Stock Price Drops 80% Over One Year Since Trading Resumption

Large-Scale Capital Increase Decided to Improve Financial Structure

Stock Price Surges Ahead of Immune Checkpoint Inhibitor Clinical Trial Results Announcement

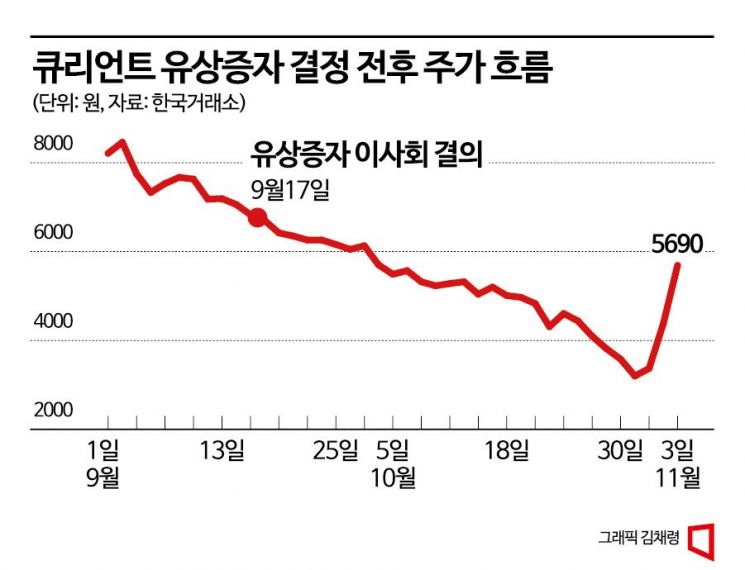

The stock price of Qurient, a new drug development company currently pursuing a large-scale paid-in capital increase to improve its financial structure and secure clinical trial costs, is soaring. After the board of directors resolved to proceed with the capital increase, the stock price fell, making the success of the capital increase uncertain. However, the recent surge in stock price has created a favorable environment for the capital increase.

According to the Financial Supervisory Service's electronic disclosure system, Qurient plans to raise 41.7 billion KRW by issuing 8 million new shares. The planned issue price per new share is 5,210 KRW, and the final issue price will be confirmed on the 24th. For every one existing share, 0.602 new shares will be allocated.

Qurient is a new drug development company established by the Korea Pasteur Institute to commercialize promising basic research projects. It focuses on developing novel mechanism anticancer therapies. Qurient has signed a joint development contract with the global pharmaceutical company Merck (MSD) and receives Keytruda free of charge for the development of combination therapies. The largest shareholder of Qurient is the Korea Pasteur Institute, holding 7.36% of the shares. The participation of the largest shareholder in the capital increase has not yet been decided. The management team, including CEO Nam Gi-yeon, who holds 4.36% of the shares, plans to participate in more than 40% of the allocated shares.

Earlier this year, Qurient signed a technology transfer agreement for the multidrug-resistant tuberculosis treatment drug 'Telacebec' with TB Alliance, the world's largest international organization for tuberculosis treatment development. The atopic dermatitis treatment 'Q301' has confirmed efficacy in Phase 2 clinical trials and is preparing for technology transfer.

