Hana Financial Management Research Institute Announces '2024 Financial Industry Outlook'

Household and Corporate Debt, Real Estate PF Require Caution

Particular Concern Over Non-Bank Sectors... Strengthened Soundness Management

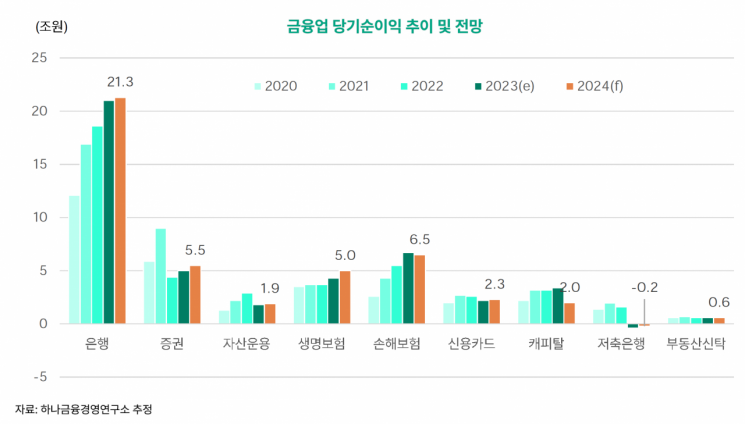

Despite expectations for economic recovery next year, the growth of the financial industry is expected to be sluggish due to domestic and international uncertainties and high interest rates. Accumulated household debt, rapidly increasing corporate debt, and real estate project financing (PF) were cited as variables to watch. While the banking sector is expected to maintain a steady state and the insurance sector to show relatively favorable growth, the specialized credit finance industry is anticipated to continue its sluggish performance.

On the 25th, Hana Financial Management Research Institute released a report titled "2024 Financial Industry Outlook" containing these insights. The report predicted that the financial industry will overall experience only slight growth next year. In particular, it emphasized the need to strengthen soundness management in the non-bank sector, where concerns about insolvency are relatively high due to self-employed individuals, marginal companies, and distressed real estate PF projects.

It also analyzed that 2024 will be a year in which capital regulations to enhance loss absorption capacity and deregulation for financial innovation will be pursued simultaneously. Therefore, it recommended that financial companies focus on improving productivity and innovating business structures by utilizing artificial intelligence (AI) and other technologies, and discover new growth engines in line with structural changes such as aging.

Deepening Profitability Differentiation by Sector Amid Growth Slowdown

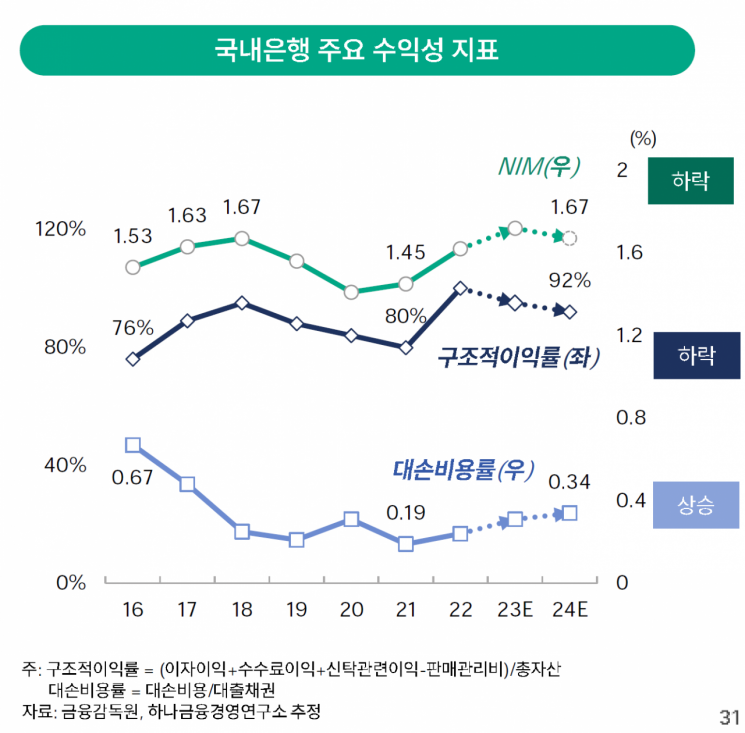

By sector, the banking industry’s growth is expected to slow somewhat. The loan growth rate is forecasted to be 3.4% next year, following 4.9% in 2022 and 3.5% in 2023, once again falling below the nominal gross domestic product (GDP) this year. Specifically, household loans are expected to turn to an increasing trend next year, but sluggish real estate market recovery and continued regulatory stance on household loans by authorities are expected to keep performance weak. Corporate loans, which had grown steadily since 2020, are also expected to weaken, centered on loans to large corporations and individual business owners. While demand for funds such as facility capital from small and medium enterprises will continue, the surge in large corporate loans is expected to slow as the corporate bond market recovers.

However, net profits in the banking sector itself are expected to exceed 20 trillion won, reaching an all-time high. Nevertheless, the increase in net profit is not expected to be significant. Despite loan growth, net interest margin (NIM) is expected to decline from the second half of the year, and loan loss costs are expected to rise. The structural profit rate, which indicates profit generation relative to asset size, is believed to have already entered a downward trend after peaking in 2022.

