Bitcoin Prices Fall as US Treasury Yields Rise

Bitcoin Prices Do Not Rise When Treasury Yields Fall

The trend of U.S. Treasury yields is drawing the attention of cryptocurrency investors. Despite forecasts that Bitcoin prices would rise, the surge in Treasury yields dealt a direct blow, causing prices to turn downward.

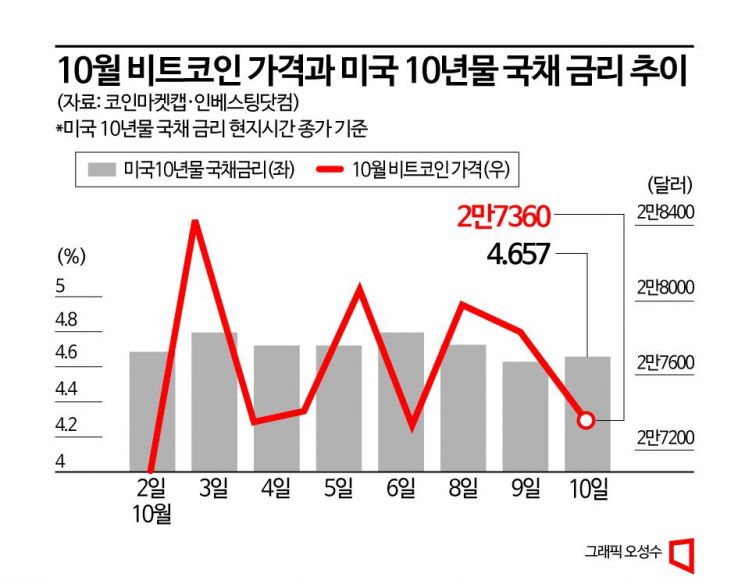

According to the global cryptocurrency market tracking site CoinMarketCap, as of 1:20 PM on the 11th, Bitcoin was priced at $27,103 (approximately 36.29 million KRW), down 1.86% from the previous day. Until the 2nd of this month, Bitcoin prices showed strength, hovering above the $28,400 mark. However, prices have since followed a downward trend, falling to $27,360 as of the previous day.

At the beginning of this month, the prevailing outlook was that Bitcoin prices would show strength. Historically, Bitcoin prices have tended to rise every October. Over the past 10 years since 2013, Bitcoin prices generally increased each October, closing higher 8 out of 10 times. This pattern has fueled bullish expectations every October. On October 1st last year, Bitcoin was priced around $19,900, but by October 31st, it had risen to about $20,400. In 2021, Bitcoin surged from around $43,000 in early October to approximately $60,400 by the end of the month.

Additionally, the upcoming Bitcoin halving scheduled for April next year was expected to act as a positive factor. Bitcoin will undergo its fourth halving, reducing the mining reward by half to 3.125 BTC per block. Historically, Bitcoin’s supply reduction after halving events has led to price increases.

Despite these positive factors, the decline in Bitcoin prices is analyzed to be influenced by the rise in U.S. Treasury yields. When Treasury yields rise, Bitcoin prices tend to fall. The expectation that the Federal Reserve’s high-interest-rate policy will persist longer than initially anticipated has caused Treasury yields to soar. As U.S. Treasuries, considered virtually risk-free assets, offer interest rates around 4.6% annually, funds are flowing out of risk assets like cryptocurrencies. The 10-year U.S. Treasury yield, which serves as a benchmark for global bond yields, surpassed 4.8% intraday on the 3rd (local time). Bitcoin prices, which were above $28,400 on the 2nd, dropped to the $27,300 range as the 10-year Treasury yield rose from 4.685% to 4.795%. On the 9th, the yield fell from 4.725% to 4.628% but then rose slightly to 4.635% the next day, with Bitcoin prices fluctuating between $27,800 and $27,300.

Conversely, when Treasury yields stabilized, Bitcoin prices showed an upward trend. On the 6th, the 10-year Treasury yield rose intraday to 4.86%. However, as the rapid rise in yields eased and positive factors such as a rebound in the U.S. stock market emerged, Bitcoin prices began to climb.

However, a decline in U.S. Treasury yields does not necessarily guarantee a rise in Bitcoin prices. Although the 10-year Treasury yield dropped from 4.725% on the 8th to 4.628% on the 9th, Bitcoin prices remained weak due to other factors such as geopolitical tensions in the Middle East, concerns over international oil prices, and inflation.

Meanwhile, cryptocurrency investor sentiment has not revived following the rise in U.S. Treasury yields. According to cryptocurrency data provider Alternative, the Fear & Greed Index, which measures investor sentiment, fell by 3 points from the previous day to 47 points (neutral) on this day. The index recorded 50 points (neutral) on the 2nd and 3rd of this month but did not improve beyond that. Alternative’s Fear & Greed Index ranges from 0, indicating extreme fear and pessimism about investing, to 100, indicating strong optimism.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)