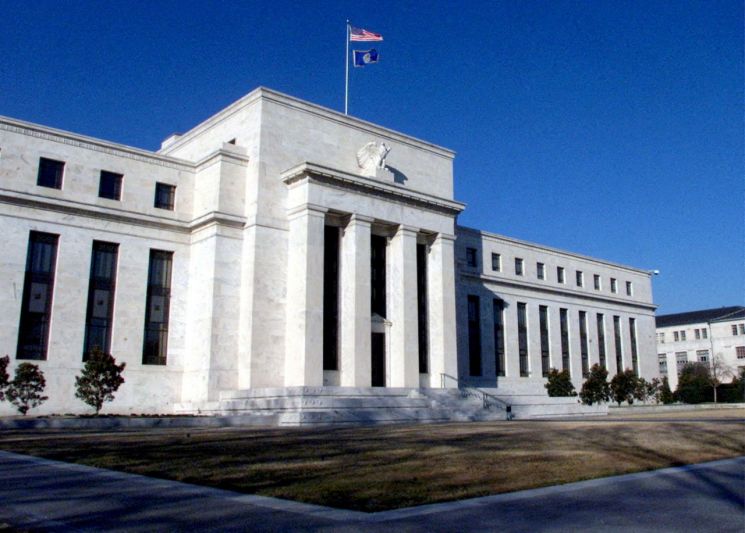

The U.S. central bank, the Federal Reserve (Fed), has kept the benchmark interest rate unchanged as expected. This decision is interpreted as reflecting recent core inflation slowdown and a sharp rise in Treasury yields, despite strong economic indicators.

On the 1st (local time), the Fed announced after the Federal Open Market Committee (FOMC) regular meeting that it would unanimously keep the federal funds rate at 5.25-5.5%. This marks the second consecutive hold following September.

The FOMC stated, "Recent indicators suggest that economic activity expanded at a strong pace in the third quarter," adding, "Job gains have moderated since the beginning of the year but remain solid. Inflation remains elevated." It also noted, "Tightened financial and credit conditions for households and businesses may weigh on economic activity, employment, and inflation," but "the extent of these effects remains uncertain."

Furthermore, it confirmed, "In determining the appropriate extent of additional policy firming needed to return inflation to the 2 percent target, we will take into account the cumulative tightening of monetary policy, the lagged effects of monetary policy on economic activity and inflation, and economic and financial developments."

The policy statement released that day showed no major changes, but some wording was adjusted. Notably, the phrase describing the economy changed from "solid pace" in September to "strong pace." The U.S. GDP for the third quarter, released last week, showed a 4.9% year-on-year increase, the highest growth since Q4 2021. The wording related to job gains also shifted from "slowed" to "moderated." While keeping rates on hold as the market expected, the Fed pointed to a strong economy, implying a prolonged period of high interest rates.

However, the policy statement also included references to tightened "financial" conditions alongside credit conditions. This is interpreted as reflecting the impact of the recent sharp rise in Treasury yields, which has further tightened financial markets and contributed to the unanimous decision to hold rates. Previously, at the September FOMC, the Fed hinted that one more rate hike could follow this year, but analyses inside and outside Wall Street have suggested that the need for further tightening has diminished due to the surge in Treasury yields. Core inflation, closely watched by the Fed, has also continued its downward trend.

The market is currently awaiting the upcoming press conference by Fed Chair Jerome Powell, scheduled to begin at 2:30 p.m. Eastern Time.

With this hold, the interest rate gap between South Korea and the U.S. remains at 2 percentage points (based on the upper limit of U.S. rates). Earlier, the Bank of Korea kept its rate steady at 3.50% last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.