[Urgent Mid-Year Real Estate Market Check]

High Interest Rates Dampen Buying Sentiment

Inventory Backlog Expected to Worsen Temporarily

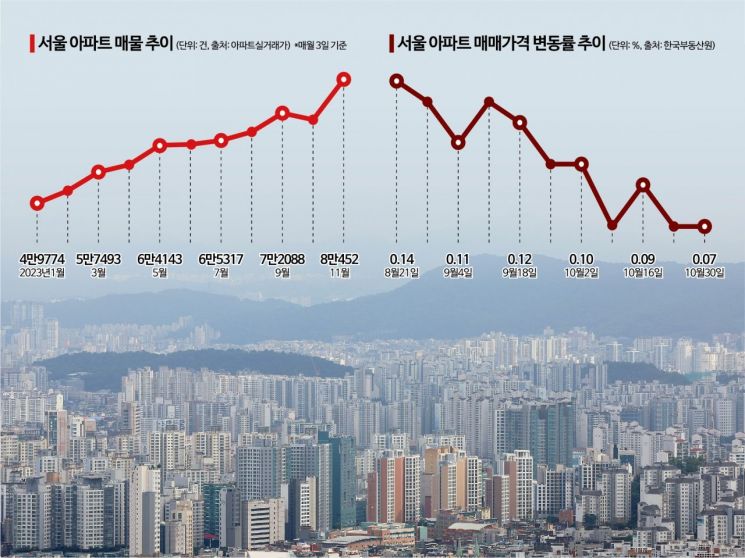

The number of apartment listings in Seoul has exceeded '80,000' for the first time. After home prices plummeted during the winter, they have risen for 24 consecutive weeks, leading to a continuous increase in sellers, but buyers have turned cautious due to prolonged high interest rates. As the conflicting interests of buyers and sellers deepen, it is expected that the backlog of listings will worsen for the time being.

Seoul Apartment Listings Pile Up Like a Mountain... Surpassing a Record High of 80,000

According to the real estate big data platform Apartment Real Transaction Price (hereafter Asil) on the 3rd, the total number of apartment sale listings in Seoul was recorded at 80,452. This is the highest number since Asil began compiling the statistics in November 2020. Compared to 50,513 at the beginning of this year, it represents an increase of about 59.3% (29,939 listings) in roughly 10 months. Even compared to a month ago, it rose by 14.1% (9,987 listings). Among the 24 autonomous districts in Seoul, 22 districts except Jongno-gu and Songpa-gu saw an increase rate of over 10%.

The sharp backlog of Seoul apartment listings can simply be attributed to the conflicting interests of sellers and buyers. Sellers are lining up quickly, but buyers are unable to keep pace and are just watching.

The core reason for this cautious stance is price. There is a significant gap between the asking prices of sellers and buyers. Seoul apartment prices sharply declined in the second half of last year due to the impact of high interest rates from the U.S., but quickly recovered early this year thanks to government deregulation. According to the Korea Real Estate Board, Seoul apartment prices have risen for 24 consecutive weeks as of the fifth week of October. The actual transaction price index for Seoul apartments from January to August recovered 12.4%, which is half of last year's total decline (-22.2%). Accordingly, sellers want to sell their homes at the increased prices.

On the other hand, buyers find these prices burdensome. Recently, household loans have surged, and the government has tightened lending through measures such as the Special Home Loan Program, while concerns over prolonged high interest rates have increased the burden of financing. The upper limit of fixed mortgage interest rates at some banks has already exceeded 7% per annum.

Yeogyeonghee, Senior Researcher at Real Estate R114, explained, "The increase in loan interest rates has raised interest burdens, and the government's loan restrictions have worsened financing conditions, significantly dampening buyer sentiment."

Buyers Say "Financing is Difficult" vs Sellers Say "Prices Are Rising..." Conflicting Interests Lead to Growing Listings

"In August and September, at least two or three groups came to see the house every week, but in October, not a single group has come. The atmosphere feels ominous."

Kim, a man in his 30s living in a small, older apartment priced around 800 million KRW in Mullae-dong, Yeongdeungpo-gu, Seoul, could not hide his anxiety over the sudden drop in buyer inquiries. He put his house on the market to move to another neighborhood for his children's education, but nearly 10 similar listings are piled up in the same apartment complex. Kim said, "When someone said they would buy if I lowered the price in September, I wondered if I should have accepted it, but since prices keep rising, I don't want to lower my asking price."

The serious backlog of listings due to the conflicting interests of sellers and buyers is expected to continue for the time being. Despite the prolonged high interest rates dampening buyer sentiment and slowing transaction volumes, prices are still rising statistically, and the rising pre-sale prices and jeonse (long-term deposit lease) prices supporting existing apartment prices mean sellers are unlikely to lower their asking prices easily.

According to the Seoul Real Estate Information Plaza, apartment sales transactions in September totaled 3,362, down about 13% (490 transactions) from 3,852 in the previous month. This is the lowest figure since April (3,186 transactions). Although it is better than the transaction freeze last winter when transactions fell below 1,000, buyer demand is subdued. Although there is still a month left to report September transactions, the sentiment on the ground is clearly different from the statistics. A real estate industry official said, "Transactions have definitely slowed down since Chuseok. Even when there are buyer inquiries, most are passive buyers who only ask about prices over the phone rather than actively visiting to see the houses."

Since the government has recently tightened lending, it seems difficult for buyer sentiment to recover. Especially significant is the fact that the Special Home Loan Program, which had been a source of funds for buying mid- to low-priced apartments under 900 million KRW since early this year, has effectively been suspended. From the 27th of last month, couples with combined incomes exceeding 100 million KRW or homes priced over 600 million KRW can no longer use the Special Home Loan Program.

Ham Youngjin, Head of the Big Data Lab at Zigbang, explained, "With the depletion of urgent sale listings, the recent suspension of the general type of the Special Home Loan Program, the government's household debt regulations being fully implemented, and rising market interest rates, the hurdles for buyers to secure financing are increasing, which is likely to act as a negative factor for the recovering apartment transaction market."

For transactions to pick up, asking prices need to fall, but sellers still have expectations of price increases. Since apartment pre-sale prices are soaring and jeonse prices supporting sale prices continue to rise, sellers are reluctant to lower prices easily. According to the Korea Real Estate Board, Seoul jeonse prices rose 0.19% compared to the previous week as of the fifth week of October, marking 24 consecutive weeks of increase. One reason asking prices are maintained is the reinforced learning from the recent real estate cycle of sharp declines followed by recovery, leading to the belief that "Seoul home prices will eventually rise."

Experts believe that the backlog of listings in the Seoul apartment market will not be easily resolved for the time being. Yeogyeonghee, Senior Researcher at Real Estate R114, said, "Since pre-sale prices continue to rise and there is a shortage of housing supply in Seoul, the gap between the hopeful prices of sellers and buyers makes it difficult for transactions to be completed. Also, with high interest rates expected to continue for a while, listings are likely to increase, especially in areas where there was a high demand for leveraged purchases in the past."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.