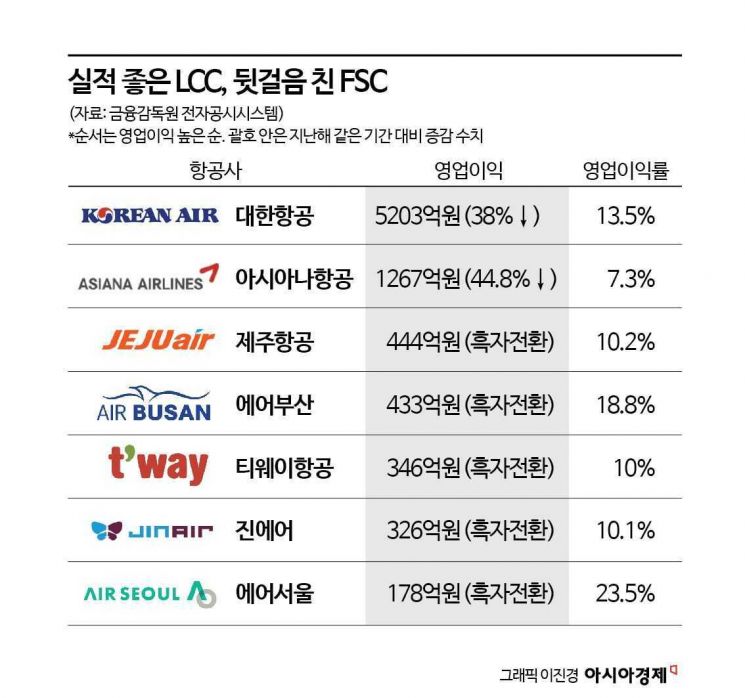

Earnings Announcement: 4 out of 5 LCCs "All-Time High"

Korean Air and Asiana Operating Profit Decline

'Weak Yen Phenomenon → Increased Demand on Japan Routes' Behind Strong Performance

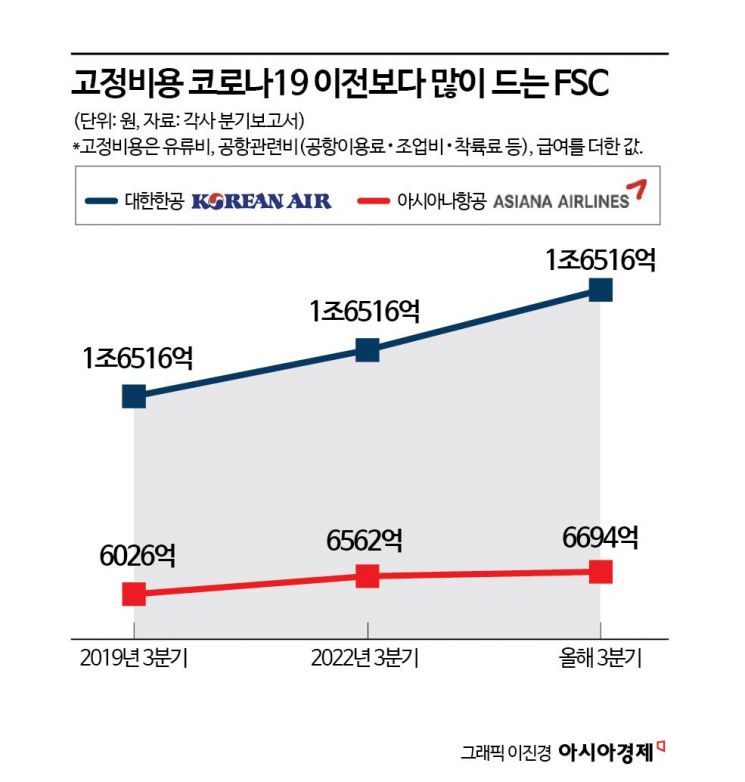

FSC Fixed Costs Higher Than During COVID-19

As domestic airlines announced their third-quarter earnings this year, the fortunes of LCCs (Low Cost Carriers) and FSCs (Full Service Carriers) diverged. Among the five LCCs that reported results, four recorded their highest quarterly earnings ever. In contrast, both Korean Air and Asiana Airlines saw their operating profits decline compared to the same period last year. The depreciation of the yen, which led to an increase in Japanese tourists, was a key factor behind the strong performance of LCCs. FSCs experienced a decrease in profits due to increased fixed costs compared to the pre-COVID-19 period and last year.

