Holding Company System Adopted by 48% of Large Business Groups

"Large-Scale Investment Path Must Be Opened Through Corporate-Led Strategic Funds"

The Korea Chamber of Commerce and Industry (KCCI) urged the improvement of regulations separating ownership and banking functions for holding companies to promote the growth and innovation of domestic companies in its "Proposal for Regulatory Improvement on Separation of Ownership and Banking Functions for Holding Companies" released on the 18th.

In the proposal, KCCI pointed out, "Among the 81 publicly disclosed corporate groups in Korea, 39 (48.2%) have adopted a holding company system," and stated, "The outdated and excessive separation of ownership and banking regulations are blocking holding company system enterprises from investing in advanced strategic industries and entering new businesses."

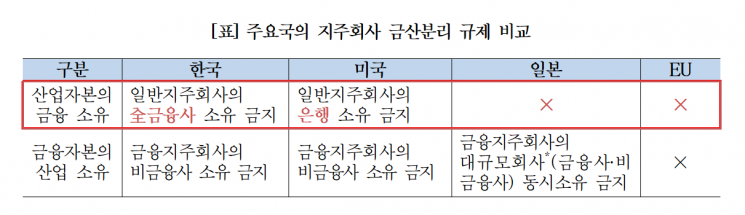

They also argued that these regulations are far from global standards. Japan and the European Union (EU) have no related regulations, and the United States only prohibits bank ownership. KCCI said, "Korea applies broad separation of ownership and banking regulations that prohibit all financial businesses," adding, "In the U.S., non-bank financial companies can be owned under a holding company." In fact, companies like Alphabet (Google's holding company) and Intel actively conduct mergers and acquisitions (M&A) and investments in promising industries through Google Ventures and Intel Capital.

Furthermore, KCCI mentioned that "the scope of financial businesses subject to separation of ownership and banking regulations is too broad," including questionable strict regulations on credit finance businesses, which poses problems.

KCCI also raised the issue of overregulation. "The Fair Trade Act blocks the expansion of control over holding companies through regulations on debt ratios, investment stages, and minimum shareholding ratios," they said. Additionally, "The Financial Conglomerate Supervision Act designates financial conglomerates annually and manages them in advance to prevent the risk of financial affiliates from spreading to other affiliates, so the separation of ownership and banking regulations under the Fair Trade Act constitutes overlapping and excessive regulation," they argued.

They went on to say that the separation of ownership and banking regulations act as discriminatory regulations unfavorable to holding company systems compared to non-holding company systems. Holding company system groups are prohibited from owning any financial companies, whereas non-holding company system groups can own insurance, securities, and collective investment businesses excluding banks. In fact, the seven groups designated as financial conglomerates this year own 117 financial companies domestically.

To address this, KCCI called for maintaining the separation of ownership and banking regulations while excluding deposit-taking financial businesses such as banks from regulation and easing regulations on credit function financial businesses. They also emphasized the need for the government to strengthen support so that companies can enhance technological competitiveness and build leading industrial structures.

Lee Su-won, head of the Corporate Policy Team at KCCI, said, "The establishment of a simple and transparent holding company system from a complex circular shareholding structure through over 20 years of efforts by the business community and government is a remarkable achievement," adding, "Prohibiting only holding companies from owning non-bank financial companies is an excessive regulation unique to Korea and a disadvantageous shackle for domestic companies that must be improved promptly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)