IMF "APAC Growth Rate Declines Due to China's Real Estate Slowdown"

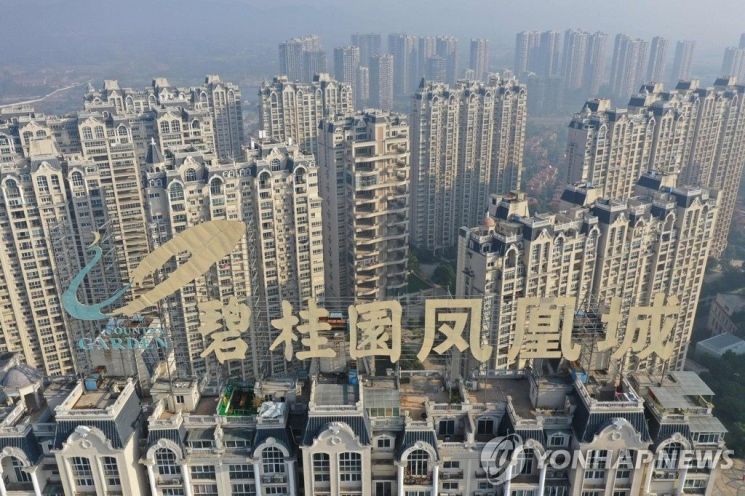

Country Garden, China's largest private real estate developer, has failed to make interest payments on its dollar bonds, Bloomberg reported on the 18th.

When asked by Bloomberg about the repayment plan for the $15.4 million interest on the same day, Country Garden stated, "The company expects to be unable to fulfill its overseas payment obligations due to adjustments in the domestic Chinese market and sluggish sales." One of the bondholders explained that even after the 30-day grace period following the interest payment due date expired, they had not received the bond interest.

Country Garden holds $186 billion in debt, the largest among private real estate developers. The company was supposed to pay interest on the 17th-18th after the grace period ended, but its failure to make the interest payment has made an official default declaration inevitable.

Ting Meng, Senior Credit Strategist at Australia and New Zealand Banking Group, said, "Country Garden's failure to repay interest will create more obstacles for its future credibility and debt restructuring."

China's real estate market has not recovered since the Evergrande default crisis in 2021. Real estate development investment in the first to third quarters of this year decreased by 9.1% compared to the same period last year, showing that despite the authorities' efforts to stimulate the real estate market, the market remains sluggish. According to Bloomberg Intelligence (BI), the real estate developer index fell 2.1% on the day, and real estate-related stocks recorded their lowest levels in 14 years.

The International Monetary Fund (IMF) forecasted that the slowdown in China's real estate market could also reduce economic growth in the Asia-Pacific region. In its regional economic outlook report released on the same day, the IMF predicted, "If China's housing market adjustment prolongs, financial stress on real estate developers will increase in the short term, and asset quality will deteriorate further." Accordingly, it projected that China's GDP could decline by up to 1.6% from the baseline by 2025, and global GDP could fall by 0.6%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)