i-SENS, First Domestic Company to Launch CGM

Blood Sugar Management with Sensor Without Blood Draw

i-SENS has entered the domestic market, which has been dominated by foreign companies, by launching the first continuous glucose monitor (CGM) developed by a Korean company. The device, which can be conveniently attached to the body to measure blood sugar without the need for blood sampling, is expected to drive significant market growth due to its improved convenience compared to traditional blood glucose meters.

The ‘CareSens Air,’ launched by i-SENS on the 11th, is the first domestically developed and released ‘No. 1 Korean-made CGM.’ After obtaining product approval from the Ministry of Food and Drug Safety in June, it was also registered for health insurance coverage in July. In the domestic market, Dexcom’s ‘Dexcom G6,’ Abbott’s ‘FreeStyle Libre,’ and Medtronic’s ‘Guardian 4’ are already being sold ahead of CareSens Air.

CGM is a medical device that allows real-time blood glucose monitoring through a sensor attached to the body without the need for finger-prick blood sampling. Since it eliminates the blood sampling process and allows easy blood sugar checking via a smartphone application linked to the CGM, it enhances convenience for diabetes patients. The CGMs released in Korea involve attaching a sensor that can be used for a certain period to the body, which measures real-time blood glucose and transmits the data to a smartphone. The accompanying app provides blood glucose management functions such as monitoring and hypoglycemia alerts.

i-SENS emphasizes the CareSens Air’s advantages of being the most affordable CGM among those released domestically and having the longest sensor usage period. CareSens Air can be used for 15 days after attachment, whereas previously released products can be used for a minimum of 7 days to a maximum of 14 days depending on the product. In terms of price, it is also the cheapest CGM on the domestic market based on a one-month usage standard. As of the 12th, on each company’s official online mall, the costs for about one month’s use without insurance coverage are ▲CareSens Air (165,000 KRW) ▲FreeStyle Libre (202,400 KRW) ▲Guardian 4 (280,000 KRW) ▲Dexcom G6 (300,000 KRW). Currently, insurance coverage for CGMs is only provided for type 1 diabetes patients, so type 2 diabetes patients, who account for over 90% of diabetes cases, are sensitive to CGM prices.

However, CareSens Air has the drawback that it requires blood glucose values measured by a traditional finger-prick blood glucose meter to be input once a day to calibrate the blood glucose readings. Regarding this, an i-SENS official explained, “Calibration of blood glucose values is necessary for accurate real-time blood glucose measurement,” adding, “After the first application, blood glucose values must be input twice at 12-hour intervals, and then once every 24 hours using a blood glucose meter.” Other CGMs sold domestically do not require this calibration process.

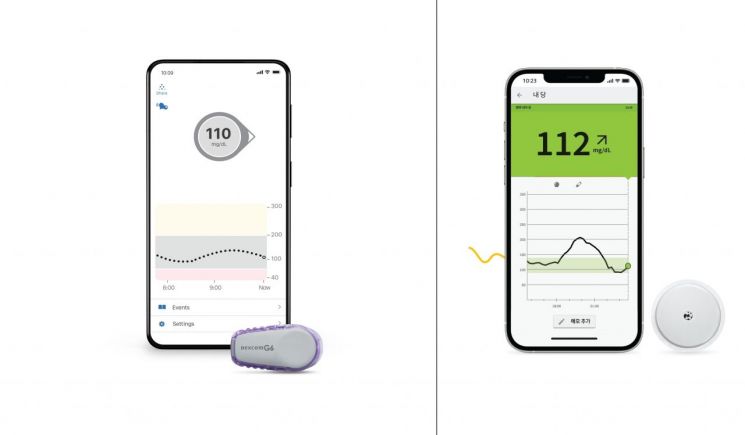

Continuous Glucose Monitoring (CGM) devices Dexcom's 'Dexcom G6' (left) and Abbott's 'FreeStyle Libre'. [Photo by each company]

Continuous Glucose Monitoring (CGM) devices Dexcom's 'Dexcom G6' (left) and Abbott's 'FreeStyle Libre'. [Photo by each company]

Other companies are also reorganizing their strategies. Huons, responsible for the domestic sales of Dexcom G6, has decided to expand the free provision of transmitters, which was previously limited to type 1 diabetes patients, to include type 2 diabetes patients as well. Accordingly, type 2 diabetes patients can receive a transmitter free of charge even if they use the Dexcom G6 for only one month. The transmitter is a device that transmits blood glucose measured by the sensor attached to the body to the user’s device such as a smartphone, and the Dexcom G6 consists of a sensor and a transmitter.

The integration of CGM with healthcare services is also expected to become more active. Kakao Healthcare plans to prominently feature blood glucose care services using CGM in its healthcare service scheduled for release in the fourth quarter of this year. The core concept is to link CGM with a healthcare app so that patients can check their blood glucose themselves and share blood glucose data with medical professionals for management. To this end, Kakao Healthcare has signed a business agreement with Dexcom and i-SENS to develop blood glucose management solutions.

Meanwhile, the CGM market size is also showing annual growth. According to global market research firm Research and Markets, the global CGM market is expected to grow from $4.6 billion (approximately 6.1 trillion KRW) in 2019 to over $31.1 billion (approximately 41.3 trillion KRW) by 2026. The compound annual growth rate (CAGR) during this period is projected to be 27.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)