Display in 2030... Breaking Spatial Boundaries

XR, Transparent, and iLED Markets Set for Fierce Competition

MicroLED Offers Longer Lifespan and Higher Brightness

iLED Expected to Capture 40% of Market by 2045

By simply wearing glasses, a virtual world indistinguishable from reality unfolds before your eyes. You watch news and content floating on the glass while viewing the outside scenery beyond the transparent glass. This is the world seven years from now, which will unfold once products made with inorganic light-emitting diode (iLED) displays and transparent organic light-emitting diode (OLED) technology become commercialized.

The government and industry expect display companies to compete in the fields of iLED displays for XR (Extended Reality) devices and transparent displays in the future. Liquid crystal displays (LCDs) ended with China's victory, and OLEDs are fiercely contested by Korean companies such as Samsung and LG and Chinese companies across various sectors including smartphones, tablets, laptops, and TVs. The XR, transparent, and iLED markets are expected to open in the 2030s. Korea, China, Taiwan, and the United States are expected to compete intensely.

2024 is the inaugural year for the microdisplay market. The microdisplay market is expected to open as Japanese Sony’s micro OLED panel will be installed in Apple’s spatial computer 'Vision Pro,' launching next year. A microdisplay is an ultra-high-resolution display that implements thousands of PPI (Pixels Per Inch) pixels within about a 1-inch size. Pixels are the smallest unit points that make up an image, and the more pixels there are, the higher the resolution.

The micro OLED market will grow as the XR market expands. LG Display has been conducting national research on microLED since 2019. Samsung Display launched a 'Microdisplay Team' last year to research both micro OLED and micro LED.

Microdisplays are expected to evolve from micro OLED to micro LED. Currently, micro LED panels are mainly used for TVs made by home appliance companies such as Samsung Electronics and LG Electronics. Micro LED for XR devices is still under development.

Micro LED components have pixel sizes smaller than 100 micrometers (μm, one-millionth of a meter). 100 μm is about the thickness of a single hair strand. Anything above 100 μm is considered mini LED. When TV companies first released micro LED TVs, there was controversy that mini LED panels, not micro LED, were used. However, the display industry now explains that TVs made by Samsung, LG Electronics, and Chinese companies like BOE all properly use micro LED panels.

Micro LED is made from inorganic materials. It differs in the manufacturing process from OLED, which is made from organic materials. OLED can be made on glass substrates, but micro LED is created by making microscopic current paths on wafers (semiconductor discs) and then attaching panels on top. Semiconductor companies produce chips on wafers (front-end process), and display companies implant red, green, and blue (RGB) panels into each chip (back-end process).

Even advanced display companies find it difficult to make micro LED panels without collaborating with semiconductor firms. LG Display has partnered with SK Hynix. Samsung Display is known to produce micro LED panels together with Samsung Electronics’ DS (semiconductor) division. Micro LED has a longer lifespan and higher luminance (brightness) than LCD and OLED. Because it is made by connecting multiple chip blocks, it can be implemented from small screens with a diagonal length of 0.3 inches to large screens over 300 inches. It is considered a suitable display for metaverse devices, smart home appliances, and autonomous vehicles.

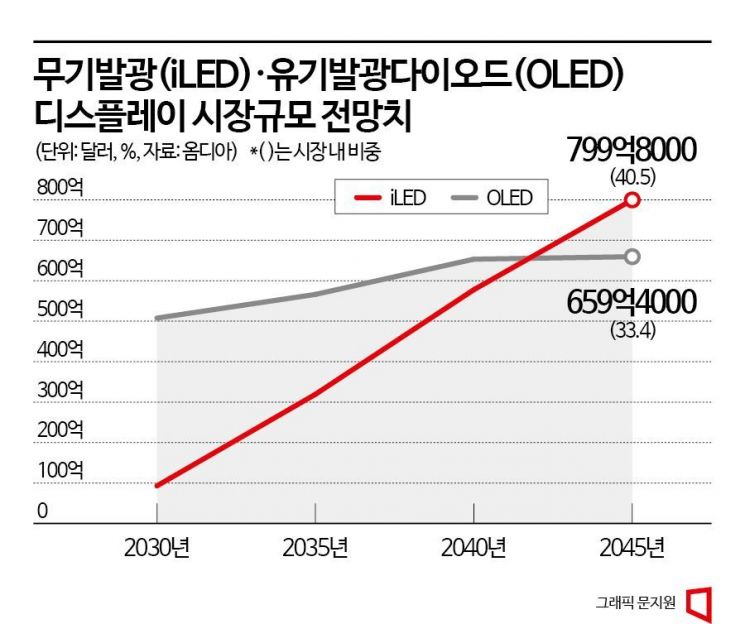

The industry views the micro LED panel market for XR devices, not for TVs, as the true competitive stage. The iLED market, including micro LED for XR devices, is expected to grow from $1 billion (about 1.35 trillion KRW) in 2026 to $80 billion (about 107.86 trillion KRW) in 2045. The expected average annual growth rate over 20 years is 23.4%. It is predicted that iLED will occupy 40% of the global display market by 2045.

If 2024 is the nascent stage of the microdisplay market, experts say the blooming period will be 2030. The Display Industry Association predicted, "The iLED display market will fully bloom after 2030." The core component of iLED is micro LED. After 2030, if XR devices equipped with micro LED panels become widely used, anyone will be able to travel through 3D spaces. For example, disabled customers who wish to travel to the United States can enjoy similar experiences by viewing 3D photos and videos stored in XR devices. The current form, where no matter how large the display is, the screen is confined within a rectangular frame, is expected to disappear.

The transparent OLED market began blooming in 2019, led by LG Display. They commercialized related products in 2019 and currently have achieved transparency levels of 40-45%. They plan to increase this to 70% in the future. Transparent OLED is, in short, a 'see-through display.' Traditional large displays such as TVs are installed on walls or desks. The space behind the wall is unusable, making it a 'blocked display.'

Using transparent displays allows viewing the scenery behind the glass. You can enjoy the actual scenery beyond the glass while watching news or content reflected on the glass substrate. They can be installed in offices, shopping malls, art galleries, subway screen doors, cars, and homes. An industry insider said, "Anywhere with glass can be replaced with transparent OLED displays," adding, "Windows or car glass act as blackboards or memo pads."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.