Announcement of Enforcement Decree for Capital Market Act Amendment... Fines Imposed on 3 Major Unfair Trades

Specifics of 'Unjust Profit Calculation Formula' for Sentencing Standards... Voluntary Reporters Receive Fine Reduction

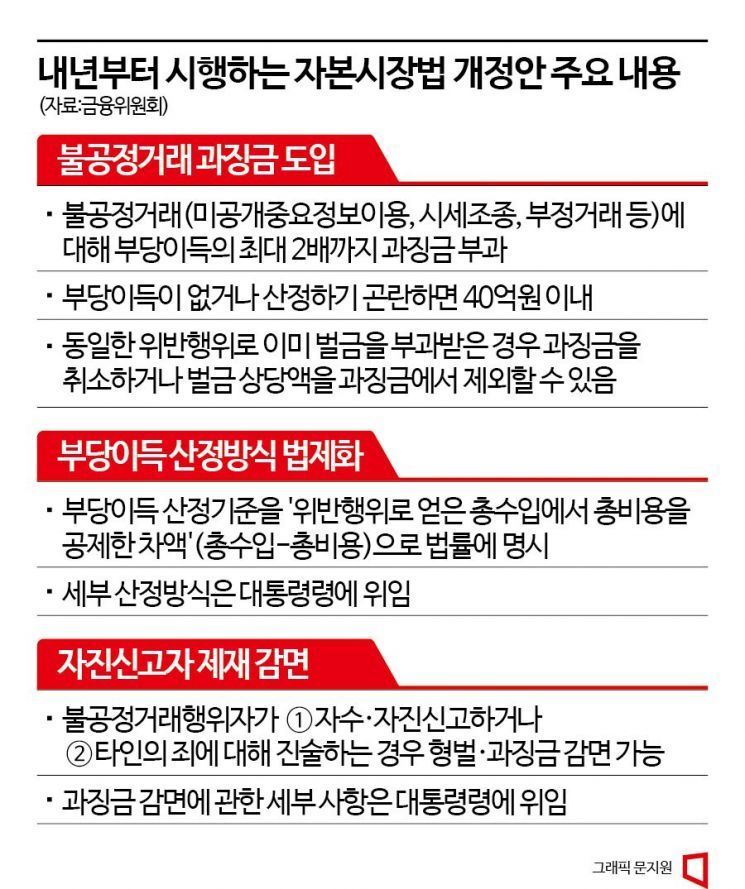

Starting next year, financial authorities will be able to impose fines of up to twice the amount of illicit gains on offenders involved in the three major unfair trading practices (insider trading, fraudulent trading, and market manipulation). In particular, it is expected that 'lenient' judgments in criminal penalties will decrease, as the 'method for calculating illicit gains,' which serves as the sentencing standard, has been codified into law.

On the 25th, the Financial Services Commission announced the legislative notice for the amendment of subordinate statutes under the "Capital Markets and Financial Investment Services Act" containing these provisions. The public notice period is from the 25th until November 6th. Afterward, it will go through procedures such as review by the Regulatory Reform Committee, examination by the Ministry of Government Legislation, and approval by the Deputy Prime Minister's Meeting and the Cabinet Meeting, and will be enforced from January 19, 2024.

Getting caught manipulating stock prices could lead to ruin?

With the law amended, from next year, administrative sanctions (fines) will be possible for offenders involved in the three major unfair trading practices. Administrative sanctions are considered effective because they allow for quicker punishment than criminal penalties and impose economic disadvantages. The three major acts, which account for over 90% of unfair trading, are currently only subject to criminal penalties led by the prosecution.

The imposition of fines is legally grounded by adding Paragraph 3 to Article 380 of the Capital Markets Act. According to the amendment, the Financial Services Commission may impose fines after receiving notification of investigation and disposition results from the Prosecutor General.

The Financial Services Commission can also impose fines before receiving notification of investigation and disposition results. It is stipulated that the Commission must first notify the Prosecutor General of the suspect's charges, consult with the Prosecutor General, and then impose the fines. The Commission may also impose fines if one year has passed after notifying the Prosecutor General of the charges.

Imposing fines has long been a goal of the financial authorities. Discussions to amend the law in 2011 were unsuccessful. This time, there were many twists and turns, including canceling and re-announcing the legislative notice. The new legislative notice includes an exception condition that fines can be imposed if one year has passed after notification of charges.

Even if one year has passed since the Financial Services Commission notified the prosecution of the charges, the imposition of fines is excluded if there is a reasonable cause for delay in investigation or disposition. Suspension of prosecution is a representative example. Also, if there is a reasonable concern that imposing fines after one year may conflict with the prosecution's final investigation or disposition, the fines are excluded.

A Financial Services Commission official explained, "Considering the purpose of introducing the fine system and the results of parliamentary discussions, it is necessary to ensure consistency between fines and criminal penalties such as fines. In cases requiring confidentiality of investigations or for harmonious operation between administrative sanctions (fines) and judicial procedures, consultation with judicial authorities before imposing fines is necessary."

Sentencing standards for criminal penalties specified in law... Penalties reduced for voluntary reporting

The core content of the legislative notice for the amendment of the Capital Markets Act is the 'method for calculating illicit gains.' The current law does not specify the method for calculating illicit gains. Without a legal standard for calculating illicit gains, which serves as the sentencing criterion, lenient punishments were inevitable.

The amendment to the Capital Markets Act (Article 442-2) defines the standard for calculating illicit gains as "the difference obtained by deducting total costs from total revenue earned through the violation (total revenue - total costs)." Definitions of total revenue, total costs, and calculation methods for each type of violation are specifically detailed in the subordinate statute amendment.

According to the subordinate statute amendment, total revenue includes realized gains, unrealized gains, and avoided losses. Gains not yet liquidated, such as stocks not yet sold or deposits, are also included in illicit gains. Total costs are defined as all costs incurred during trading, such as commissions and transaction taxes. Violations are categorized by type?insider trading, fraudulent trading, market manipulation?and calculation methods are specified accordingly.

In particular, a basis for calculating illicit gains has been established even when external factors and illegal factors are combined. For example, until now, if the stock price increase due to good performance completely offset the increase caused by stock price manipulation, it was difficult to prove illicit gains. Going forward, when external factors are combined, the proportion of price fluctuations reflected will be applied differentially.

First, illicit gains are calculated based on the point in time before external factors such as good performance occur. If the stock price increase due to external factors is recognized as comparable to the price fluctuation caused by stock price manipulation, only 50% of the price fluctuation after the occurrence of external factors will be reflected.

A leniency (fine reduction) standard has also been established. If an individual voluntarily reports their involvement in unfair trading, they can receive a reduction in fines. Moreover, reporting other unfair trading acts voluntarily also qualifies for fine reduction.

The fine reduction rate ranges from 50% to 100%, depending on the whistleblower. It is specified that the decision will be based on evidence provision and cooperation. However, reductions will not be granted if the person coerces others to participate in unfair trading or repeatedly commits illegal acts.

A Financial Services Commission official said, "This plan was prepared through discussions with related agencies involved in unfair trading, including the Ministry of Justice, prosecution, Financial Supervisory Service, and Korea Exchange, to efficiently detect and strictly sanction unfair trading. It is expected that the amendment will contribute to restoring trust in the capital market once implemented."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)