As domestic inflationary pressures intensify due to the recent rise in international oil prices, there are forecasts that dining-out prices will rise again by more than 5%. The sharp increase in prices of various food ingredients such as crude oil, sugar, and salt, along with the growing burden of public energy charges, is leading to a domino effect of service price hikes by self-employed business owners, analysts say.

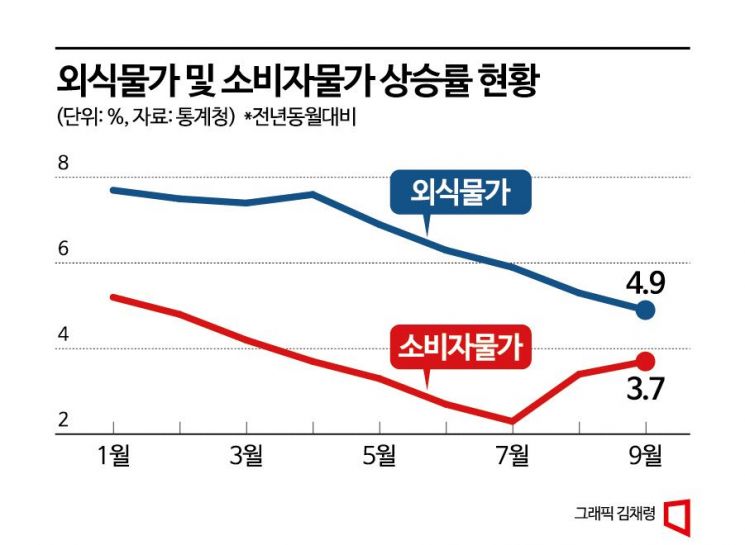

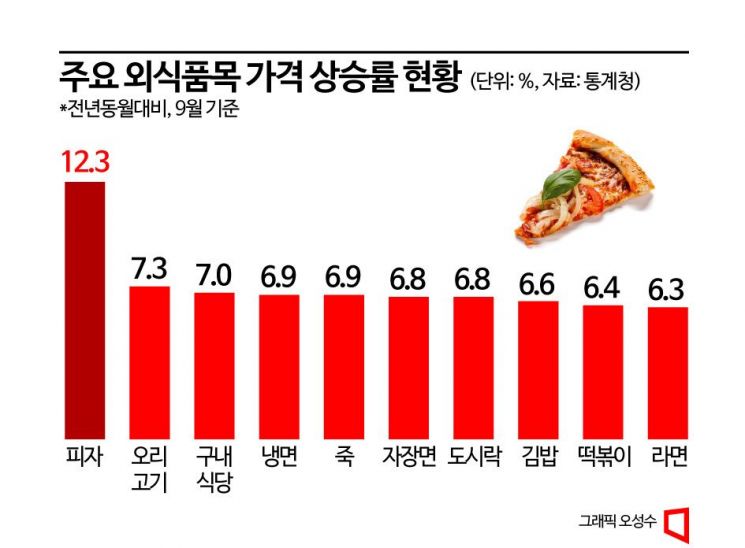

According to related government departments on the 27th, the dining-out price inflation rate is likely to rebound to the 5% range this month for the first time in six months. Last month, the average dining-out price inflation rate was 4.9%, narrowing the gap with the consumer price inflation rate (3.7%) to 1.2 percentage points. Once dining-out prices rise, their rate of slowdown is slower than that of consumer prices, prolonging the perceived inflation burden on ordinary citizens. For example, when the consumer price inflation rate slowed to 2.3% in July, dining-out prices were at 5.9%, widening the gap to 3.6 percentage points.

The reason dining-out prices do not easily slow down is due to the complex interplay of factors such as rising international food prices and labor costs. According to a survey by the Ministry of Agriculture, Food and Rural Affairs, the factors affecting operating costs in the dining industry are composed of 41% food ingredient costs, 34% labor costs, 10% rent, 8% fees, and 7% taxes. Recently, the war between Israel and Hamas has increased uncertainty in international oil prices, causing price increases in raw materials, logistics costs, and even labor costs. In fact, recent increases in food ingredient prices are directly pushing up dining-out prices.

Sugar is a representative example. According to the United Nations Food and Agriculture Organization (FAO), the international sugar price index last month was 162.7, up 9.8% from the previous month. The price index is based on the average price from 2014 to 2016 set at 100 for comparison. The global sugar price index recorded 157.2 in May this year and showed a downward trend until July, but rose for two consecutive months in August and September, reaching the highest level in 13 years since November 2010. The sharp rise in sugar prices is leading to expanding signs of 'sugarflation,' where prices of snacks, bread, beverages, and other products using sugar as an ingredient are sequentially increased.

The problem is that dining-out prices are showing signs of a sharp rise in the fourth quarter. Expected inflation rebounded this month to 3.4%, up 0.1 percentage points from the previous month, marking the first increase in eight months. Pressure to raise energy charges is also a burden. Since it takes about three months for the rise in international oil prices to directly affect domestic prices, increases in electricity and gas charges in the fourth quarter are inevitable. The government set electricity rates at 8.0 won per kWh (kilowatt-hour), up 5.3% each quarter until the second quarter of this year, and city gas rates at 1.04 won per MJ (megajoule). The government is currently discussing with relevant departments the necessity and extent of additional electricity rate hikes, which are expected to be at least 20 to 30 won per kWh.

The government has recently been making all-out efforts to curb dining-out prices by releasing reserved food ingredient stocks and considering extending the tariff quota on raw sugar to lower sugar prices. However, experts point out that given the inevitability of consumer price inflation, there are limits to immediately controlling dining-out prices. Kim Jeong-sik, emeritus professor of economics at Yonsei University, said, "As uncertainty in the Middle East increases, the rise in public utility charges due to rising international oil prices is expected to exert upward pressure on service prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)