CEO Hong Seong-hyeok Suspended, Executives and Reviewers Fired... Business Virtually Halted

Second Largest Shareholder Suan Partners Initiates 'Legal Procedures' Over CEO's Personal Misconduct

KOSDAQ-listed venture capital (VC) firm M-Venture Investment has effectively ceased operations by locking its office doors and laying off most of its employees. Soo & Partners, the second-largest shareholder engaged in a management dispute with CEO Hong Seong-hyeok of M-Venture Investment, is currently pursuing legal action regarding problematic management activities committed by CEO Hong.

According to the VC industry, Soo & Partners removed CEO Hong Seong-hyeok from his position and dismissed most of the investment officers and employees, including Vice President Lee Jong-hee and Executive Director Yoo Sang-hyun. Citing obstruction and uncooperativeness from employees during the investigation into M-Venture Investment’s management status, Soo & Partners took disciplinary dismissal actions not only against executives but also against managers and assistant managers.

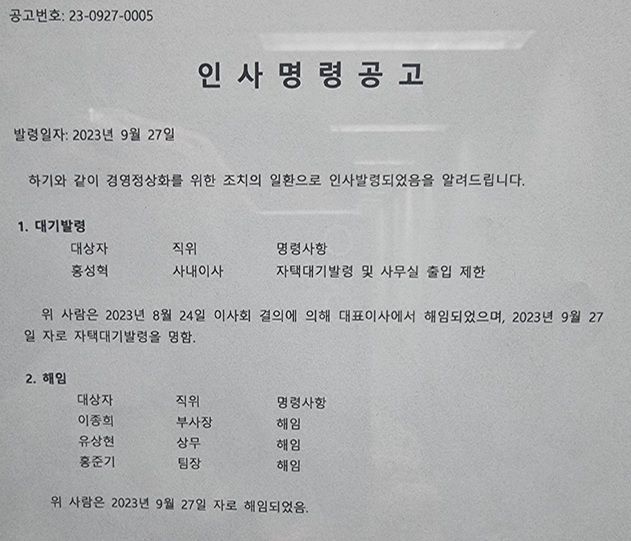

Notice of Personnel Announcement Posted at the Entrance of M Venture Investment, Samseong-dong, Gangnam-gu

Notice of Personnel Announcement Posted at the Entrance of M Venture Investment, Samseong-dong, Gangnam-gu

With most employees laid off, M-Venture Investment is currently unable to conduct business activities such as fundraising and sourcing investment opportunities. The office door of M-Venture Investment in Gangnam, Seoul, is locked, and only a personnel notice about employee dismissals is posted at the entrance. Until the management dispute is resolved, hiring new investment officers or administrative staff is also impossible.

The only activity is Soo & Partners representatives occasionally entering the company for document verification or investigations. Despite being a KOSDAQ-listed company, proper disclosures are currently not being made. A Soo & Partners representative stated, "This situation is expected to continue at least until next year’s shareholders’ meeting."

Soo & Partners claims to have uncovered multiple misconducts by CEO Hong, including illicit and illegal loans involving investee companies. They allege that M-Venture Investment, as a VC, failed to properly diversify its investment portfolio and excessively invested in a single company, GCT Semiconductor, causing losses to the firm. Furthermore, CEO Hong reportedly arranged tens of billions of won in loans to GCT Semiconductor in a problematic manner by bringing in external funds in addition to internal capital. A Soo & Partners representative said, "We are pursuing legal procedures such as lawsuits and complaints regarding CEO Hong’s inappropriate matters."

M-Venture Investment was listed on KOSDAQ in 2007 after merging with the former Shin Young Technology Finance. At the time, it attracted industry attention by successfully going public, which was rare among venture capital firms. It expanded its overseas network by forming investment funds with major Asian investors from China and Taiwan and establishing joint funds with Israel, playing a pioneering role in overseas expansion for venture capital firms.

However, the company’s management deteriorated after consecutive failures to exit equity stakes. Subsequently, GCT Semiconductor, a key investment target, failed to pass the preliminary review for listing on the Korea Exchange, leading to a liquidity crisis. Amid this, Soo & Partners urgently provided financial support by securing shares through a third-party allotment capital increase.

A Soo & Partners representative said, "We participated in the capital increase expecting mutual cooperation, but CEO Hong continued inefficient and irrational management." The representative added, "We proposed management improvements several times, but they were rejected, and the situation worsened as CEO Hong viewed it as management interference or a hostile takeover, leading to the current dispute." The representative concluded, "We will strive to normalize the company as soon as possible for the sake of the shareholders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)