Office Sales Market Continues Mixed Trends

Rental Market Vacancy Rates Decline for Two Consecutive Months

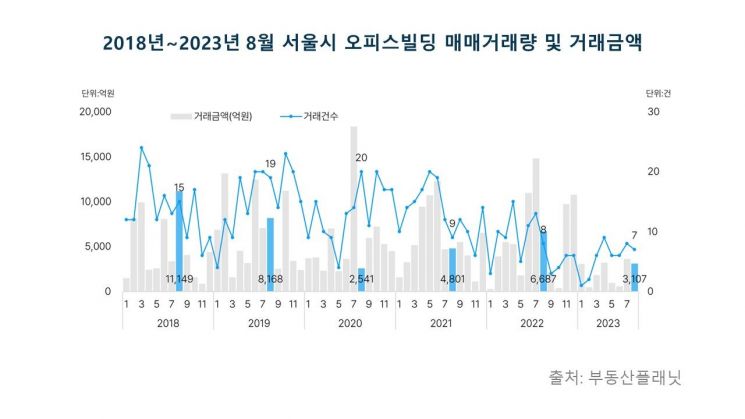

As the high interest rate trend continues, office building transactions in Seoul were sluggish in August. While the office sales market has shown mixed trends this year, the office rental market vacancy rate has decreased for two consecutive months.

On the 24th, Real Estate Planet, a commercial real estate specialist company based on big data and artificial intelligence (AI), analyzed the actual transaction data from the Ministry of Land, Infrastructure and Transport and found that the number of office building transactions in Seoul last August was a total of 7, down by 1 from the previous month (8). The transaction amount also decreased by 13.3% from 358.5 billion won to 310.7 billion won. Compared to the same month last year, the transaction volume decreased by 12.5% (8 cases), and the transaction amount decreased by 53.5% (668.7 billion won). The sluggish office building transactions are interpreted as being due to the continued high interest rates, which have dampened investment sentiment in office buildings.

Unlike office buildings, office transaction volume reached 130 cases, increasing by 75.7% from the previous month, marking the highest point this year. This shows a rebound in transaction volume after two consecutive months of decline since June. However, compared to the same period last year (168 cases), it decreased by 22.6%.

The transaction amount for sales was 530.7 billion won, which increased by 1568.9% from the previous month and also rose by 445.4% compared to the same month last year. Real Estate Planet explained that the sharp increase in office transactions was largely due to multiple transactions conducted in two buildings located in Jung-gu and Yongsan-gu, Seoul, suggesting that this might be a temporary phenomenon.

According to a survey conducted by Real Estate Planet targeting office facilities through phone calls, visits, and rental notices from real estate management companies, the office building vacancy rate in August was 2.42%. This is a decrease of 0.11 percentage points from the previous month, showing a downward trend for two consecutive months. Compared to major cities such as San Francisco and New York in the U.S. and London in the U.K., where office building vacancy rates have reached double digits due to reduced office demand following the hybrid work system established after COVID-19, this is a relatively favorable level.

Jung Sumin, CEO of Real Estate Planet, said, "Along with the contrasting transaction patterns of office buildings and offices in Seoul in August, the office sales market this year has shown mixed trends with monthly fluctuations, while the rental market remains stable. However, it is estimated that the vacancy rate of office subleases operated under the 'Master Lease' system, where the office is leased and then re-leased, is increasing, so it is necessary to carefully monitor rental market trends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)