A, who runs a wholesale fruit and vegetable business in Dongdaemun-gu, Seoul, decided to close the business by the end of this year. Since last year, sales have declined and loan burdens have increased due to significant rises in prices and interest rates. A said, "I decided to close the business because it became too difficult with loans worth tens of millions of won, but since I have long overdue insurance premiums, I am not sure if I can fully receive unemployment benefits."

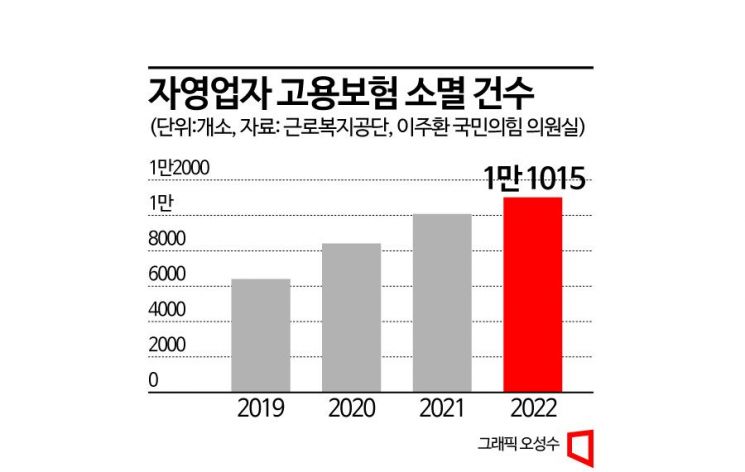

The number of businesses that have terminated self-employed employment insurance has surged by more than 70% over the past three years. This points to the growing economic difficulties of small business owners, such as canceling employment insurance due to business closures caused by the economic recession or losing insured status due to prolonged delinquency periods.

According to data submitted by the Korea Workers' Compensation and Welfare Service to Rep. Lee Joo-hwan of the People Power Party on the 6th, the number of businesses that canceled self-employed employment insurance last year totaled 11,015, a 72.0% increase compared to 2019, before the COVID-19 pandemic. Self-employed employment insurance is a system that supports the livelihood security and reemployment of self-employed individuals with irregular income, where the government provides support for vocational training and job-seeking benefits upon insurance enrollment.

Over the past four years, the number of businesses terminating self-employed employment insurance has steadily increased each year. It rose from 6,404 in 2019 to 8,411 in 2020, then to 10,085 in 2021. As of January to July this year, the number of businesses canceling insurance already reached 7,419, and it is expected to exceed 10,000 by the end of the year. Last year, the largest cause of self-employed employment insurance termination was business closure, accounting for 34.8% (3,835 businesses), followed by continuous delinquency at 18.5% (2,038 businesses), and cancellation requests at 11.2% (1,237 businesses), each exceeding 10%. In particular, insurance termination due to business closure increased by 56.0% compared to 2019, and continuous delinquency also rose by 52.2%.

The recent surge in businesses terminating self-employed employment insurance is mainly due to decreased operating profits caused by prolonged high interest rates and economic recession. Even if some sales increase, operating profits decline as loan interest rates rise. Delinquent loans of individual business owners are also rapidly increasing. According to the Bank of Korea, delinquent loans of self-employed individuals amounted to 7.3 trillion won in the second quarter of this year, an increase of 1 trillion won compared to the previous quarter. The delinquency rate was also 1.15%, the highest in 8 years and 9 months since the third quarter of 2014. The delinquency rate for low-income self-employed individuals in the bottom 30% income bracket (1.8%) recorded the highest level in 9 years and 3 months since the first quarter of 2014 (1.9%).

Due to the nature of self-employed employment insurance, where individuals directly choose their monthly wage amount according to their preference, this is also identified as a factor prolonging delinquency periods. If one joins employment insurance without rational judgment when income is high, the possibility of long-term delinquency due to sales decline increases.

If employment insurance is terminated, even if a business closure is reported immediately, there is a high possibility that unemployment benefits will not be received. Even if one voluntarily closes the business after paying employment insurance premiums for more than one year, it must be recognized by the Korea Workers' Compensation and Welfare Service that the decision was due to unavoidable reasons such as sales decline, continuous deficits, or natural disasters. Rep. Lee said, "From the perspective of employment insurance cancellation and business closure, this is evidence that our economy is that difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)