The Era of Depositing OLED on Silicon Wafers

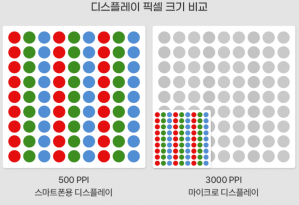

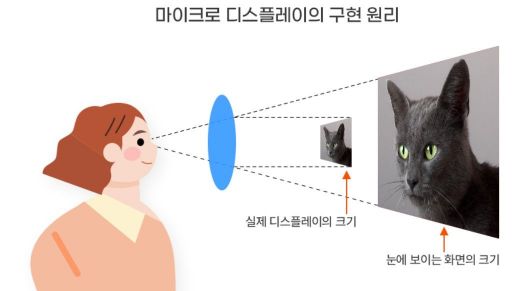

The display industry is strengthening collaboration with semiconductor companies to develop advanced products. In the past, it was possible to manufacture liquid crystal display (LCD) and organic light-emitting diode (OLED) panels without advanced semiconductor technology, but as the types of displays demanded by customers have diversified, the era has come where micro OLED devices must be deposited on wafers instead of glass substrates to realize ultra-small, high-definition displays.

The display industry considers how to utilize semiconductor processes in developing next-generation microdisplays for extended reality (XR) devices as crucial, and is enhancing cooperation with semiconductor companies. Samsung Display paid 39.1 billion KRW on the 1st of this month to acquire a related technology license from Samsung Electronics to secure semiconductor process technology for the development and manufacturing of OLEDoS (OLED on Silicon), which deposits OLED on silicon wafers.

Generally, a license to practice refers to the right to use patented inventions, registered utility models, or registered designs. With this contract, Samsung Display has obtained the permanent right to use Samsung Electronics’ semiconductor process technology necessary for OLEDoS development. Industry insiders expect this to be an opportunity for Samsung Display to complete the acquisition of 100% equity in the U.S. OLEDoS company Imagine within this year and accelerate product development to establish a mass production system for OLEDoS panels.

From Samsung Electronics’ perspective, collaboration with Samsung Display, part of the same group, is naturally welcome. If Samsung Display succeeds in mass-producing OLEDoS panels using Samsung Electronics’ semiconductor process technology, new business opportunities can be created through synergy between the two different semiconductor and display businesses. Samsung Electronics can also secure a stable panel supply chain while aiming to launch XR devices.

LG Display also considers securing semiconductor processes essential to develop and mass-produce OLEDoS for XR devices. LG Display unveiled a prototype OLEDoS for XR devices at CES 2023, the world’s largest IT and home appliance exhibition, in January this year and is currently progressing with technology development. It is known to be cooperating with semiconductor companies SK Hynix and LX Semicon during this process.

However, as the collaboration is still in its early stages, LG Display, SK Hynix, and LX Semicon have not disclosed details of contracts related to the processes. LG Display has both Apple and LG Electronics as clients, so if it succeeds in mass-producing OLEDoS panels, the number of potential customers will increase.

In the case of Sony, a Japanese company that supplied OLEDoS panels for Apple’s XR device prototype ‘Vision Pro’ unveiled in June this year, it has partnered with Taiwanese foundry (semiconductor contract manufacturing) company TSMC.

The Korean government and industry expect the XR market to grow to over 100 billion USD (approximately 134 trillion KRW) by 2026. To respond to the XR ecosystem, they are promoting technological convergence among different advanced industries such as display and semiconductor. Recently, the Korea Display Industry Association has consecutively signed XR industry convergence alliances and semiconductor fabless alliances with related companies this year to foster policies, technology, joint research, and infrastructure through inter-industry convergence and cooperation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)