Decision Made to Apply the Previously Contested Standard API

Insurance companies and the fintech industry have agreed to introduce a 'standard API' to insurance comparison and recommendation platforms. Starting January next year, it is expected that insurance products such as automobile insurance and indemnity health insurance can be compared and purchased through these platforms.

The Life Insurance Association, the General Insurance Association, and the Korea Fintech Industry Association announced that on the 1st, 22 life insurance companies, 18 general insurance companies, and 11 fintech companies signed an agreement titled 'Agreement for Smooth Preparation and Operation of Platform Insurance Product Comparison and Recommendation Services' at the Life Insurance Education and Culture Center in Jongno-gu, Seoul.

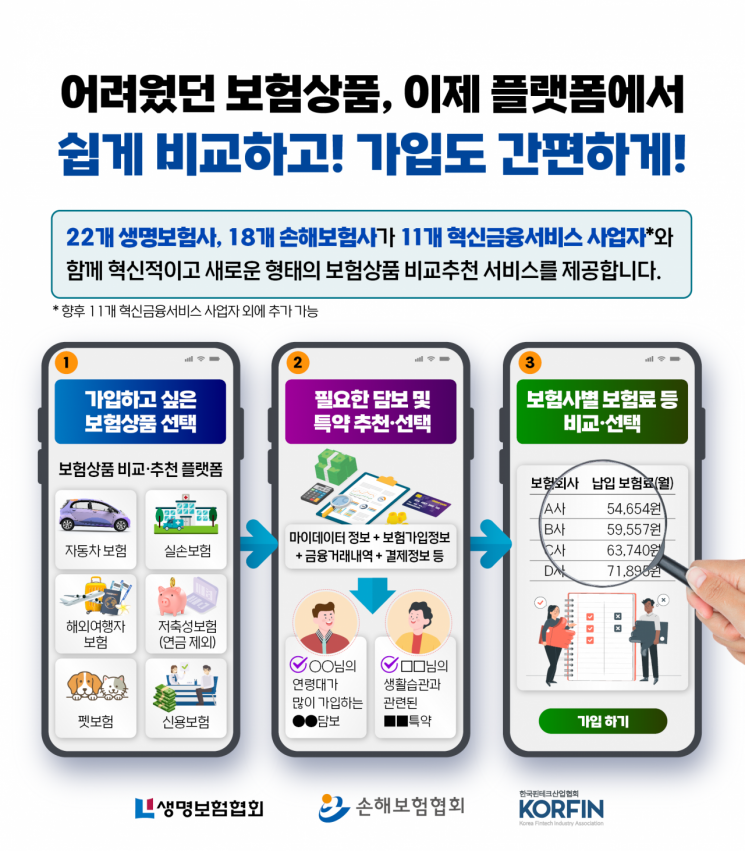

The platform insurance product comparison and recommendation service is operated by 11 fintech companies designated as innovative financial service providers by the Financial Services Commission in July last year (Naver Financial, Kakao Pay, Toss, BankSalad, SK Planet, Payco, Kukon, Finda, Fink, Habit Factory, Hecto Data). Through these platforms, users can compare and purchase online insurance products from multiple insurance companies.

They plan to launch comparison and recommendation services starting January next year for automobile insurance, overseas travel insurance, indemnity health insurance, and savings insurance (excluding pensions).

The standard API, which had been a point of disagreement between insurance companies and fintech firms, was ultimately accepted. The Life Insurance Association, the General Insurance Association, and the Korea Fintech Industry Association agreed to prepare standard API specifications through discussions on data standardization necessary for the comparison and recommendation services. Accordingly, a consultative body representing each member company will be formed and operated to discuss the preparation and operation of future services and to enhance the effectiveness of the agreement.

The three associations stated, "Through this service, insurance companies will improve consumer convenience, and fintech companies will expand their business areas such as handling insurance products, creating a mutually beneficial 'win-win' opportunity." They added, "We will continue to monitor the market to ensure the stable operation of the hard-won comparison and recommendation services and review institutional improvements and supplementary measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.