Increase in CP Supply Drives Short-Term Interest Rates of A2, A3 Grades Close to 6-10%

Growing Refinancing Concerns Amid Declining Short-Term Investment Demand

As short-term interest rates rise, companies that have been raising funds by issuing commercial paper (CP, including short-term bonds) with maturities of less than one year are facing increased refinancing burdens. In particular, companies with low credit ratings of A3 or below are experiencing double difficulties as they find it hard to secure liquidity in the corporate bond market and are also struggling to raise short-term funds.

According to the short-term financial market, the supply of high-quality A1-rated CP has recently increased, widening the interest rate gap between A1-rated CP and A2-rated (including A2+, A2, A2-) and A3-rated (A3+, A3, A3-) CP. This is because the issuance of time deposit asset-backed commercial paper (time deposit ABCP) and CP by public enterprises and financial companies has increased, concentrating short-term investment demand on high-quality A1-rated CP.

According to the Korea Financial Investment Association, CP saw a net issuance of 5.0122 trillion won last month alone. This marks a shift from net redemption to net issuance for the first time in three months since July. The net issuance trend of CP has continued into November, with about 3.3 trillion won net issuance recorded by the 8th. Korea Electric Power Corporation’s CP issuance has exceeded 12 trillion won, and Korea Gas Corporation’s CP issuance has long surpassed 12 trillion won as well.

CP investment demand mainly comes from money market funds (MMF), money market trusts (MMT), and money market wrap accounts (MMW). Recently, as the preference for safe assets has intensified, investment demand has concentrated solely on A1-rated CP. A representative from an asset management firm explained, "The yield on high-quality A1-rated CP is around 4-5%, which is relatively high, and the supply volume is sufficient. Therefore, there is no incentive to take risks by investing in lower-rated CP just to slightly increase the yields of MMF or MMW."

Relatively lower-rated companies are now forced to raise short-term funds at significantly higher interest rates compared to the past. Hyosung Chemical, an affiliate of the Hyosung Group, recently issued CP with a 3-month (92-day) maturity at an interest rate of about 7%. Hyosung Chemical’s short-term credit rating is A2-, and CP issuance rates for similar ratings range between 6-8% depending on maturity. The issuance rates for CP with maturities under one year for E-Land World, rated A3, and AJ Networks, rated A3+, have also risen to between 6-8%.

In particular, companies rated A3 or below are reportedly finding it difficult to raise short-term funds even if they accept high interest rates. An investment banking industry official said, "Recent defaults such as the Daeyu Group bankruptcy and the insolvency of mid-sized and small construction companies have increased corporate credit risks. Investors are avoiding bonds and CP with relatively low credit ratings, reducing the means for lower-rated companies to secure liquidity."

Companies facing CP maturities are also increasingly concerned. By the end of this year, companies such as Hyosung Heavy Industries (A2), Hyosung TNC (A2+), Hyosung Advanced Materials (A2), High Plaza (A2+), and Daewon Kangup (A2) need to respond to CP maturities. Early next year, CP maturities for A3-rated companies such as Homeplus (A3), Samsung Heavy Industries (A3), E-Land World (A3), Megabox Central (A3), Korea Shipping (A3), and Clean Nara (A3+) are lined up one after another.

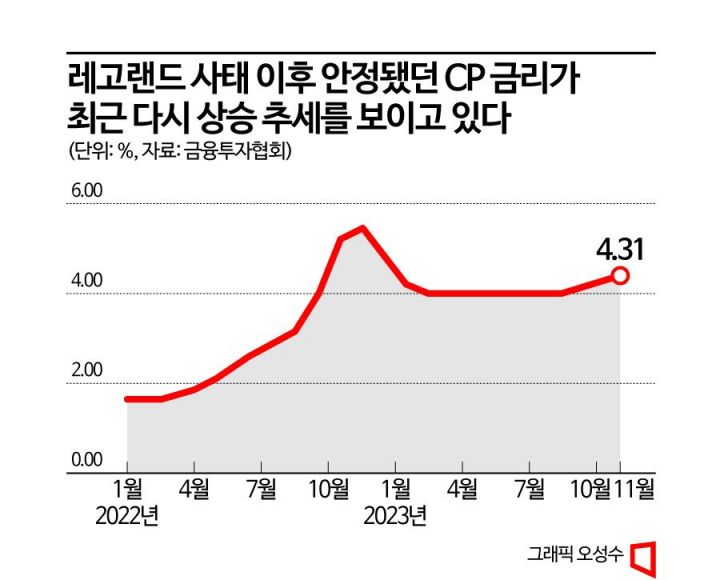

A bond market official said, "Recently, more companies have been canceling CP issuance or abandoning CP ratings altogether due to lack of investor demand." He added, "Since the Legoland incident last year, the short-term financial market seemed to stabilize, but it is gradually becoming unstable again due to the prolonged high interest rate environment and worsening corporate earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.