Although the government froze the fuel cost adjustment unit price, one component of the electricity bill for the fourth quarter of this year, out of concern for the burden on the low-income economy, electricity and gas prices have continued to rise in double digits for 18 consecutive months. The global energy prices, which surged due to the aftermath of the Russia-Ukraine war last year, have yet to subside. Recently, international oil prices have shown an upward trend again, raising concerns that the burden on low-income households due to high winter oil prices will worsen.

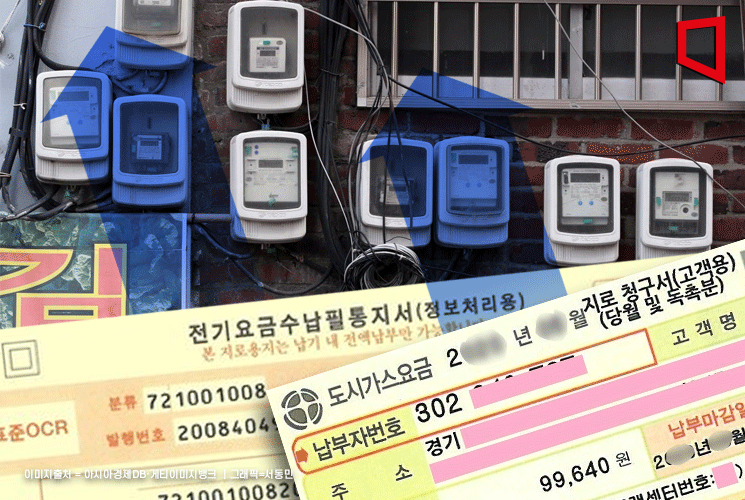

According to Statistics Korea on the 23rd, the price increase rates for electricity and city gas last month were 25.0% and 21.4%, respectively, compared to the same period last year. Electricity prices have maintained a double-digit increase for 18 months, peaking at 29.5% in January this year after recording 11.0% in April last year. Gas prices also surged up to 36.2% in October last year and are still maintaining an increase rate in the 20% range.

According to the Monthly Electricity Statistics Report published by Korea Electric Power Corporation (KEPCO), the cumulative average electricity sales price from January to July this year was 148.9 won per kWh (kilowatt-hour), a 30.9% increase compared to the same period last year (113.8 won). As the increase in electricity sales prices grew, KEPCO has escaped the negative margin structure of 'losing money the more it sells' since the beginning of this year, but on the other hand, there are criticisms that the burden on low-income households has significantly increased.

Surge in International Oil Prices, Boomerang Effect on Low-Income Households

The problem is that the double-digit energy price increases are likely to continue into next year. On the New York Mercantile Exchange (NYMEX), the West Texas Intermediate (WTI) crude oil futures price closed at $89.63 per barrel, down $0.03 (0.03%) as of the previous day. Earlier, on the 15th, it recorded $90.77 per barrel, breaking the yearly high.

The main reason behind the recent rise in oil prices is the production cut policies by oil-producing countries Saudi Arabia and Russia. Both countries decided to extend their policy of cutting production by 1.3 million barrels per day until the end of this year. At the same time, China's solid economic indicators support the outlook that supply-demand imbalances will worsen due to increased energy demand. The Organization of the Petroleum Exporting Countries (OPEC) expressed concerns that the global oil market could face a supply shortage of more than 3 million barrels per day starting next quarter.

This is a factor that raises the possibility of electricity price hikes in the fourth quarter of this year. Although the government maintained the fuel cost adjustment unit price at the current level, it has not decided to freeze the actual electricity bill. Considering the rise in international oil prices, the government plans to finalize the increase rate soon after discussions with the Ministry of Economy and Finance and the Ministry of Trade, Industry and Energy. Some expect that, considering KEPCO’s deficits, the increase rate within this year could be around 5%.

Pressure for interest rate hikes due to rising oil prices is also increasing. The U.S. Federal Open Market Committee (FOMC) kept the policy rate at 5.25?5.50% on the 20th (local time) but raised the median forecast for next year’s rate from 4.6% to 5.1%, signaling further rate hikes. As a result, the interest rate gap between Korea and the U.S. widened to 2.0 percentage points, and the dominant analysis is that the Bank of Korea will find it difficult to lower its base rate for the time being.

Consequently, the possibility of exceeding the government’s expected consumer price inflation rate for this year (3.3%) is increasing. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said at the emergency macroeconomic and financial meeting the day before, "With the prolonged high interest rates and rising international oil prices, uncertainties in the international economy are expanding, so we will maintain heightened vigilance and closely monitor market conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.