Air Seoul announced on the 16th that it achieved its best third-quarter performance with sales of 75.8 billion KRW, operating profit of 17.8 billion KRW, and net profit of 9.1 billion KRW. T'way Air also posted its highest-ever third-quarter results with sales of 345.1 billion KRW and operating profit of 34.6 billion KRW. Operating profit turned positive this year at 34.6 billion KRW, compared to a loss of 32.3 billion KRW in the third quarter of last year.

This article is unrelated. On the 2nd, an Asiana Airlines aircraft was parked at Gimpo Airport in Gangseo-gu, Seoul. Photo by Jang Jin-hyung aymsdream@

This article is unrelated. On the 2nd, an Asiana Airlines aircraft was parked at Gimpo Airport in Gangseo-gu, Seoul. Photo by Jang Jin-hyung aymsdream@

Jeju Air and Air Busan showed similar results. The two airlines recorded operating profits of 44.4 billion KRW and 43.257 billion KRW respectively in the third quarter, achieving their highest quarterly earnings ever. Jeju Air has been profitable since the fourth quarter of last year, while Air Busan has been in the black since the first quarter of this year.

The operating profit margins of LCCs related to Asiana Airlines (Air Seoul and Air Busan) stood out. Air Seoul posted an operating profit margin of 23.5%, ranking first in the domestic airline industry. Air Busan followed in second place with 18.8%. Korean Air (13.5%) and Jeju Air (10.2%) came next. Asiana Airlines had the lowest margin among the seven companies that reported results, at 7.3%.

Full Service Carriers saw their operating profits decline compared to the same period last year. Korean Air’s operating profit was 520.3 billion KRW, down 38% from 839.2 billion KRW in the third quarter of last year. Asiana Airlines’ operating profit also fell 44.8% to 126.7 billion KRW from 229.3 billion KRW in the same period last year. Although net losses continued at 31.2 billion KRW, this was an improvement compared to a loss of 172.3 billion KRW last year.

One reason LCCs achieved record earnings is the high demand for routes to Japan. The number of Japanese tourists continues to increase in the fourth quarter as well. Last month, the number of flights (including cargo) and passengers traveling between Korea and Japan reached 10,013 flights and 1,859,943 passengers respectively, the highest figures this year. Compared to January, when there were 7,661 flights and 1,309,281 passengers, these numbers rose by 30.7% and 42% respectively. The continued increase in Japanese tourists is due to the sustained yen depreciation, which keeps Korean outbound travel demand steady. On the 15th, the KRW/JPY exchange rate fell to the 865 KRW per 100 yen level. Additionally, local governments in small Japanese cities have been actively attracting airlines by providing subsidies. An industry insider said, “Demand for routes to small Japanese cities like Takamatsu is higher than for major city routes. These local governments offer many benefits, including subsidies to airlines, to attract Korean tourists.”

Full Service Carriers experienced a decline in profitability due to increased fixed costs. Fuel costs were a major factor. FSCs operate more long-haul routes than LCCs, which naturally leads to higher fuel consumption. In the third quarter, Korean Air and Asiana Airlines spent 1.1696 trillion KRW and 548.9 billion KRW on fuel respectively, which is at least 4.8 to 10 times more than Jeju Air (135.8 billion KRW) and T'way Air (112.9 billion KRW).

Fixed costs (fuel, airport-related expenses, employee salaries) have increased compared to the third quarter of 2019, before COVID-19. Airport-related expenses include airport usage fees, ground handling fees, and landing fees. Korean Air’s fixed costs for the third quarter rose from 1.6516 trillion KRW in 2019 to 1.7896 trillion KRW last year, and further increased to 1.9685 trillion KRW this year. Asiana Airlines also saw an upward trend with 602.6 billion KRW, 656.2 billion KRW, and 669.4 billion KRW respectively. An FSC industry official stated, “External factors such as a strong dollar also affected profitability.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)