As the armed conflict between Israel and the Palestinian militant group Hamas entered its third day, geopolitical risks intensified, causing international oil prices to surge by more than 4%.

On the 9th (local time) at the New York Mercantile Exchange, the price of West Texas Intermediate (WTI) crude oil for November delivery closed at $86.38 per barrel, up $3.59 (4.34%) from the previous session. This is the highest closing price since October 3. The December Brent crude price also rose more than 4% that day, closing at $88.15 per barrel.

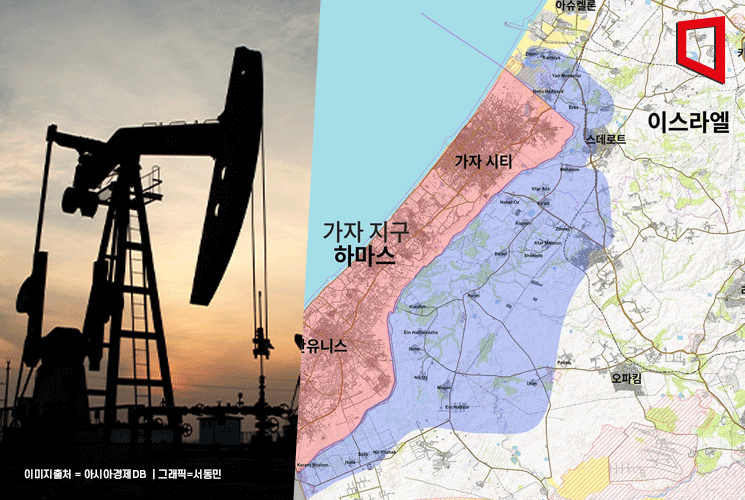

Earlier, Hamas launched a surprise attack on Israel in the early morning of the 7th, the Jewish Sabbath, and Israel has retaliated with airstrikes. As the armed conflict enters its third day, casualties are increasing. In particular, reports that Iran is behind Hamas's attack have added upward pressure on oil prices. Since oil-producing countries have already agreed to continue production cuts until the end of the year, any additional variables such as Western sanctions on Iran or an escalation in the Middle East would inevitably disrupt oil transportation.

Robbie Fraser, Global Research and Analysis Manager at Schneider Electric, said, "Oil production in the Gaza Strip, the base of Hamas, is zero," but added, "Geopolitical risks are increasing, and oil prices are rising due to reports that Iran may have played a decisive role in this attack."

Vivek Dhar, Energy Commodities Analyst at Commonwealth Bank, predicted, "If Western countries link Iran's intelligence agencies to Hamas's attack, Iran's oil exports will face risks." Josh Young, Chief Investment Officer at energy investment firm Bison, estimated that if the U.S. imposes export sanctions on Iran, WTI could rise by $5 per barrel.

The market also sees other threat factors besides Iran. It is assessed that if Hezbollah, a militant group based in Lebanon, becomes involved, international oil prices will face even greater upward pressure. Bob McNally, Chairman of Rapidan Energy Group, said that if Israel and Iran clash, oil prices could rise by $5 to $10 per barrel, adding, "If the market expects the war to expand to Lebanon's Hezbollah, it will become a real problem for the oil market and could lead to a much larger surge."

Safe-haven assets such as the dollar and gold also strengthened together. The U.S. Dollar Index, which measures the value of the dollar against six major currencies, showed a firm tone around the 106 level. Gold futures rose more than 1.6%, trading near $1,875 per ounce.

However, despite the geopolitical risks from the Middle East, the New York stock market closed slightly higher that day. At the New York Stock Exchange (NYSE), the blue-chip Dow Jones Industrial Average rose 0.59% from the previous session. The large-cap S&P 500 index and the tech-heavy Nasdaq index increased by 0.63% and 0.39%, respectively. The bond market was closed in observance of Columbus Day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.