"Do you currently feel that the (monetary) policy is too tight? I think the answer should be 'no'." Jerome Powell, Chair of the U.S. Federal Reserve (Fed), stated on the 19th (local time) that he intends to continue the tightening stance, pointing to persistently high inflation and stronger-than-expected economic indicators.

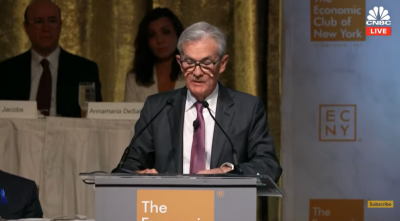

Jerome Powell, Chairman of the Federal Reserve (Fed), is delivering a speech at the New York Economic Club on the 19th (local time). [Image source=Captured screen from CNBC broadcast]

Jerome Powell, Chairman of the Federal Reserve (Fed), is delivering a speech at the New York Economic Club on the 19th (local time). [Image source=Captured screen from CNBC broadcast]

In his speech at the New York Economic Club that day, Chair Powell said, "Inflation remains high," adding, "The good indicators over the past few months are only the beginning of building confidence that inflation is steadily declining toward the target."

He emphasized, "We still do not know how long the low figures will last or when inflation will stabilize in the coming quarters," and said, "The road is rough and it may take some time, but my colleagues and I are united in our commitment to bring inflation down to 2%."

He further suggested the possibility of additional rate hikes, stating, "If there is more evidence of below-trend growth or if the labor market does not ease, further tightening may be necessary." Powell has previously expressed that below-trend low growth and a slowing labor market are necessary to achieve price stability, and he reaffirmed this message on this occasion as well.

Earlier, U.S. retail sales for September increased by 0.7% month-over-month, significantly exceeding market expectations of 0.2%. Contrary to market forecasts that U.S. consumption would slow due to accumulated tightening, depletion of excess savings, and the resumption of student loan repayments, consumption remained robust. The weekly initial jobless claims released that day also fell to the lowest level in nine months, indicating continued overheating in the labor market. These factors all support the need for further Fed tightening.

In a subsequent discussion, Chair Powell evaluated that the current monetary policy is not excessively tight and reaffirmed his hawkish (monetary tightening preference) stance. He said, "As a practitioner, we need to focus on what the economy is telling us," and assessed that the recent economy is absorbing the 5% range interest rates without major difficulties. He then asked rhetorically, "What does this tell us? Do we feel the current policy is too tight?" and answered, "I think the answer should be no."

That day, Chair Powell made it clear that although the Fed has steadily made progress in lowering inflation by raising rates 11 times since March last year, the war against inflation is not over yet. However, he also mentioned signs of slowing in the employment market and some economic indicators returning to pre-pandemic levels, indicating that the cumulative effects of tightening are gradually being confirmed.

Chair Powell said, "I think it takes time for the effects of interest rates and monetary policy to appear," and added, "It is difficult to predict the neutral rate and how far rates will go." He cautioned that over-tightening could unnecessarily harm the economy, while under-tightening could cause inflation to become entrenched. He further stated, "We will proceed cautiously, considering how far we have come."

Regarding the recent rise in Treasury yields, he evaluated, "The rise in Treasury yields has tightened financial conditions. Continued changes in financial conditions can affect the direction of monetary policy." Earlier, the Fed held the benchmark interest rate steady at 5.25?5.5% at the September Federal Open Market Committee (FOMC) meeting as expected, while signaling one more rate hike later this year. However, some inside and outside the Fed analyze that the recent sharp rise in Treasury yields has tightened financial market conditions further, reducing the need for additional hikes. Investors were keenly watching how Chair Powell would assess the recent surge in Treasury yields during his speech.

Additionally, Chair Powell expressed concern over the war between Israel and the Palestinian militant group Hamas. He said, "Geopolitical tensions have increased. This poses a significant risk to global economic activity," adding, "The Fed's role is to monitor the economic fallout that remains uncertain amid geopolitical risk situations."

Market expectations still favor a rate hold in November. According to the Chicago Mercantile Exchange (CME) FedWatch tool, as of that day, the federal funds futures market reflects more than a 99% probability that the Fed will hold rates steady at the FOMC regular meeting scheduled for October 31?November 1. The probability of a hold continuing at the final FOMC meeting of the year in December is around 67%.

Following Chair Powell's hawkish remarks, long-term Treasury yields continued to rise that day. In the New York bond market, the 10-year U.S. Treasury yield briefly hit 4.996%, marking the highest level since 2007. Amid expectations of prolonged high interest rates and confirmed solid consumer spending, the 10-year yield rose for the fourth consecutive trading day, approaching the 5% mark. The 30-year yield also rose to around 5.07%. The 2-year yield, which is sensitive to monetary policy, slightly declined to about 5.18% from the previous day but remains at a high level.

Meanwhile, despite the strong U.S. economy, an analysis suggested that the resumption of federal student loan repayments, which was expected to be a burden on the economy in the fourth quarter, will not cause a significant shock. According to a report released the previous day by the Federal Reserve Bank of New York, the reduction in consumer spending capacity due to student loan repayments starting this month is estimated at about $56 (approximately 76,000 KRW) per month. The New York Fed stated, "The overall impact on consumption appears relatively small," estimating it would reduce U.S. consumer spending by about 0.1 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.