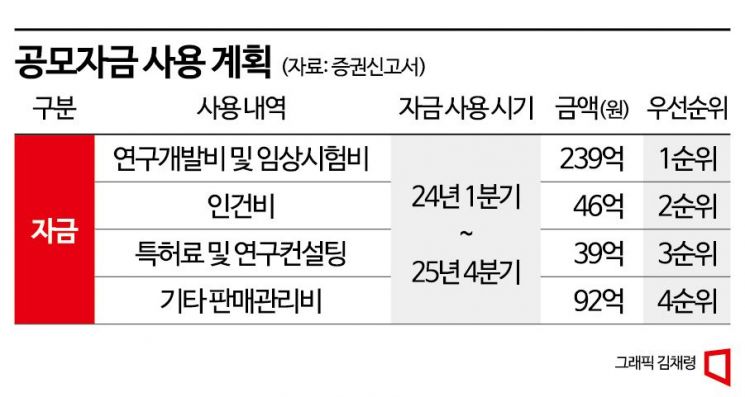

Of the funds raised through the new share issuance, 23.9 billion KRW will be used for clinical trials and research and development of pipelines under development. 8.5 billion KRW will be spent on personnel expenses and patent fees, and the remaining funds will be used for selling and administrative expenses. Clinical trials are underway in the US and Korea for combination therapy of Adricetibin and Keytruda targeting patients with advanced gastric cancer, esophageal cancer, liver cancer, and cervical cancer.

Challenging New Drug Development... Trading Suspension Due to Quarterly Sales Shortfall

Qurient's stock price has been on a downward trend since trading resumed on October 7 last year. Over the past year until the end of last month, the stock price fell by more than 80%. The prolonged trading suspension led institutional investors holding the stock to quickly liquidate their shares, causing the price to drop. Recently, when it was decided to conduct a paid-in capital increase through a shareholder priority offering, the stock price, which had been above 6,000 KRW, fell to around 3,000 KRW.

Qurient's trading was suspended from May 14, 2021, to October 6, 2022. It became subject to a delisting review because its sales in the first quarter of 2021 did not exceed 300 million KRW. The Korea Exchange's Corporate Evaluation Committee granted a one-year improvement period. The following October, the Korea Exchange held a Corporate Evaluation Committee meeting and decided to maintain the listing. This was thanks to increased sales after acquiring H-Pharm on October 18, 2021, and starting a pharmaceutical distribution business. Sales increased from 4.6 billion KRW in 2021 to 12.2 billion KRW in 2022. In the first half of this year, sales reached 6.429 billion KRW.

Although sales have increased, the company has not escaped losses. Operating losses of 21.5 billion KRW and 23 billion KRW were recorded in 2021 and 2022, respectively. The operating loss in the first half of this year reached 11.4 billion KRW.

Qurient is a technology growth special listing company and may be designated as a management item if it fails to meet requirements such as ▲sales and pre-tax continuing business loss conditions ▲capital erosion conditions.

If the pre-tax continuing business loss exceeds 50% of equity this year, the company will be designated as a management item. Qurient recorded a pre-tax net loss of 25.5 billion KRW last year, which corresponds to 72.5% of its equity. The pre-tax net loss for the first half of this year is 12.3 billion KRW, which, when simply annualized, corresponds to 101.3% of equity. By raising capital through the paid-in capital increase, the possibility of being designated as a management item due to the pre-tax continuing business net loss condition will decrease. The company expects that if capital is increased by at least 31.6 billion KRW through the capital increase, it will avoid designation as a management item due to the pre-tax net loss condition.

In a situation where financial structure improvement is urgent, Qurient's stock price has risen 77.8% this month. The stock price, which had fallen to 3,200 KRW due to the capital increase impact, jumped to 5,690 KRW in three days. The planned issue price at the board meeting was 5,210 KRW. On the day of the board meeting, the stock price was 6,700 KRW, but after the capital increase news was announced, the price dropped more than 50% to 3,200 KRW by the end of last month. Although a first adjustment of the issue price seemed inevitable, the recent sharp rise in stock price suggests that the adjustment range of the planned issue price will not be large. The stock price surged after news that Qurient plans to present a poster on the Phase 1 clinical trial results of the immuno-oncology drug Adricetibin (Q702), both as a monotherapy and in combination with Keytruda, at the Society for Immunotherapy of Cancer (SITC) in the US.

A Qurient official said, "The clinical results of Adricetibin have demonstrated its potential as a novel concept immuno-oncology drug," adding, "The efficacy in blood cancer treatment, jointly developed with the Mayo Clinic and MD Anderson Cancer Center in the US, will soon bear fruit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)