Kakao Suspected of Market Manipulation Using Private Equity in SM Acquisition

FSS Confident in Fact-Finding... Kim Beom-su to Appear on 23rd

If Kim Beom-su Found Guilty, Kakao Bank Major Shareholder Status 'Shaken'... Forced Sale of Kakao Bank Shares Possible

Fair Trade Commission Proceeding with Final Approval of Kakao-SM Merger

Bae Jae-hyun, Head of Investment at Kakao, is heading to the courtroom on the 18th at the Seoul Southern District Court in Yangcheon-gu to attend the pre-arrest detention hearing (warrant review). [Image source=Yonhap News]

Bae Jae-hyun, Head of Investment at Kakao, is heading to the courtroom on the 18th at the Seoul Southern District Court in Yangcheon-gu to attend the pre-arrest detention hearing (warrant review). [Image source=Yonhap News]

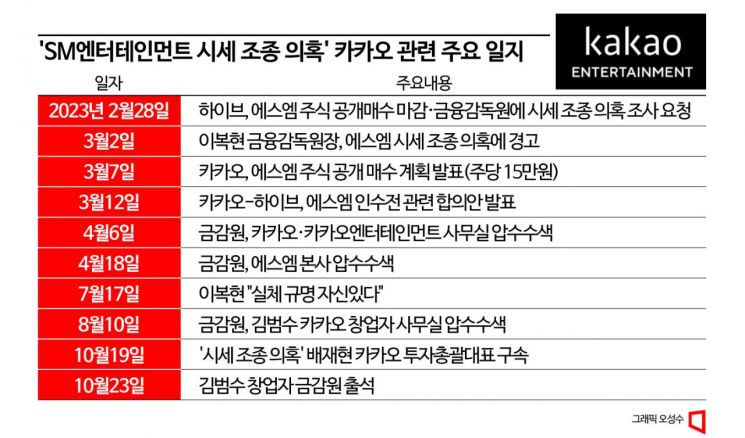

Financial authorities are accelerating their investigation into Kakao's alleged market manipulation during the acquisition process of SM Entertainment (SM). Following the arrest of Bae Jae-hyun, Kakao's Chief Investment Officer (CIO), on the 19th, Kim Beom-su, head of Kakao's Future Initiative Center, is scheduled to appear before the Financial Supervisory Service (FSS) on the 23rd. The FSS believes that Kakao deliberately drove up SM's stock price to obstruct HYBE's tender offer in the competition for SM's management rights in February. The summons for Kim Beom-su was issued on the grounds that he may have been informed of or directed the market manipulation.

According to financial authorities, the FSS's Capital Market Special Judicial Police (Special Judicial Police) has notified Kim Beom-su to appear by 10 a.m. on the 23rd. The Special Judicial Police plan to investigate whether Kim was informed of or directed the market manipulation of SM. It is reported that the Special Judicial Police have secured phone call recordings and text messages containing evidence of market manipulation from Kakao's staff phones. An FSS official stated, "The summons was indeed issued due to matters related to SM's market manipulation," but added, "It is difficult to disclose specific charges or investigation schedules."

Since the court issued an arrest warrant for Bae Jae-hyun, Kakao's CIO, stating that "the objective facts appear to have been substantially established based on the evidence obtained," the authorities, including the prosecution and the FSS, seem to have gained the upper hand in the standoff with Kakao. Notably, FSS Governor Lee Bok-hyun expressed confidence in uncovering the truth. If illegal acts by Kakao employees escalate into violations by Kakao itself, the worst-case scenario could unfold, forcing Kakao to withdraw from financial businesses such as KakaoBank due to shareholder eligibility issues. This could also negatively impact the corporate merger review between Kakao and SM.

Market Manipulation Unveiled... Lee Bok-hyun's Confidence

The core issue in this case is whether Kakao participated in market manipulation in an organized manner. On February 28, HYBE filed a petition with the FSS requesting an investigation, stating that "an abnormal purchase amounting to 2.9% of SM's total issued shares occurred at IBK Investment & Securities Pangyo branch on February 16," and alleging violations of the Capital Markets Act. HYBE argued that as SM's stock price surged from HYBE's tender offer price of 120,000 KRW to 130,000 KRW, it strongly suspected that the price was manipulated to obstruct HYBE's tender offer.

The Capital Markets Act prohibits trading or entrusting transactions intended to induce trading of listed securities by manipulating prices. It also forbids trading or entrusting transactions aimed at fixing or stabilizing the prices of listed securities.

Despite these twists and turns, Kakao and HYBE reached an agreement, ending the management rights dispute for the time being. Kakao became the largest shareholder by acquiring a 35% stake in SM through a tender offer at 150,000 KRW per share, securing more than the target amount. However, investigations into Kakao's market manipulation allegations continued. The Special Judicial Police conducted raids on SM's headquarters, Kakao, Kakao Entertainment, and Kim Beom-su's office.

