Top Short Selling Stocks in Secondary Batteries, Bio, Duty-Free, Travel, and Distribution Sectors Benefit

Positive Impact Expected on Securities Stocks Due to Increased Market Trading Volume

On the 6th, when the temporary short-selling ban until June next year began, the KOSPI started with an upward trend, rising more than 50 points immediately after the opening. Photo by Heo Younghan younghan@

On the 6th, when the temporary short-selling ban until June next year began, the KOSPI started with an upward trend, rising more than 50 points immediately after the opening. Photo by Heo Younghan younghan@

With financial authorities deciding to impose a full ban on short selling until the end of the first half of next year, market attention is focused on the potential impact on the stock market. Past cases show that trading volume tends to increase during short selling bans, which is expected to have a positive effect on securities stocks. Secondary battery stocks, which have been heavily targeted by short selling, are also expected to benefit. However, the short selling ban is likely to have a negative impact on the inclusion of Korea in the Morgan Stanley Capital International (MSCI) Developed Markets Index, and there are concerns about foreign capital outflows.

As of 9:30 a.m. on the 6th, the KOSPI rose 2.19% from the previous session to 2,420.30, and the KOSDAQ increased 3.53% to 809.63. Both the KOSPI and KOSDAQ recovered to the 2,400 and 800 levels respectively after about two weeks. The short selling ban appears to have been the driving force behind the sharp rise in the indices.

Secondary battery stocks, which had been prime targets for short selling, are finally showing strength due to the short selling ban. POSCO Future M rose 17.84%, EcoPro increased 17.27%, and EcoPro BM climbed 15.43%. LG Energy Solution and L&F showed gains in the 10% range. POSCO Holdings also rose more than 6%.

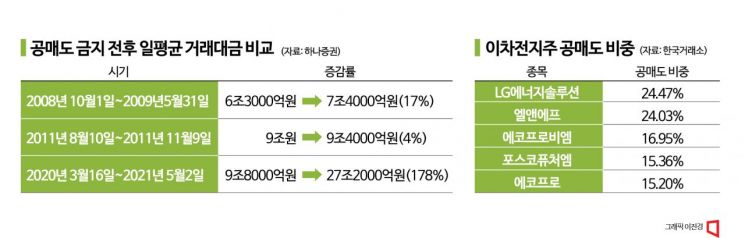

Secondary battery stocks, which had been heavily shorted, are considered beneficiaries of the current short selling ban. As of the 3rd, the short selling trading volume of five secondary battery stocks?POSCO Future M, LG Energy Solution, EcoPro BM, EcoPro, and L&F?reached approximately 261.6 billion KRW. These stocks ranked among the top in short selling trading volume. On the KOSPI, POSCO Future M led with 55.5 billion KRW, followed by LG Energy Solution with 43.3 billion KRW. On the KOSDAQ, EcoPro BM had the highest volume at 73.7 billion KRW, followed by EcoPro and L&F with 64.9 billion KRW and 24.2 billion KRW respectively. These stocks also showed high short selling ratios. LG Energy Solution's short selling ratio was 24.47%, L&F 24.03%, EcoPro BM 16.95%, POSCO Future M 15.36%, and EcoPro 15.20%.

Stocks with large short selling balance ratios are expected to see price increases due to short covering (buying back shares to cover short positions) triggered by the short selling ban. Kim Dae-jun, a researcher at Korea Investment & Securities, said, "Besides the index, on an individual stock basis, short covering due to the short selling ban should be considered. Stocks that have accumulated large short selling balances due to specific issues will likely move the fastest in the short term." Han Ji-young, a researcher at Kiwoom Securities, also explained, "From this week, the effects of the short selling ban can be felt at the sector and individual stock levels. Considering that growth stocks like secondary batteries and biotech, as well as Chinese consumption-themed stocks such as duty-free, travel, and distribution, rank high in short selling balances, it is necessary to keep open the possibility of short-term price momentum forming around these sectors."

The support to the market downside and increase in trading volume due to the short selling ban are expected to positively impact securities stocks' earnings. According to Hana Securities, during the three previous short selling ban periods, the average daily trading volume in the stock market increased. Korea's previous short selling bans occurred during the 2008 financial crisis (October 1, 2008 ? May 31, 2009), the 2011 European sovereign debt crisis (August 10, 2011 ? November 9, 2011), and the COVID-19 outbreak period (March 16, 2020 ? May 2, 2021).

Comparing the average daily trading volume before and after the short selling bans, it increased from 63 trillion KRW to 74 trillion KRW (a 17% rise) in 2008-2009, from 90 trillion KRW to 94 trillion KRW (a 4% increase) in 2011, and surged from 98 trillion KRW to 272 trillion KRW (a 178% jump) in 2020-2021. Ahn Young-jun, a researcher at Hana Investment & Securities, said, "During the short selling ban periods, despite downward pressure, the market found support at the bottom and subsequently rose, with trading volume increasing during the rise. During this short selling ban period, increased participation by individual investors is likely to boost trading volume and brokerage fee income for securities firms." He added, "Even if short-term supply-demand momentum is not large, profit improvement due to increased trading volume is expected later, benefiting securities firms with high brokerage market share."

Thanks to the short selling ban, the index is expected to maintain an upward trend for the time being. Yang Hae-jung, a researcher at DS Investment & Securities, said, "Regardless of debates about institutional effectiveness, this short selling ban can be positive for the stock market. Risk factors are easing, and after the U.S. Federal Reserve's decision, real interest rates and the dollar value have declined, creating a favorable environment for risk assets. Although indicators and earnings are slow, they are improving, and valuation is at a price-to-book ratio of about 0.8, which is a buying zone, supporting stock price gains through the end of the year."

However, foreign capital outflows remain a concern. Researcher Han Ji-young said, "The short selling ban may cause changes in hedge fund flows among foreign investors. Foreign long-short hedge funds tend to build long positions as hedges when establishing short positions in specific countries, but the short selling ban could limit these hedge funds' access to the Korean stock market."

The short selling ban is also expected to have a negative impact on Korea's inclusion in the MSCI Developed Markets Index. MSCI classifies developed markets based on economic development level, market capitalization and liquidity, and market accessibility, and the short selling ban is expected to affect market accessibility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)