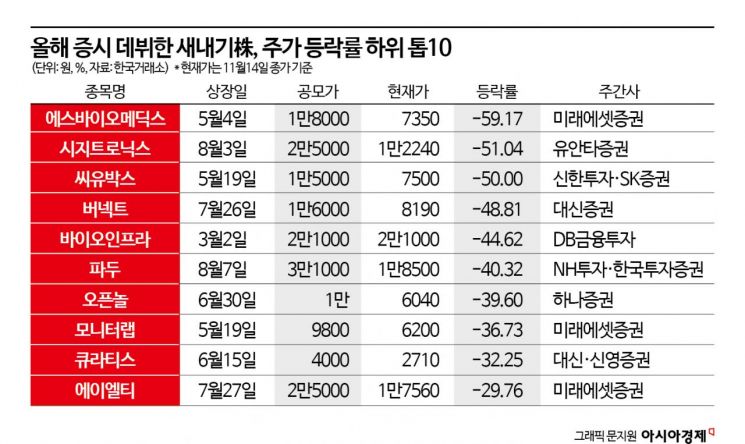

According to the Korea Exchange on the 17th, the stock with the largest decline in price compared to its IPO price among companies debuting this year was S-Biomedics, which closed at 7,350 KRW as of the previous day's closing price. This represents a 60% plunge about six months after its IPO on May 4, when the offering price was 18,000 KRW. S-Biomedics is a company that develops and manufactures treatments and new drugs using stem cells, and like Fadoo, it entered the market through a technology special listing. The lead underwriter was Mirae Asset Securities. At the time of the IPO, S-Biomedics projected annual sales of 4.7 billion KRW for this year, but actual cumulative sales through the third quarter amounted to only 26.356 million KRW (separate basis), which is just 5.5% of the target. Moreover, the cumulative operating loss reached 5.92686 billion KRW, an increase from 4.66126 billion KRW in the same period last year.

In addition, there are numerous stocks whose prices have halved, including CJ Tronics (-51.04%, based on price change compared to IPO price), CU Box (-50%), Vernect (-48.81%), and Bioinfra (-44.62%). In the case of Fadoo, its stock price has fallen 40.32% from the IPO price of 31,000 KRW on August 7 to 18,500 KRW.

The Fadoo incident has sparked not only debates over the overvaluation of newly listed companies but also discussions about the accountability of underwriters. Among the ten companies with the lowest stock price changes among those newly listed this year, Mirae Asset Securities was the lead underwriter for the most companies (three), followed by Daishin Securities (two). Regarding Fadoo, a class-action lawsuit movement is already underway against the lead underwriters NH Investment & Securities and Korea Investment & Securities. The law firm Hannuri stated, "We plan to file a securities-related class-action lawsuit against Fadoo and the underwriting securities firms for concealing the fact that second-quarter sales were virtually zero and pushing forward with the listing process on August 7," and they are recruiting affected shareholders. As the situation escalates, the Financial Supervisory Service is also reportedly planning to investigate Fadoo's listing process.

Meanwhile, attention is also focused on the stock price direction of Ecopro Materials, which is scheduled to be listed on the KOSPI market on the same day. Following the Fadoo incident, Ecopro Materials suddenly disclosed on the 15th, just three days before its IPO, that it had posted an operating loss in the third quarter. Ecopro Materials announced that it recorded sales of 240 billion KRW and an operating loss of 6.9 billion KRW in the third quarter. Although only second-quarter results were disclosed during the IPO process, since the demand forecast was conducted in early November after the third quarter ended, it is pointed out that the company should have been internally aware of the poor performance. The lead underwriters for Ecopro Materials' IPO are Mirae Asset Securities and NH Investment & Securities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.