Taiwan TSMC and UMC Sales Decline from January to August

Foundry Industry Forecasts Q3 Earnings Drop

Q3 Bottom Expected... Growth to Accelerate Next Year

Taiwanese foundry (semiconductor contract manufacturing) companies experienced a decline in sales in August, resulting in a disappointing performance. Due to the sluggish foundry market, the third-quarter earnings outlook for major companies is also bleak. The industry expects the market to gradually recover starting in the fourth quarter.

Taiwan's TSMC recorded sales of NT$188.686 billion in August, down 13.5% compared to the same month last year. Although sales increased by 6.2% from the previous month due to the upcoming launch of new iPhone models by its major client Apple, the overall performance remained weak. The cumulative sales from January to August this year amounted to NT$1.355777 trillion, a 5.2% decrease compared to the same period last year.

The situation is even worse for Taiwan's UMC, the fourth largest in the industry. UMC's sales in August were NT$18.952 billion, down 25.23% from last year. The cumulative sales from January to August totaled NT$148.52178 billion, a sharp 20% decline. This is due to negative monthly sales growth since January and a decrease rate exceeding 20% since May.

Given these circumstances, the third-quarter earnings outlook for the foundry industry is also gloomy. TSMC expects third-quarter sales to be between $16.7 billion and $17.5 billion, which could represent a decrease of at least 13% compared to last year's $20.23 billion. U.S.-based GlobalFoundries also projects third-quarter sales between $1.825 billion and $1.87 billion, potentially down by up to 12% from $2.074 billion in the same period last year.

Samsung Electronics does not disclose foundry sales separately. However, securities firms estimate that Samsung's system semiconductor business, including foundry, will record sales of 5 to 6 trillion KRW in the third quarter, about 14% lower than last year's estimated 7 to 8 trillion KRW. Market research firm TrendForce forecasted that due to the economic downturn, demand for smartphones, PCs, and laptops will decline in the third quarter, which could lead to a decrease in Samsung Electronics' foundry sales compared to the second quarter.

There is a positive outlook that the foundry market may hit bottom in the third quarter. TrendForce expects that orders for high value-added processes will increase, leading to higher sales for the top 10 foundry companies. They explained that "after rebounding from the third-quarter low point, gradual growth is possible."

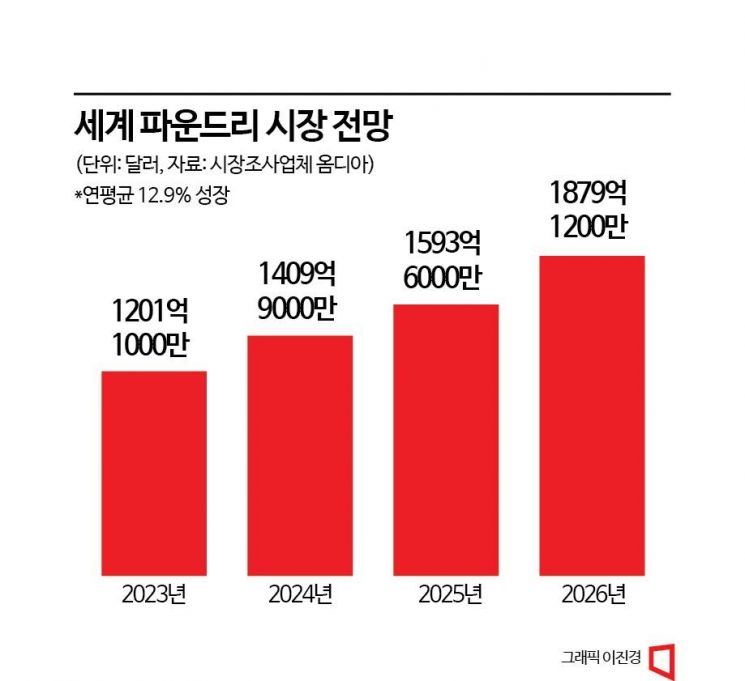

A full market recovery is anticipated starting next year. Major market research firms such as Omdia and IDC share the common forecast that the foundry market will grow next year. It was also suggested that investments in the foundry industry, centered on advanced processes, will continue, potentially increasing the scale of semiconductor equipment investments within factories.

The Semiconductor Equipment and Materials International (SEMI) predicted, "Investment in foundry equipment will increase by 5% to $51.5 billion in 2024 compared to this year," and added, "It will lead the overall growth of the semiconductor fab (factory) equipment market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.