Weak Bio Business Due to Poor Lysine Market in H1

Lysine Price Rebound in H2...Entering Performance Improvement Phase

The bio businesses of CJ CheilJedang and Daesang are expected to perform well in the second half of the year. This is because the price of lysine is rebounding as demand gradually recovers following the Chinese government's active support policies for the pig farming market.

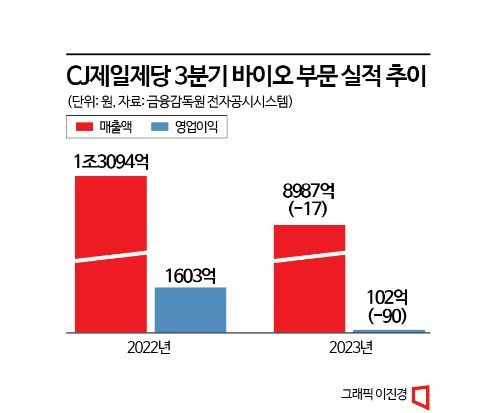

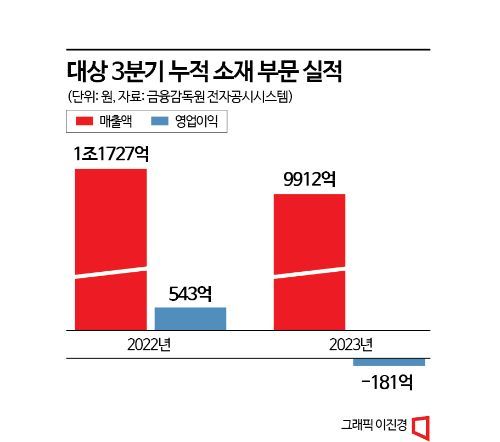

According to the Financial Supervisory Service's electronic disclosure system on the 16th, CJ CheilJedang's (excluding CJ Logistics) bio business sales in the third quarter of this year amounted to 898.7 billion KRW, a 17% decrease compared to the same period last year, and operating profit fell 90% to 10.2 billion KRW. Specialty amino acids such as tryptophan, valine, and arginine, which are high-margin products, maintained strong sales growth of over 30%, but sales and operating profit sharply declined due to the base effect from last year on major amino acids and the drop in soybean-related product prices, which intensified the sales decrease of Brazilian subsidiary CJ Selecta. Daesang also saw its material division's cumulative sales for the third quarter drop 15.5% year-on-year to 991.2 billion KRW, with an operating loss of 18.1 billion KRW, turning into a deficit.

CJ CheilJedang and Daesang, leading the domestic green bio industry, have been suffering from deteriorating performance in their bio business segments due to sluggish market conditions for lysine, an amino acid used in animal feed. Lysine is an essential material that promotes the growth and development of livestock such as pigs, and its demand is influenced by pork consumption fluctuations in major export markets like China. Until last year, the lysine market enjoyed a boom, and both companies achieved good results, but as demand in China decreased, selling prices fell, which was a major cause of poor performance for both companies through the first half of this year.

Although the slump continues, the situation is not entirely bleak. The selling prices of major amino acids, including lysine, which had been declining, began to rebound in the second half of the year. Shim Eun-joo, a researcher at Hana Securities, said, "In Daesang's case, lysine prices have risen, and local companies have partially shut down lysine plants due to worsening profitability, which appears to be resolving the oversupply." She added, "With lysine price normalization, a meaningful reduction in losses is expected, and performance improvement is likely to continue through next year."

CJ CheilJedang is also expected to see a change in momentum starting in the fourth quarter. The rebound in prices of major amino acids such as lysine is encouraging, and the recent sale of shares in CJ Selecta last month is anticipated to have a positive impact. By divesting Selecta, which had large performance fluctuations depending on soybean meal prices, and restructuring its bio business portfolio to focus on high-margin specialty amino acids and solution products, CJ CheilJedang's performance is expected to stabilize.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)