Housing Business Outlook 68.8... Down 18.8p from Previous Month

Seoul Down 28.7p, Daejeon Down 34.4p

Due to the prolonged high interest rates and the government's tightening of loans, there is a forecast that the nationwide housing market in November will sharply decline, similar to the downturn last winter. Experts have raised the need for swift measures as housing market instability is increasing due to rising raw material prices caused by the Israel-Hamas war.

According to the Korea Housing Industry Research Institute on the 14th, the nationwide Housing Business Sentiment Index for November fell by 18.9 points from the previous month to 68.8. This is the first time in nine months since last February that the index has recorded below the 60 mark.

This index is calculated based on surveys conducted among members of the Korea Housing Association and the Korea Housing Builders Association. If the index exceeds the baseline of 100, it indicates that a higher proportion of companies expect the market to improve.

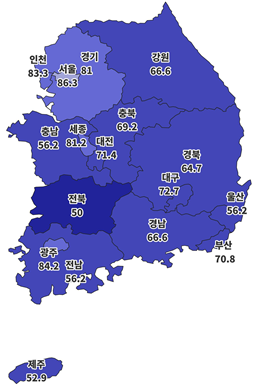

By region, the metropolitan area dropped by 19.4 points (102.9 → 83.5), with Seoul experiencing the largest decline of 28.7 points (115.0 → 86.3). Gyeonggi Province fell by 16.2 points (97.2 → 81.0), and Incheon decreased by 13.2 points (96.5 → 83.3). A representative from the Korea Housing Industry Research Institute explained, "The housing market outlook in the metropolitan area, which had been steadily rising, has rapidly turned negative."

Among non-metropolitan metropolitan cities, Daejeon saw a decline of 34.4 points (105.8 → 71.4). Daegu dropped by 27.3 points (100.0 → 72.7), Ulsan by 22.3 points (78.5 → 56.2), Busan by 16.1 points (86.9 → 70.8), Sejong by 11.1 points (92.3 → 81.2), and Gwangju by 9.5 points (93.7 → 84.2).

November Housing Business Sentiment Index

November Housing Business Sentiment Index

In other regions, Jeonbuk showed the largest decline of 25 points (75.0 → 50.0), followed by Gangwon with 24.3 points (90.9 → 66.6), and Jeju with 22.1 points (75.0 → 52.9). All have entered a downward phase below the 50 mark, indicating a very negative market outlook.

The sharp deterioration in the housing business outlook is attributed to the high interest rates originating from the U.S. and the government's tightening of loans. A representative from the Korea Housing Industry Research Institute stated, "At the end of October, the upper limit of variable interest rates on mortgage loans at commercial banks exceeded 7%, and it is expected that the U.S. benchmark interest rate will remain at a high level throughout next year, so mortgage loan interest rates are also expected to stay high. Due to concerns over loan defaults caused by the rapid increase in household loans, restrictions on mortgage loans are also increasing, which seems to have expanded the negative outlook for the housing market."

Meanwhile, the material supply index in November fell by 12.6 points (95.0 → 82.4). This is interpreted as a result of supply chain difficulties and rising raw material prices caused by the Israel-Hamas war following the Ukraine war. The financing index also dropped by 9.5 points (75.0 → 65.5). With the rapid rise in market interest rates and difficulties in raising business funds such as bridge loans and project financing (PF), the financing supply index is also deteriorating rapidly.

The Korea Housing Industry Research Institute warned that various indicators have plummeted, worsening the real estate market to the level seen in February when housing prices continued to fall. The institute emphasized, "This year, housing permits, construction starts, and pre-sale volumes have all sharply decreased by 30-50%. In this situation, the housing business outlook is deteriorating to the worst level, raising concerns about negative impacts on the regional and macroeconomy. Also, due to the prolonged supply-demand imbalance and resulting housing market instability, urgent and sufficient measures are needed promptly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.