In the insurance sector, growth is expected to continue mainly in protection-type insurance due to the application of new accounting standards. Life insurance sales of savings-type policies are expected to slow, while non-life insurance is anticipated to achieve favorable profits through growth in long-term insurance. However, as authorities provide guidelines for applying the new accounting standards, the 'illusion effect' of significantly improved profitability compared to the previous year this year is expected to diminish and stabilize downward. Additionally, insurance comparison and recommendation through online platforms are expected to become more active, and the influence of General Agencies (GA) will expand, leading to the establishment of separation between underwriting and sales.

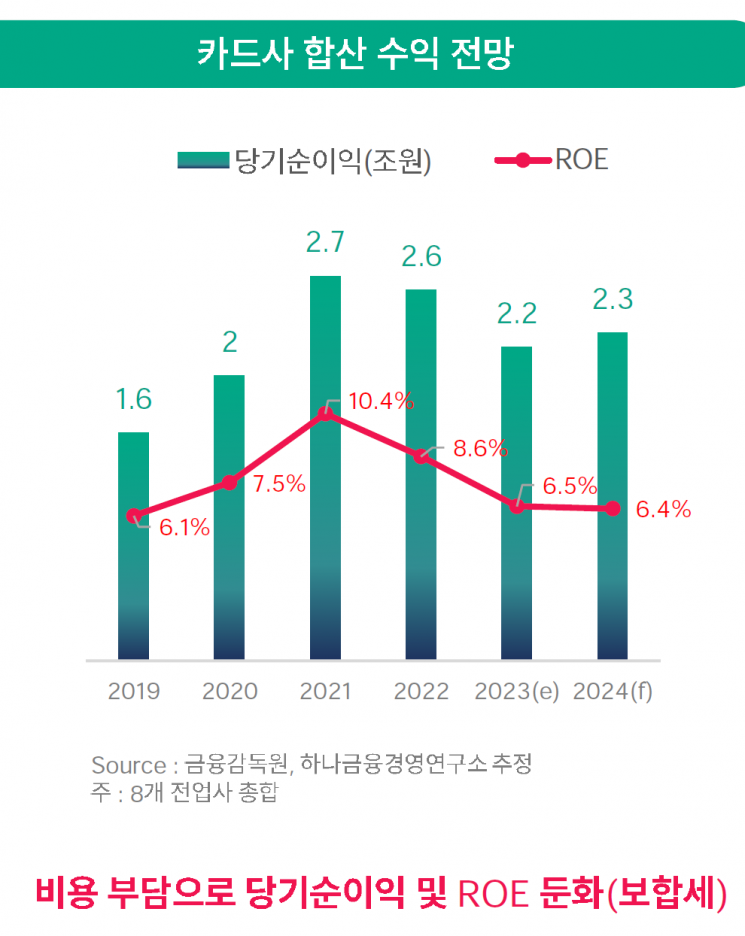

The situation in the specialized credit finance industry is expected to be the most challenging. It is analyzed that profitability improvement will be difficult due to the continued burden of funding costs through specialized credit finance bonds. Specifically, the credit card industry is expected to see payment segments remain flat due to nominal consumption slowdown, with ongoing burdens from funding costs and provisions. The capital industry is expected to grow in leasing and installment sales due to recovery in the automobile industry, but funding costs and loan loss burdens related to real estate PF are expected to be significant. Savings banks are judged to have a high possibility of deficits next year as well, following this year, due to competition with banks over deposit interest rates and the possibility of real estate PF insolvency.

Ryu Chang-won, a research fellow at Hana Financial Management Research Institute, explained, "The financial industry in 2024 will see overall improvement in growth due to moderate economic recovery, but profitability will become more differentiated among sectors depending on the duration of the high interest rate environment. In particular, the specialized credit finance industry, which relies on market funding, requires caution. If economic uncertainties such as war increase, the risks across the entire financial industry could rise, so it is necessary to strengthen fundamentals rather than pursue reckless growth."

Attention Needed on Accumulated Household Debt, Rapidly Increasing Corporate Debt, and Real Estate PF

The institute identified accumulated household debt, rapidly increasing corporate debt since COVID-19, and deferred real estate PF insolvency as variables to watch. It diagnosed that if interest rate cuts and economic recovery are delayed, insolvency could surface, necessitating active risk management. It also pointed out that the non-bank sector, which has a high proportion of loans to self-employed individuals, non-apartment, and regional construction real estate PF projects, requires even greater caution.

Baek Jong-ho, a research fellow at Hana Financial Management Research Institute, emphasized, "Although financial companies’ soundness indicators are still relatively good, the delinquency rates of loans to small and medium enterprises and households in banks, as well as loans in the non-bank sector, are rapidly rising due to the prolonged high interest rates. Especially, active measures are needed to prevent loan defaults among self-employed individuals."

Therefore, it was suggested to strengthen risk management while seeking new growth engines. It is expected that comparison recommendations and separation of underwriting and sales will be established across all financial sectors through various online platforms and GAs, and that strengthened capital regulations and deregulation for financial innovation will be implemented simultaneously.

Research fellow Ryu advised, "Financial companies next year should prioritize short-term crisis response but also strive to improve productivity and build sustainable business models. Given the high interest rates, strengthened capital regulations, and the solidifying aging trend, the financial industry is now a high-cost structure. Therefore, efforts should be made to enhance productivity and efficiency using AI and other technologies, and to concretize new growth engines such as senior care and token securities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.