Supply of Solvent Raw Materials Affecting Production Yield in Semiconductor Manufacturing Process

Attempt to Localize Organic Solvent for Secondary Battery Cathode Coating, Currently Fully Imported

IPO Market Overheating Due to 'Unbeatable Public Offering Investment' Also Brings Spillover Benefits

The KOSDAQ index, which had been on a downward trend, fell below the 800-point mark. Amid this, Purit, a semiconductor and display material manufacturer preparing for an initial public offering (IPO), has attracted attention by gathering 7.8 trillion KRW in subscription deposits from retail investors during its public offering.

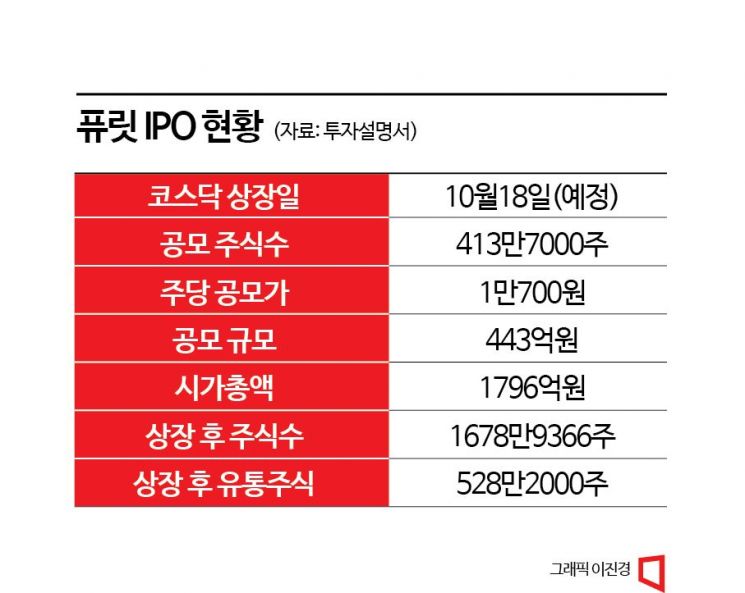

According to Mirae Asset Securities on the 11th, Purit’s public offering subscription, conducted over two days from the 5th to the 6th, recorded a subscription competition rate of 1,416 to 1. The subscription deposits totaled 7.8338 trillion KRW. Purit also succeeded in demand forecasting among institutional investors, finalizing the public offering price at the upper end of the expected range, 10,700 KRW per share.

As the perception of "unbeatable IPO investment" among individual investors has solidified, the recent IPO market has shown signs of overheating. The KOSDAQ index fell 14.4% in just over a month after recording 928.40 at the end of July, dropping below the 800-point level. Despite the KOSDAQ’s sluggish performance over the past month, most newly listed companies’ stock prices did not fall below their IPO prices on the first day of listing. IMT, which was listed on the KOSDAQ market the previous day, closed at 20,750 KRW, up 48.2% from the IPO price of 14,000 KRW. Recently listed companies such as Revu Corporation, Hanssak, Millie’s Library, and Inswave Systems all closed well above their IPO prices on their first day of trading.

As the competition rate for public offering subscriptions increases, more investors are putting in the maximum deposit allowed. The competition to receive even one more share of the IPO is fierce. Few investors carefully evaluate growth potential before investing in IPOs. Since the price limit on the first day of listing was expanded to 400% of the IPO price, "blind investments" have been rampant.

A financial investment industry official explained, "Purit’s proportion of old shares sold among the total public offering shares is 30%, and the tradable volume after listing is 32%." He added, "Until the first half of this year, when the proportion of old share sales was high, subscription competition rates were not high." He continued, "With the increased price fluctuation on the first day of listing, the expected returns on IPO investments have risen," and "Since the possibility of losses is low, the competition to secure shares is intense."

Founded in 2010, Purit is a company that produces materials necessary for advanced IT industries such as semiconductors, displays, and secondary batteries. It mainly supplies raw materials for thinner used in the photolithography process, which passes light through to print circuits on wafers during semiconductor manufacturing. Thinner is one of the materials that affect production yield in memory and system semiconductor manufacturing processes. From 2020 to 2022, Purit’s sales increased at an average annual rate of 41%. As sales rapidly grew, its operating profit margin exceeded 10% last year. It has secured clients such as Samsung Electronics, Samsung Electro-Mechanics, SK Hynix, LG Chem, LG Display, Intel, and Unid. Si-on Kang, a researcher at Korea Investment & Securities, analyzed, "The existing semiconductor materials segment will continue to grow by acquiring new customers," and "We expect performance improvements due to recovery in the upstream industries."

Purit is also pursuing a secondary battery business. It aims to mass-produce materials necessary for electrolyte manufacturing by 2025. It extracts materials by refining waste liquid of NMP (N-Methyl-2-pyrrolidone), an organic solvent added to secondary battery cathode coating. NMP is a material entirely imported from overseas. If domestic production is successful, orders are expected to increase. Jong-seon Park, a researcher at Eugene Investment & Securities, explained, "Purit is pursuing a business that refines and recycles solvent waste liquid added to secondary battery cathode coating based on its proprietary technology," and "The IPO price is set at a 28% discount compared to the per-share valuation of 14,824 KRW."

Purit plans to invest the funds raised through the IPO in factory expansion. Of the 30.4 billion KRW raised, 25.2 billion KRW will be invested to establish a new factory. The company explained that new investment is necessary to respond to increased production volume and product changes in the upstream semiconductor and display markets. It expects to secure production capacity 2.5 times larger than the current scale. The remaining funds will be used to repay debt.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.