Report on the Status and Evaluation of Disinflation in Major Countries

The war between Israel and the Palestinian armed group Hamas has emerged as an unexpected variable, leading to forecasts that the pace of inflation slowdown in South Korea will be slower than initially expected. Analysts suggest that if international oil prices and agricultural product prices remain high as they have recently, the resumption of the decline in the consumer price inflation rate could be somewhat delayed.

Accordingly, attention is focused on how much the Bank of Korea will revise upward its inflation forecasts for this year and next in its upcoming updated economic outlook next month.

In a report titled "Current Status and Evaluation of Disinflation in Major Countries," published on the 30th in the 'BOK Issue Note,' the Bank of Korea stated, "Although the consumer price inflation rate in South Korea, which had recently rebounded, is expected to resume its slowing trend due to weakening demand pressures, the pace of slowdown will be slower than initially expected due to the Middle East situation and other factors."

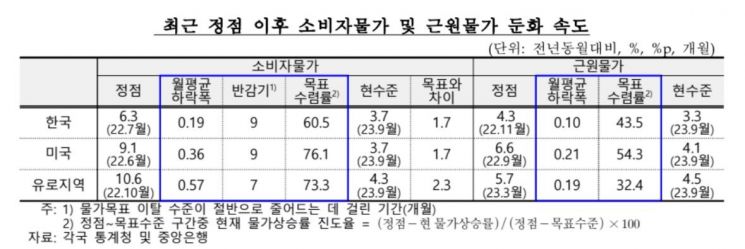

According to the report, since the second half of last year, the patterns and speeds of inflation slowdown in major countries have generally shown similar trends, but the underlying causes differ. In particular, considering factors such as the average monthly decline, half-life, and convergence rate to targets, the Bank of Korea found that the speed of inflation slowdown in South Korea is not faster compared to major countries.

In the case of the United States, the consumer price inflation rate peaked at 9.1% in June last year and fell to 3.7% in September this year, currently showing a 1.7 percentage point gap from the inflation target level (2%). In South Korea, the consumer price inflation rate peaked at 6.3% in July last year and was recorded at 3.7% in September, also showing a 1.7 percentage point gap from the inflation target level.

The Bank of Korea analyzed that in South Korea, recent demand-side pressures and labor market tightness are weakening, but the ripple effects of cost-push inflation pressures are still ongoing.

In the United States, the impact of supply shocks is easing, but demand-side and labor market inflation pressures remain robust. In the Euro area, despite a slowdown in growth, the secondary effects of supply shocks and high wage growth rates continue to constrain disinflation.

Global IBs Forecast South Korea to Reach Inflation Target in First Half of 2025

The Bank of Korea expects that while inflation rates in major countries will exceed target levels for a considerable period, the timing of convergence to inflation targets will vary somewhat by country depending on the drivers of disinflation.

Major forecasting institutions, including global investment banks (IBs), project that the United States will reach its inflation target in 2026, the Euro area in the second half of 2025, and South Korea in the first half of 2025. However, these figures are aggregated from global IB forecasts and may differ from the Bank of Korea’s internal projections.

Lee Dong-jae, head of the Price Trends Team at the Bank of Korea’s Research Department, explained, "In the United States and the Euro area, service price inflation, which is heavily influenced by demand and wage pressures, remains high, constraining disinflation, whereas in South Korea, the core goods price inflation is slowing down relatively more slowly compared to service prices recently." He added, "The possibility that economic agents in South Korea have changed their price and wage-setting behaviors after experiencing high inflation could also be a factor slowing disinflation."

Regarding future inflation outlooks, Lee Jung-ik, head of the Price and Employment Department at the Bank of Korea, said, "If the assumptions about oil prices change, inflation forecasts will inevitably be revised," adding, "Due to the Middle East situation and other factors, the timing of reaching the inflation target could be somewhat delayed compared to the inflation path expected in August."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)