Bitcoin Price Rises as US Federal Reserve Holds Key Interest Rate

Gold Futures Climb... Acts as Safe Haven Amid Ukraine War, Silicon Valley Bank Collapse

The price of Bitcoin, the leading virtual asset, has surged more than 25% over the past month, attracting funds into the cryptocurrency market. This price increase is due to a combination of factors, including the positive news of the U.S. Federal Reserve (Fed) holding interest rates steady and growing demand as Bitcoin is increasingly perceived as a safe-haven asset.

According to the global virtual asset market tracking site CoinMarketCap, as of 3:20 p.m. on the 2nd, Bitcoin was priced at $35,140 (approximately 47.2 million KRW), up 2.16% from the previous day. Compared to a month ago, this represents a sharp increase of 25.26%. On the same day, Bitcoin's price briefly rose to $35,902 in the morning, approaching the $36,000 level.

The rise in Bitcoin's price on this day was driven by the positive news of the Fed's decision to hold the benchmark interest rate steady. Following the Federal Open Market Committee (FOMC) regular meeting, the Fed maintained the federal funds rate at 5.25?5.5%. This decision appears to reflect tightening financial conditions due to the sharp rise in Treasury yields. With the benchmark rate held steady, the U.S. stock market, a representative risk asset market, saw the Nasdaq index rise 1.64%, and Bitcoin also showed an upward trend.

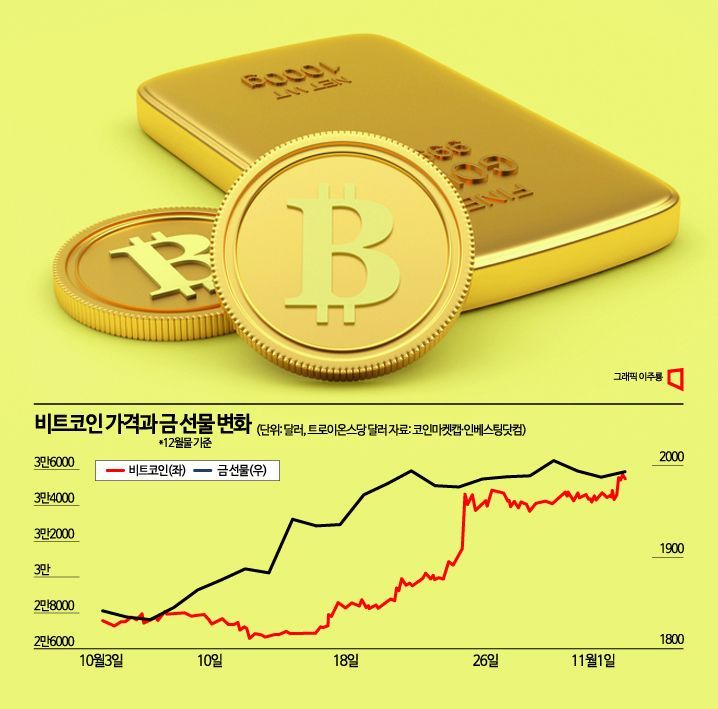

Before the price increase on this day, Bitcoin exhibited characteristics of a safe-haven asset, with its price rising accordingly. As the price of gold futures, a typical safe-haven asset, increased, Bitcoin's price also moved in a similar pattern. According to investment information provider Investing.com, as of the 2nd (local time), December gold futures were priced at $1,993.50 per troy ounce. Although the price had declined to $1,831.80 per troy ounce as recently as the 5th of last month, it subsequently trended upward, reaching $2,005.60 on the 30th of the same month. The ongoing war between Israel and the Palestinian militant group Hamas, combined with concerns over prolonged high interest rates, reinforced the effectiveness of safe-haven investment strategies.

Bitcoin's price responded to these factors by showing an upward trend. After fluctuating around the $27,000 level on the 5th of last month and experiencing a slight decline, Bitcoin began to rise from the 16th of the same month. Analysts attribute this to expectations for the launch of Bitcoin spot exchange-traded funds (ETFs) and geopolitical risks in the Middle East.

Previously, when the war between Russia and Ukraine broke out, Bitcoin was also identified as a safe-haven asset alongside gold, resulting in price increases. Virtual assets have the characteristic of being transferable across borders and, when stored in personal wallets, have relatively low risk of physical theft. Additionally, they have been recognized as a store of value during currency depreciation. In February last year, when the Russian ruble's value plummeted, Russians purchased Bitcoin, causing its price to surge more than 14% in a single day.

Furthermore, in March of this year, when banks such as Silicon Valley Bank (SVB) failed, Bitcoin was perceived as a refuge asset. As distrust in traditional banks grew, Bitcoin's price jumped by about $10,000 in just over a month. Hong Seong-wook, a researcher at NH Investment & Securities, explained, "From the perspective of citizens in war-affected countries, Bitcoin is a much more useful store of value than the dollar or gold." He added, "Even without war, if economic instability causes a sharp decline in currency value, Bitcoin's value will be highlighted." He continued, "During bank run incidents, Bitcoin attracted attention in the financial sector, and if concerns about bank runs arise in the future, everyone will think of Bitcoin first." He also noted, "Especially if Bitcoin spot ETFs are launched, making Bitcoin investment a realistic option for institutional investors, inflows of institutional funds will be possible whenever financial company instability issues occur."

As Bitcoin prices surged due to these positive factors, investor sentiment also improved significantly. According to data from the virtual asset data provider Alternative, the Fear & Greed Index, which measures investor sentiment, rose to 72 points (greed) on the 2nd, up 6 points from 66 points (greed) the previous day. Compared to 50 points (neutral) a month ago, this is an increase of 22 points. Alternative's Fear & Greed Index ranges from 0, indicating extreme fear and pessimism about investment, to 100, indicating strong optimism.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)