Attention on Decentralized Exchanges Due to FTX Incident

Coin Market Slump... Trading Volume Declines Since March This Year

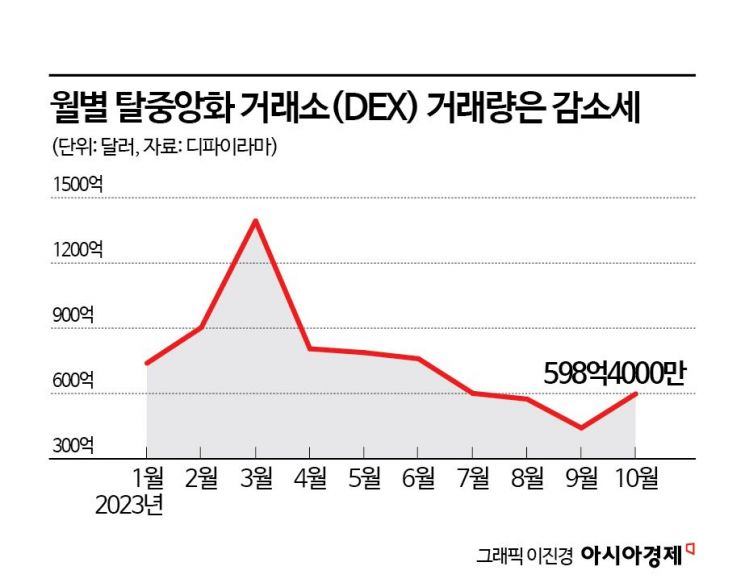

The trading volume of decentralized exchanges (DEXs), once seen as an alternative, is showing a declining trend. This phenomenon is interpreted as a result of the cryptocurrency market experiencing a downturn, coupled with incidents such as hacking.

According to DeFi analytics platform DeFiLlama, the total monthly trading volume of decentralized exchanges has been decreasing since reaching $139.315 billion (approximately 181.4577 trillion KRW) in March this year. Last month, it dropped to $59.84 billion (approximately 77.9416 trillion KRW). Although this is a slight increase compared to $44.191 billion as of last September, it still falls short of half the trading volume recorded in March this year.

Decentralized exchanges refer to platforms where peer-to-peer (P2P) trading can occur without intermediaries or middlemen such as centralized exchanges (CEXs) like FTX, Coinbase, and Binance. Most well-known domestic exchanges such as Upbit, Bithumb, Coinone, Korbit, and Gopax are centralized exchanges. On decentralized exchanges, transactions are conducted through smart contracts?programmed electronic contracts that execute when pre-agreed conditions are met. Therefore, they are relatively safer from incidents where deposited cryptocurrencies cannot be retrieved. However, since there is no operating entity responsible for transactions, it is relatively difficult to resolve issues such as erroneous trades or fraud.

Decentralized exchanges began to attract investor attention after FTX, once considered one of the top three global cryptocurrency exchanges, went bankrupt. The bankruptcy of FTX, caused by issues such as misuse of customer deposits, hacking suspicions, internal accounting control failures, and complex governance structures, led to a bank run (mass withdrawal of deposits) by investors and raised doubts about centralized exchanges. Even after the FTX incident, concerns about the soundness of exchanges like Binance, the world’s largest exchange, spread, prompting some investors to move away from centralized exchanges toward decentralized exchanges.

The decline in decentralized exchange trading volume has been influenced by the prolonged downturn in the cryptocurrency market. Kim Min-seung, a research fellow at the Korbit Research Center, explained, "At the beginning of this year, regulatory pressure on global exchanges intensified, causing traders to temporarily increase trading volume on decentralized exchanges. However, the overall market trend of declining trading volume persisted, leading to decreases in both centralized and decentralized exchange volumes. In the second half of this year, institutional Bitcoin purchases increased due to expectations for Bitcoin exchange-traded funds (ETFs), but this volume likely occurred on centralized exchanges rather than decentralized ones."

Furthermore, the issues that had driven migration to decentralized exchanges from centralized ones have gradually been resolved, resulting in no major visible problems on the surface. Additionally, incidents of damage such as hacking on decentralized exchanges appear to have accelerated the departure from these platforms. In August, Cypher, a Solana-based decentralized exchange, announced it had frozen its smart contracts due to a vulnerability attack. The attack reportedly caused damages worth approximately $1 million. Also, Balancer, an Ethereum-based decentralized exchange, warned of potential risk exposure and advised investors to withdraw funds to prevent possible hacking damage.

Binance showed interest by investing in decentralized finance but recently revealed its limitations. Steve Young Kim, Binance’s Asia-Pacific Regional Director, stated at the "October Binance Virtual Roundtable Session," "Centralized exchanges provide relatively higher liquidity compared to decentralized exchanges, which enhances market stability," while also explaining, "There are limitations to trading on decentralized exchanges that exist in regulatory blind spots."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.