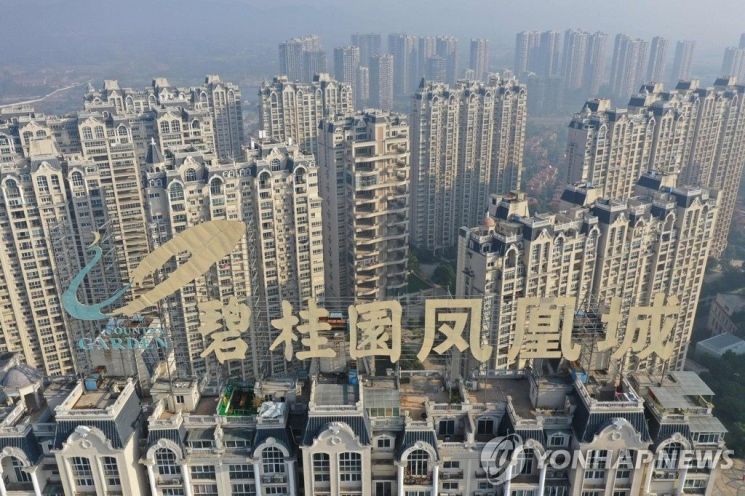

Country Garden, China's largest private real estate developer, has officially declared a default on its dollar bonds for the first time.

According to Bloomberg on the 25th, Hong Kong Citicorp International, the trustee of Country Garden, notified holders of Country Garden's dollar bonds in a memo that the company failed to pay interest on the bonds by the maturity date last week, thereby meeting the criteria for default.

Accordingly, if bondholders holding at least 25% of the outstanding principal of the bonds that Country Garden has failed to repay demand repayment, the trustee must request Country Garden to pay the principal and interest to the bondholders. However, Bloomberg reported that bondholders have not yet made such a demand.

Previously, Country Garden failed to repay $15.4 million in interest on dollar bonds that matured on the 17th of last month. After failing to make the interest payment by the end of the 30-day grace period on the 19th of this month, the default was finalized. Subsequently, Country Garden officially declared the dollar bond default through the trustee for the first time on this day.

Country Garden holds a total debt of $186 billion, the largest among China's private real estate developers. It was the largest construction company in China by real estate sales in recent years, but its ranking fell to seventh this year due to worsening financial conditions. However, it is still pursuing more than 3,000 real estate projects in small cities, so the ripple effects of the default are expected to spread throughout the market.

Bloomberg stated, "The number of Country Garden's projects is several times greater than that of Evergrande Group, which went bankrupt in 2021," and added, "Considering this situation, it could have a greater negative impact than Evergrande's debt failure."

China's real estate market has not recovered from the slump since the Evergrande default crisis in 2021. Real estate development investment in the first to third quarters of this year decreased by 9.1% compared to the same period last year, showing that the market has not revived despite the authorities' efforts to stimulate the real estate economy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)