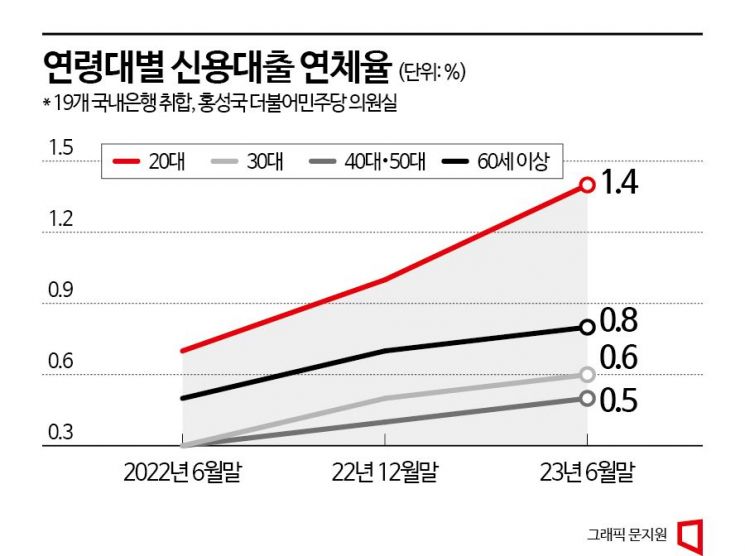

Delinquency Rate for Under 20s at 1.4% as of Late June

30s Also Record 0.6%, Doubling Year-on-Year

As high-interest rates persist along with failures in debt-financed investments (known as "bit-tu"), the number of young people unable to repay their debts is increasing. The delinquency rate on credit loans for those aged 20 and under has surpassed 1%, marking the highest level among all age groups.

According to data on "Credit Loan Delinquency Rates by Age Group from 19 Domestic Banks" obtained by Asia Economy on the 12th through the office of Hong Seong-guk, a member of the National Assembly's Planning and Finance Committee from the Democratic Party of Korea, the delinquency rate for those aged 20 and under stood at 1.4% as of the end of June. This represents a 0.7 percentage point increase from the same period last year (0.7%), doubling in rate. This is the highest level in about five years since the third quarter of 2018. The delinquency rate for those aged 20 and under, which had been below 1%, exceeded 1% for the first time at the end of last year, rose to 1.3% at the end of March this year, and reached the mid-1% range by the end of June.

The overall credit loan delinquency rate also doubled from 0.3% in the same period last year to 0.6%. Looking at delinquency rates by age group, those in their 30s also saw an increase to 0.6%, doubling from 0.3% a year earlier. The delinquency rates for those in their 40s and 50s rose by 0.2 percentage points each to 0.5%. For those aged 60 and above, the credit loan delinquency rate increased by 0.3 percentage points from 0.5% at the end of June last year to 0.8% at the end of June this year.

While the total number of credit loan borrowers showed a declining trend, the number of borrowers in their 20s and those aged 60 and above increased. As of the end of June, the total number of credit loan borrowers was 6,886,815, a decrease of 25,511 from 6,912,326 in June last year. However, the number of borrowers in their 20s increased by over 80,000 during the same period, from 610,474 to 691,948. By age group, as of the end of June, the largest number of credit loan borrowers was in their 40s at 2,058,655, followed by those in their 30s (1,648,597), 50s (1,614,285), and 60 and above (873,330).

As of the end of June, the outstanding balance of credit loans was 163.8 trillion won, down 20.6 trillion won from 184.4 trillion won in June last year. The outstanding credit loan balance for those in their 20s was 7.5 trillion won, the smallest share overall. The largest outstanding balance was among those in their 40s at 59.4 trillion won, followed by those in their 50s at 43.9 trillion won, 30s at 40.9 trillion won, and 60 and above at 12 trillion won.

Financial authorities analyze that the high delinquency rates among borrowers in their 20s and 30s are due to relatively limited income capacity and the fact that many young people have recently engaged in leveraged investments through credit loans. Professor Seo Ji-yong of Sangmyung University’s Department of Business Administration explained, "The securities market situation has not improved as expected, and young people have lower income capacity compared to middle-aged groups, compounded by the high-interest rate environment."

The Bank of Korea also pointed out in its Financial Stability Report released in June that "It is necessary to pay attention to the fact that the proportion of household loans taken out by borrowers aged 30 and under since 2020 is higher than in the past," and warned, "Given their vulnerable income base, there is a possibility that delinquency rates on household loans taken out since 2020, especially among those aged 30 and under, could rise higher than expected."

Regarding this, Assemblyman Hong stated, "This is the result of a structural phenomenon that has transformed the generation that used to save money in their 20s into a generation that borrows," adding, "We must also pay attention to the crisis among the elderly. South Korea, which has the highest elderly poverty rate, is facing an 'unprepared aging' issue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)