2024 Budget Proposal and National Fiscal Management Plan Evaluation

Next Year's Mandatory Welfare Spending Growth Rate Up 11.6%

A report from a government-funded research institute has revealed that fiscal sustainability is threatened due to mandatory expenditures accounting for 95% of national tax revenue. It also pointed out that the fiscal reforms currently being pursued by the government mostly focus on reducing discretionary spending, which has significant limitations.

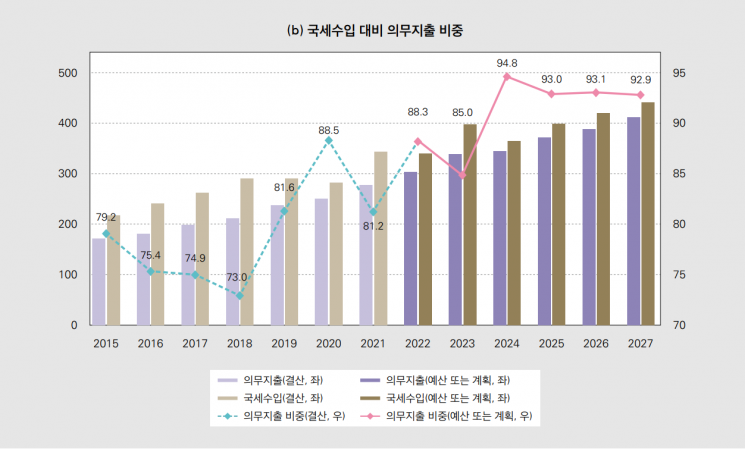

According to the September issue of the Korea Institute of Public Finance's Fiscal Forum report titled "Evaluation of the 2024 Budget and National Fiscal Management Plan" released on the 28th, mandatory expenditures for next year amount to 348.2 trillion won. Out of the 367.4 trillion won in national tax revenue, 94.8% is allocated to mandatory expenditures. The ratio of mandatory expenditures to national tax revenue increased by 9.8 percentage points from 85% this year. This ratio has exceeded 90% for the first time since 2012.

The high level of mandatory expenditures is due to welfare spending and interest payments. The growth rate of mandatory welfare expenditures has sharply increased to 6.6% last year, 10.5% this year, and 11.6% next year. During the same period, interest payments also rose rapidly by 3.3%, 21.2%, and 19.7%, respectively. This means that while the economy struggled and national tax revenue did not increase, welfare and interest costs continued to rise.

The report pointed out that because mandatory expenditures could not be controlled, the managed fiscal balance recorded a deficit despite the minimal increase in next year’s budget. The managed fiscal balance is an indicator that shows the actual state of national finances by subtracting total expenditures and social security fund balances from total revenues. Next year’s budget is 657 trillion won, a 2.8% increase from this year, with a managed fiscal balance deficit of 3.9% relative to the Gross Domestic Product (GDP). This exceeds the 3% upper limit set by the fiscal rules that the government is currently working to legislate.

Mandatory expenditures are expected to place a significant burden on future finances. The proportion of mandatory expenditures within total expenditures is projected to reach approximately 56.1% by 2027. This contrasts with last year when it did not exceed 50%. Even when measured against national tax revenue, the share of mandatory expenditures will not fall below the 90% range until 2027.

To secure fiscal sustainability, the report recommended the need for practical measures to control mandatory expenditures. Oh Jong-hyun, a research fellow at the Korea Institute of Public Finance who authored the report, advised, “There are clear limits to fiscal soundness relying solely on discretionary spending. When certain mandatory expenditures increase, it is necessary to either restructure other mandatory expenditures or encourage revenue expansion.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.