Direction for Insurance Premium Rate Increase Presented

Specific Numbers and Scenarios Missing

Ministry of Health and Welfare: "Will Go Through National Assembly and Public Discussion Process"

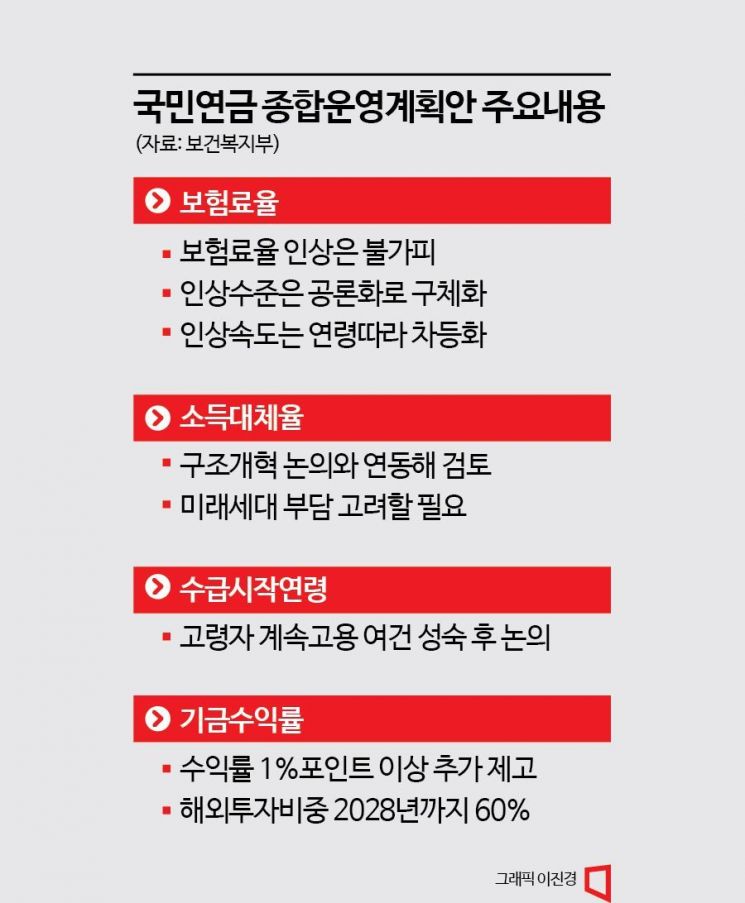

The government announced a pension reform plan excluding parametric reforms. It also omitted details on how to adjust the contribution rate and income replacement rate. The government plans to decide on specific measures through the National Assembly and a public deliberation process. Although the government explained that it presented a direction to raise the contribution rate, unlike its previous stance of not avoiding pension reform, it has been criticized for presenting a watered-down reform plan ahead of the election.

On the 27th, the Ministry of Health and Welfare held a National Pension Deliberation Committee meeting at the Government Complex Seoul in Jongno-gu, Seoul, and announced the "5th Comprehensive Operation Plan" containing these details. The comprehensive operation plan includes future financial forecasts of the National Pension, pension contribution rates, income replacement rates, and fund management plans. According to the National Pension Act, the Minister of Health and Welfare prepares this plan every five years.

This plan excluded specific parametric reform details. Parametric reform refers to adjustments in contribution rates, income replacement rates, and the pension starting age. It is considered the core of pension reform because it directly affects the pension amount that citizens will receive and the speed of fund depletion. The government stated, "Since opinions on contribution rates and income replacement rates vary, rather than presenting a specific proposal, we provided a direction to enable broad discussions through a public deliberation process," adding, "Since sufficient discussion and social consensus are paramount, we plan to decide on specific levels through a public deliberation process together with the National Assembly."

However, there are criticisms that this is far from the "completed pension reform" that President Yoon Seok-yeol had ordered. Since his inauguration, President Yoon has consistently stated that he would not avoid pension reform. At the December national agenda review meeting last year, he emphasized, "In the previous government, pension discussions did not even arise because it was believed that raising the topic would cost votes," and added, "In this government, we must start now so that a completed pension reform can be achieved."

Criticism of the government’s failure to present a concrete pension reform plan as "watered-down" has also emerged. Nam Jae-woo, director at the Korea Capital Market Institute, said, "A plan without numbers will be criticized," and pointed out, "All pension reforms have only been implemented when led by the government, and there is a strong opinion that the government should at least present a minimum proposal."

"Raising the contribution rate is inevitable... The pace of increase will be differentiated considering generational equity"

However, the government clearly indicated that raising the contribution rate is inevitable. The basis is that, compared to the Organisation for Economic Co-operation and Development (OECD), the income replacement rate is similar at around 40%, but the contribution rate is 9%, which is about half the OECD average. The level of increase will be specified through public deliberation, taking into account rapid demographic changes. Additionally, considering generational equity, the pace of contribution rate increases will be differentiated by age group. For example, assuming a 5% increase in contributions, the 40s and 50s age groups would raise the rate by 1% every year over five years, while the 20s and 30s groups would bear the 5% increase over 15 to 20 years. Accordingly, the annual increase rate will vary by age group.

Specific proposals to adjust the income replacement rate (pension amount relative to average income) were excluded. This means scenarios to raise the pension amount citizens receive were omitted. The government explained that it will review this in connection with structural reform discussions within the framework of multi-tiered old-age income security, including basic pensions and retirement pensions, through a public deliberation process with the National Assembly. It noted that raising the income replacement rate inevitably increases the burden on future generations.

The plan also did not include proposals to adjust the pension starting age. The option to delay the age at which pensions begin to be received was postponed for now. The government intends to start discussions after the employment conditions for older workers mature. It plans to discuss adjusting the pension starting age along with measures to improve consistency with other pension systems such as basic pensions and retirement pensions. Lee Se-ran, director of the Pension Policy Bureau at the Ministry of Health and Welfare, explained, "Since income gaps after retirement continue, discussions on extending retirement age and continued employment should proceed together."

The National Pension fund’s rate of return will be raised by more than 1 percentage point to enhance fund stability. To increase returns, the proportion of overseas investments will be expanded to about 60% by 2028, and the decision-making structure will be reorganized to improve expertise. The authority for strategic asset allocation, which greatly affects returns, will be transferred from the Fund Management Committee, the highest decision-making body for fund management, to the expert-centered Fund Management Headquarters. The Fund Management Committee mainly consists of government members such as the Minister of Health and Welfare and worker representatives, and has been criticized for lacking expertise. The plan also includes diversifying new asset classes with medium risk and medium returns, such as private loans.

Emphasizing financial stability, the government also included its intention to start discussions on converting the current defined benefit (DB) fund to a defined contribution (DC) system in the future. The defined benefit system guarantees a predetermined pension level, whereas the defined contribution system pays benefits proportional to individual contributions and subscription periods, making it more favorable for financial stability. However, in the DC system, the risk of loss is borne by individuals, not the state. Additionally, to enhance the real income of beneficiaries, the government plans to expand insurance premium support to low-income regional subscribers and broaden credit systems for childbirth and military service.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.