HiteJinro to Raise Soju Price by 6.95% Starting Next Month on the 9th

Restaurant Soju Price Expected to Approach 7,000 Won per Bottle

HiteJinro, the number one company in the soju industry, will raise the prices of soju products starting next month due to increases in the prices of ethanol and empty bottles. As alcohol consumption rises toward the year-end, the price hike is expected to increase the burden on consumers, with some estimates suggesting that the price of soju sold in restaurants and pubs could reach up to 7,000 KRW per bottle.

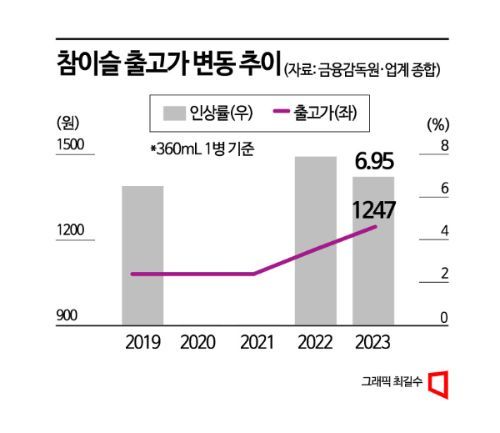

On the 31st, HiteJinro announced that from November 9th, it will raise the ex-factory prices of its flagship soju brands, Chamisul Fresh and Chamisul Original, by 6.95% due to increases in ethanol and empty bottle prices. The price hike applies to 360mL bottles and PET products under 1.8L. PET products over 1.8L, including traditional distilled liquors mainly consumed in rural areas, and products like Ilpoom Jinro are excluded from this increase.

This is HiteJinro's first soju price increase in 1 year and 8 months since February last year. A HiteJinro official explained, "Since the beginning of the year, the price of ethanol, the main raw material for soju, has risen by 10.6%, and bottle prices have increased by 21.6%, along with rising costs for raw materials, logistics, and manufacturing expenses. However, we decided on the rate of increase to align with the government's efforts to stabilize prices and to minimize the burden on consumers."

Previously, Daehan Ethanol Sales, which handles ethanol sales for 10 domestic ethanol companies, raised ethanol prices by an average of 7.8% last year for the first time in 10 years, followed by a 9.8% increase in April this year. Additionally, bottle manufacturers have raised the price of soju bottles from 180 KRW to 220 KRW since February this year. At the end of last year, the price of bottle caps also increased.

As HiteJinro raises product prices ahead of the year-end when alcohol consumption increases, the burden on consumers is expected to grow. With this increase, the price of soju sold in restaurants and pubs is expected to exceed 5,000 KRW per bottle, reaching 6,000 to 7,000 KRW. Previously, when the liquor industry raised ex-factory prices, the price of soju bottles in restaurants, which was around 4,000 to 5,000 KRW, jumped to 5,000 to 6,000 KRW.

Last February, HiteJinro raised the ex-factory price of soju by 7.9%, increasing the price from 1,081 KRW to 1,166 KRW per bottle, an 85 KRW increase. Applying the current 6.95% increase to the existing ex-factory price will raise it by 81 KRW per bottle to 1,247 KRW. Generally, even if the ex-factory price rises by less than 100 KRW, restaurant prices have increased by 1,000 KRW per bottle, so many companies are expected to implement 1,000 KRW unit price hikes this year as well.

There have been ongoing voices that the increase in consumer prices is excessive compared to the ex-factory price hike. The manufacturer's ex-factory price consists of manufacturing costs (48%), which include raw material and other manufacturing expenses, and taxes (52%). With this increase, Chamisul's ex-factory price will rise by 81 KRW per bottle. Excluding taxes from the per-bottle increase, the manufacturer's share is about 40 KRW.

The soju supplied by the manufacturer is handled by liquor wholesalers who treat it as entertainment-use alcohol. These wholesalers typically add a margin of 20-25% for transportation costs including fuel, labor, and operating expenses, supplying it to restaurants for under 1,600 KRW. Depending on the establishment, if a restaurant receives a bottle at 1,600 KRW and sells it for 6,000 KRW, a profit of 4,400 KRW is generated. Considering restaurant rent, labor, and other operating costs, this is cited as a reason for criticism regarding the excessive price increase.

Regarding this, a recent official from the Ministry of Economy and Finance stated, "We have requested restraint on price increases considering the high inflation situation, but it is difficult to prevent companies from adjusting prices due to rising costs." He added, "Currently, the ex-factory price has only risen slightly, and we are focusing on preventing situations where prices at the retail end, such as restaurants, increase by 1,000 KRW, thereby increasing household burdens." Related to this statement, it is known that the Fair Trade Commission will examine whether excessive price hikes are applied in the distribution network and final price-setting stages due to the characteristics of the liquor industry.

For now, HiteJinro plans to establish win-win measures to ensure that the price increase does not lead to a significant burden, such as a decrease in sales volume for consumers, self-employed business owners, and distribution channels. First, they will supply sufficient quantities to liquor-handling partners before the price increase date so that they can stock up at pre-increase prices.

They also plan to conduct various discount events at large discount stores, corporate supermarkets (SSM), NongHyup Hanaro Mart, and large individual supermarkets where consumers can directly purchase soju products. Through this, they aim to minimize consumers' perception of the price increase until the end of the year.

Additionally, they will implement a debt collection grace plan for liquor wholesalers. This is expected to continue the grace period for collecting loans provided by liquor wholesalers to restaurants.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.