Over $10 Billion in One Year

WeWork's Bankruptcy Crisis Intensifies

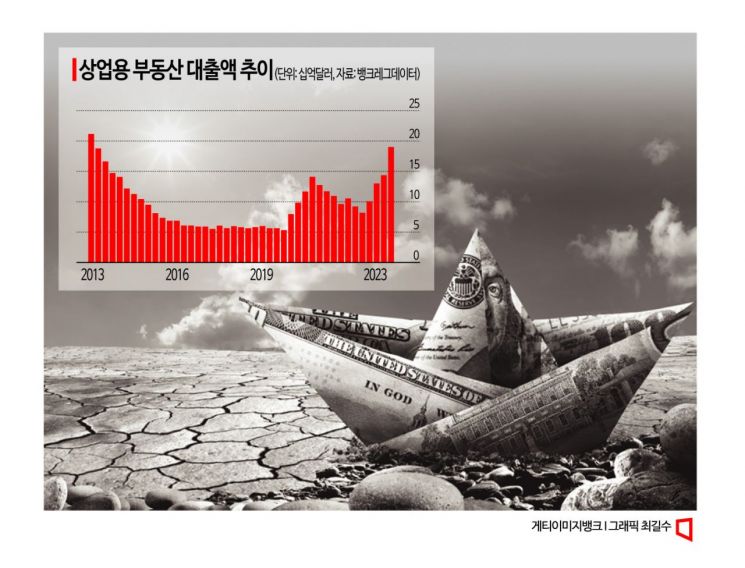

The scale of commercial real estate loan delinquencies at U.S. banks has reached its highest level in 10 years. Due to the prolonged high interest rate environment and the spread of remote work following the COVID-19 pandemic, the commercial real estate downturn is continuing, and the size of loan delinquencies is expected to grow further.

According to financial information firm BankRegData on the 9th (local time), the amount of bank loan delinquencies on U.S. commercial real estate in the third quarter of this year rose by $4 billion (30%) from the previous quarter to $17.7 billion (approximately 23.34 trillion KRW). This is the highest level in 10 years, and compared to a year ago, loan delinquencies surged by a staggering $10 billion.

Concerns over rising delinquency rates are also growing. Leo Hwang, head of the commercial real estate division at Ellington Management Group, pointed out, "More price declines are coming," adding, "Commercial real estate loans are deteriorating, and delinquency rates will rise further." The maturity delinquency rate for commercial real estate in the third quarter stands at around 1.5%.

The rapid worsening of commercial real estate delinquencies is due to the increase in office vacancy rates following the spread of remote work after the pandemic, combined with the prolonged tightening and economic slowdown, pushing the commercial real estate market to its worst state. According to the National Bureau of Economic Research (NBER), office prices in New York are expected to fall by about 40% by 2029 due to the sharp drop in demand caused by the establishment of remote work.

The collapse of U.S. office-sharing company WeWork is also increasing the risk of commercial real estate loan defaults. The third-quarter delinquency figures from BankRegData do not reflect the impact of WeWork’s bankruptcy. If WeWork, which filed for bankruptcy protection under Chapter 11 on the 6th due to severe financial difficulties and worsening management, formally enters bankruptcy proceedings, it could unilaterally terminate dozens of lease contracts. If the leased properties WeWork occupied flood the market at once, price declines and a surge in non-performing loans will be inevitable.

Accordingly, Wells Fargo recently set aside a loan loss provision of $20.5 million for a mid-sized office building loan in Lower Manhattan, citing increased default concerns due to WeWork’s bankruptcy. As of the end of the third quarter, Wells Fargo’s commercial real estate loan delinquencies stood at $3.4 billion, a 750% increase from $400 million a year earlier. Wells Fargo is the largest bank in the U.S. in terms of commercial real estate loan volume, with a commercial real estate loan balance reaching $70 billion as of the end of the third quarter.

PNC, a regional bank based in Pittsburgh, also saw its delinquent loans more than double to $723 million as of the end of the third quarter compared to the previous quarter. Rob Reilly, PNC’s Chief Financial Officer, warned, "As expected, pressure in the commercial real estate sector is materializing." U.S. banks hold about 60% of commercial real estate loans, with 60-70% of these concentrated in regional banks with assets under $100 billion.

Experts expect the commercial real estate crisis to be prolonged. After the global financial crisis in 2008, it took six years for commercial real estate values to recover. Kevin Fagan, head of commercial real estate economic analysis at global credit rating agency Moody’s, warned, "The upward trend (in loan delinquencies) could last at least 12 months or more," adding, "Severe pain lies ahead."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)