The Special Judicial Police's investigation revealed the substance of the allegations. They applied for arrest warrants for three individuals, including Bae Jae-hyun, on charges of violating the Capital Markets Act at the Seoul Southern District Prosecutors' Office. On the 19th, Judge Kim Ji-suk of the Seoul Southern District Court, responsible for warrants, issued an arrest warrant for Bae Jae-hyun, citing concerns over evidence tampering and flight risk. The arrest warrants for Kakao's Head of Investment Strategy and Kakao Entertainment's Head of Investment Strategy Division were not granted. However, the court's statement that "the objective facts appear to have been substantially established based on the evidence obtained so far" suggests that the charges against them are also partially proven.

The Special Judicial Police have determined that these individuals invested approximately 240 billion KRW in February to obstruct HYBE's tender offer for SM's management rights and artificially raised SM's stock price above HYBE's tender offer price.

With key figures related to the market manipulation allegations either arrested or under intensified investigation, attention is now focused on the investigation of Kim Beom-su. Following FSS Governor Lee Bok-hyun's statement in July expressing "a certain level of confidence in uncovering the facts" regarding the SM investigation, and considering the raid on Kim Beom-su's office and the summons issued, speculation has arisen that the Special Judicial Police have secured clues related to market manipulation.

Suspicious Transactions... Also a Question of 5% Rule Violation

Additionally, the Special Judicial Police are investigating allegations that Kakao failed to report to financial authorities despite holding more than 5% of SM's shares. According to the Capital Markets Act, if an individual or a special related party holds 5% or more of the issued shares, they must report this to the Financial Services Commission within five business days.

The Special Judicial Police included this allegation when applying for arrest warrants for Bae Jae-hyun and others. The other entities that purchased SM shares through IBK Investment & Securities Pangyo branch are Helios No. 1 Limited Partnership and private equity fund (PEF) operator One Asia Partners. One Asia invested in Kakao affiliate Kakao VX in 2021 and acquired subsidiaries of Kakao Entertainment, making it known as a company related to Kakao. Notably, One Asia's acquisition of Graygo, a troublesome Kakao affiliate, and Kakao Entertainment's investment in drama production company Acmedia, owned by One Asia, attracted industry attention.

One Asia, a newly established PEF, has frequently appeared in major Kakao transactions without competitive bidding, due to the connection between Bae Jae-hyun and Kim Tae-young, president of One Asia, who has been acquainted with Bae since their time at CJ Group's Future Strategy Office. Lee Junho, Head of Investment Strategy Division at Kakao Entertainment, who was indicted alongside Bae, served as CEO of Graygo until its sale to One Asia.

Helios No. 1 Limited Partnership and One Asia reportedly share the same registered address. If it is proven that these companies purchasing SM shares are related to Kakao, it could constitute a violation of the 5% rule. Kakao has officially stated that "One Asia's share purchase is a separate matter unrelated to Kakao," but the court's remark that "the objective facts appear to have been substantially established" supports the investigation and financial authorities' position that One Asia's large share purchase was conducted in collusion with Bae Jae-hyun, effectively treating Kakao and One Asia as a single acquiring entity, thus violating the 5% rule.

If Market Manipulation Confirmed, Forced Sale of KakaoBank Shares... Negative Impact on SM Acquisition

The industry's greatest interest lies in whether KakaoBank's shares will be forcibly sold and the corporate merger review between Kakao and SM. Depending on the investigation results, Kakao's status as the largest shareholder (27.17%) of KakaoBank could be jeopardized. According to the Internet Specialized Bank Act, a major shareholder of an internet bank (exceeding ownership limits) must not have been fined or penalized with a criminal sentence for violations of financial laws, tax evasion, specific economic crimes, or fair trade laws within the past five years.

According to the FSS, as of the semiannual report, Kakao holds 27.17% of KakaoBank shares. Other major shareholders include Korea Investment & Securities (27.17%) and the National Pension Service (5.30%). If shareholder eligibility issues arise and Kakao must sell more than 10% of its shares, Korea Investment & Securities could become the largest shareholder, or a new major shareholder could emerge.

Although the Ministry of Government Legislation issued an interpretation stating that Kim Beom-su as an 'individual' is excluded from the major shareholder eligibility review, if market manipulation penalties apply to Kakao as a 'corporation,' it could affect the outcome of the shareholder eligibility review. An industry insider noted, "If registered executive Bae Jae-hyun is convicted, it will be practically inevitable for Kakao to lose its status as the largest shareholder of KakaoBank."

A financial authority explained, "If Kakao and Kakao Entertainment, the entities that acquired SM shares, are jointly indicted and found guilty of violating the Capital Markets Act, resulting in loss of major shareholder qualifications, the Financial Services Commission can order Kakao to dispose of its holdings exceeding 10% in KakaoBank." In 2011, when Lone Star was criminally fined 25 billion KRW for foreign exchange card stock manipulation, financial authorities ordered Lone Star to sell its stake in Korea Exchange Bank.

The Fair Trade Commission's corporate merger review of Kakao and SM is also a point of interest. Kakao filed a merger notification with the Fair Trade Commission at the end of April regarding the acquisition of SM shares. The review period is 30 days from the filing date and can be extended up to 90 days if necessary. A Fair Trade Commission official stated, "It is difficult to analyze with the existing materials alone, so we have requested additional documents, and the review period is still ongoing," adding, "The corporate merger review is currently in progress."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)