Rising Market Share as Attention Focuses on Bitcoin

Altcoin Price Declines Exceed Those of Bitcoin

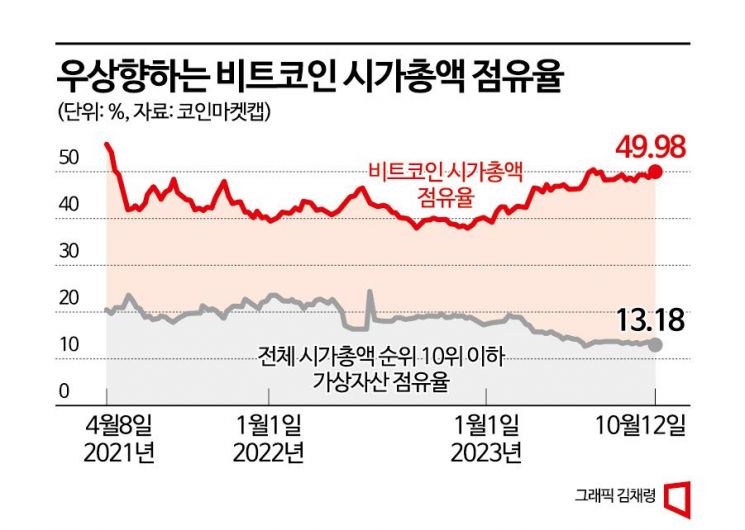

In the virtual asset market, Bitcoin's market capitalization is estimated to account for nearly 50%. At the beginning of this year, it was less than 40%, but this phenomenon appears to have occurred as the price decline of altcoins excluding Bitcoin was greater than that of Bitcoin.

According to the global virtual asset market status relay site CoinMarketCap, as of the 12th, Bitcoin's market capitalization ratio was recorded at 49.98%. This is the highest figure since June 29, when it was 50.19%. The last time Bitcoin's market capitalization ratio approached 50% was on April 22, 2021, when it recorded 50.63%. The ratio, which was below 40% at the beginning of this year, has continued to rise since then.

As Bitcoin's market capitalization ratio increased, the ratio of other altcoins declined. Ethereum, the leading altcoin, recorded 17.86% as of the 12th, which is about a 1 percentage point decrease compared to the beginning of this year.

Other altcoins showed an even more pronounced downward trend. The market capitalization ratio of other altcoins excluding the top 10 virtual assets by market capitalization was 17.60% at the beginning of this year and dropped by more than 4 percentage points to 13.18% on the 12th.

The increasing market capitalization ratio of Bitcoin is analyzed to be due to Bitcoin's price increase being greater than that of altcoins. Additionally, the recent stagnation in the coin market, where altcoins experienced a larger decline than Bitcoin, has also influenced this. Comparing the representative virtual assets Bitcoin and Ethereum, Bitcoin's price has risen about 60% compared to the beginning of the year, while Ethereum's price has only increased by about 30%. Also, Bitcoin is currently about 15% down from its highest price this year, whereas Ethereum has fallen about 26%.

Looking at the prices over the past week, the decline in altcoins was more pronounced than Bitcoin. Bitcoin fell 2.80% during this period. Ethereum dropped 4.56%, and Ripple plunged 7.78%. Solana and Dogecoin also fell by 5.74% and 4.31%, respectively.

The market expects the high market capitalization ratio of Bitcoin to continue for the time being. This is because investment preference for risky assets is not very high, and concerns about tightening persist. An industry insider said, "The perception of Bitcoin as a safe asset is gradually increasing, which is also a factor raising its market capitalization ratio," adding, "This situation will continue until the macroeconomic situation improves and the Bitcoin halving scheduled for April next year acts as a positive factor to revive the overall coin market atmosphere." Bitcoin will undergo its fourth halving, reducing the mining amount by half and thus decreasing supply. The market expects that the reduced supply will lead to a price increase for Bitcoin and also boost the prices of other virtual assets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)