Asian stock markets fell to their lowest level in 11 months due to a sharp rise in U.S. Treasury yields and heightened geopolitical risks in the Middle East.

According to major foreign media on the 20th, the Morgan Stanley Capital International (MSCI) Asia Pacific Index (excluding Japan) dropped to as low as 477.43 during the day. This low point is the lowest level since November last year. As of 4:10 PM Korean time, the index was recorded at 478.47.

On the same day, Japan's Nikkei index, KOSPI, and Australia's S&P/ASX 200 index also closed lower. The Shanghai Composite Index closed at 2983.06, down 0.74% from the previous day.

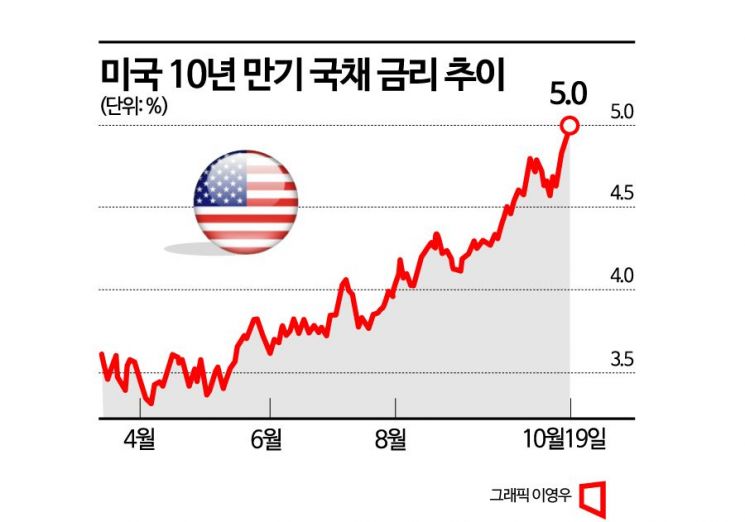

The factor that froze sentiment across Asian stock markets was the sharp rise in the U.S. 10-year Treasury yield, which serves as the benchmark for global bond yields. On the 19th (local time), the U.S. 10-year Treasury yield surpassed 5% for the first time in 16 years. Concerns that borrowing costs for governments, corporations, and households might increase dampened investor sentiment.

The Bank of Japan (BOJ) intervened in the market after the Japanese 10-year government bond yield surpassed its highest level in 10 years.

The increased geopolitical risks in the Middle East also acted as a negative factor for the stock markets. The U.S. Department of Defense announced that a U.S. Navy destroyer in the Red Sea shot down missiles and drones suspected to be from Yemeni rebels targeting Israel, raising fears of escalation.

U.S. President Joe Biden urged Congress to approve a budget of $14 billion (approximately 19 trillion won) to assist Israel in its fight against the Palestinian militant group Hamas.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)