Samsung Electronics and SK Hynix, which dominate the global memory semiconductor market as the top two players, are rapidly reducing their losses amid an improving semiconductor industry outlook. Given that DRAM and NAND memory semiconductors constitute a significant portion of their businesses, the timing of their return to profitability is expected to depend on which company captures a larger share of products with faster price recovery.

On the 20th, the semiconductor industry viewed the earliest possible timing for domestic semiconductor companies to return to profitability as the fourth quarter of this year, with the latest being the first half of next year. SK Hynix President Kwak No-jung recently urged employees to work hard with the goal of turning a profit in the fourth quarter. Having started cutting memory semiconductor production earlier than Samsung Electronics and improving its product mix, SK Hynix shows confidence as its losses are rapidly shrinking.

Early expansion into the artificial intelligence (AI) market and securing leadership in the high-bandwidth memory (HBM) market have also raised expectations that the timing of profitability could be accelerated. Achieving profitability in a quarter is a critical issue for SK Hynix employees as well. If the company fails to turn a profit in the fourth quarter of this year, employees will not receive this year's wage increase. In June, SK Hynix labor and management agreed to apply a 4.5% wage increase once quarterly operating profit turns positive.

Among SK Hynix employees, while the ideal scenario is to return to profitability in the fourth quarter of this year, there is a strong perception that this goal is practically difficult to achieve at this point. However, some employees believe that profitability could be achieved on a monthly basis by the end of the year. One employee said, "As President Kwak urged, even if turning a profit in the fourth quarter is difficult, December, the last month of this year, could be the starting point for profitability."

Samsung Electronics, which has a larger deficit, is likely to see its return to profitability delayed compared to SK Hynix. A senior Samsung Electronics executive said, "Internally, expectations for the semiconductor division to turn a profit in the fourth quarter are low," adding, "There is a possibility that third-quarter results will fall short of external expectations, so it is risky to view the situation too optimistically." Samsung Electronics, which decided to cut production later than competitors like SK Hynix and Micron, posted an operating loss of 4.36 trillion won in the semiconductor division in the second quarter, barely reducing the loss from 4.58 trillion won in the first quarter. This has led to criticism that "Samsung's late decision to cut production after attempting a chicken game was a fatal mistake that slowed the industry's recovery."

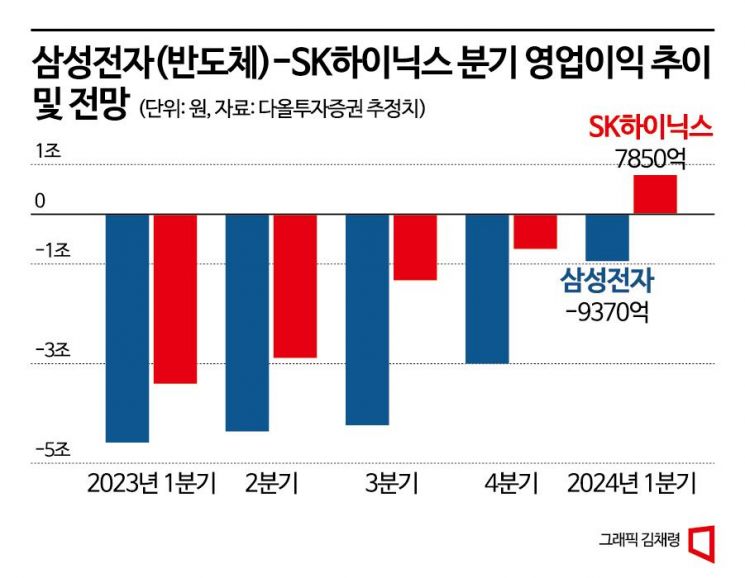

In the securities industry, there is also a diagnosis that SK Hynix, which turned a profit earlier than Samsung Electronics in the fourth quarter of last year, will also return to profitability sooner. Daol Investment & Securities forecasts Samsung Electronics' semiconductor division to return to profitability in the second quarter of next year. It expects losses of 4.232 trillion won and 2.999 trillion won in the third and fourth quarters of this year, respectively, and predicts a loss of 937 billion won in the first quarter of next year.

On the other hand, SK Hynix is expected to post losses of 1.325 trillion won and 694 billion won in the third and fourth quarters of this year, respectively, but is forecasted to return to profitability with 785 billion won in the first quarter of next year. Researcher Ko Young-min said, "With the unrivaled competitiveness of new products like DDR5 and HBM3, SK Hynix entered the upcycle earlier than competitors," adding, "A premium on average selling price (ASP) due to its monopolistic supplier position is occurring, so it is highly likely to benefit from supplier dominance until the first half of next year." Researcher Noh Geun-chang of Hyundai Motor Securities also expects both Samsung Electronics and SK Hynix to return to profitability in the first quarter of next year but forecasts that Samsung Electronics' semiconductor division losses in the third and fourth quarters will be 3.599 trillion won and 1.088 trillion won, respectively?about twice the losses of SK Hynix (1.775 trillion won in Q3 and 680 billion won in Q4).

However, there is also a view that one should not forget that Samsung Electronics' losses are accompanied by investments. Samsung Electronics' capital expenditure in the first half of this year (20.2519 trillion won) increased by about 5 trillion won compared to last year (25.2593 trillion won). Investment reduces current profits but increases future profits. If Samsung had invested at last year's level, its operating profit in the first half would have increased by 5 trillion won. In contrast, SK Hynix's capital expenditure in the first half of this year was 2.714 trillion won, nearly 7 trillion won less than the 9.597 trillion won spent in the first half of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)