Korean Rural Economic Institute, Food Industry Issues Survey for the First Half of the Year

In the first half of this year, the food industry faced the greatest difficulties due to the increase in raw material purchase prices and the resulting rise in product shipment prices.

On the 25th, the Korea Rural Economic Institute conducted a survey on management difficulties in the first half of the year targeting 153 managers from domestic food companies and food research institutes. The results showed that difficulties caused by the rise in raw material purchase prices scored the highest at 3.97 on a 5-point scale, followed by the increase in product shipment prices at 3.71.

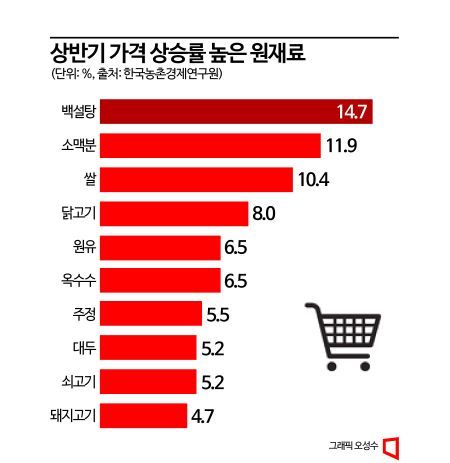

Among raw materials, the price increase rate of Baeksultang (white sugar) was the highest at 14.7% compared to the same period last year. This is believed to be due to the continuous rise in international prices caused by supply shortages of raw sugar and sugar resulting from abnormal weather conditions in the first half of this year, which affected the food manufacturing industry. Following sugar, the price increase rates for wheat flour (11.9%) and rice (10.4%) also rose by double digits compared to the same period last year. In the case of wheat flour, the increase in shipment prices appears to have been influenced by the time lag between wheat futures prices and import prices, as well as exchange rate effects.

In response to the rise in raw material prices, food companies dealt with it by raising product shipment prices (45.3%), changing the purchase sources of domestic raw materials (12.7%), and substituting imported raw materials from other countries (12.0%). In addition, some companies responded by proactively stockpiling raw materials or reducing costs in other areas, while many companies were found to have no special measures to cope with the rise in raw material prices.

Among the auxiliary materials used by food companies, packaging materials showed the largest unit price increase at 67.3%, followed by paper boxes (49.0%) and plastic containers (28.1%). This is analyzed as an effect of the increase in international pulp prices in March, which led to a rise in the supply price of white cardboard in the paper industry, resulting in a significant increase in the unit prices of packaging materials and paper boxes.

Regarding the timing of product shipment price increases reflecting the rise in raw material prices, 29.3% of companies raised prices 6 to 9 months after the increase in raw material and auxiliary material prices, followed by 3 to 6 months (22.0%), over 9 months (16.7%), and less than 3 months (13.3%). The proportion of companies that responded that the product shipment price increase timing was less than 3 months was 9.7% for large companies, which was lower than small companies (16.7%) and medium-sized companies (15.6%). This is interpreted as large companies being able to delay product shipment price increases when costs rise by purchasing and stockpiling raw materials in bulk, considering the timing of raw material procurement.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)