Korea Institute of Finance Report

"Expansion of Insolvency in Real Estate, Transportation, and Construction Industries"

The debt of distressed companies with a default probability exceeding 10% has increased 2.3 times in four years.

Senior Research Fellow Lee Ji-eon of the Korea Institute of Finance revealed this in the report titled "Corporate Debt Risk and Credit Soundness Estimation" on the 10th.

Senior Research Fellow Lee analyzed about 35,000 non-financial companies listed on KOSPI, KOSDAQ, KONEX, and those subject to external audit laws, defining companies with a default probability exceeding 10% as distressed companies.

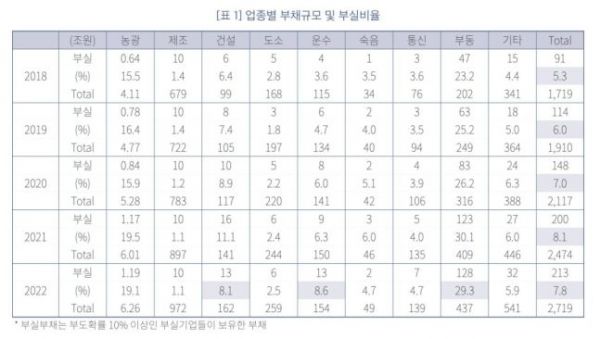

As a result, the total debt of the analyzed companies increased from 1,719 trillion won in 2018 to 2,719 trillion won last year, growing at an average annual rate of 12%. Meanwhile, the debt of distressed companies rose from 91 trillion won to 213 trillion won during the same period, increasing at an average annual rate of 24%, showing a faster growth rate. The proportion of distressed company debt in total corporate debt also grew from 5.3% in 2018 to 7.8% last year over the past five years.

By industry, real estate, transportation, and construction sectors were found to have significant distress.

Senior Research Fellow Lee calculated industry default probabilities based on corporate default probabilities and applied these to the loan portfolios of domestic banks and savings banks. As a result, credit risk, defined as distressed loans divided by total corporate loans, decreased in 2019 but increased significantly in 2020?2021, and remained at that level in 2022.

As of the end of last year, comparing the ratio of credit risk amount (distressed loans) to equity capital by industry showed that savings banks (18.8%) had a higher ratio than domestic banks (11.8%).

Senior Research Fellow Lee stated, "In terms of loss-bearing capacity, it is judged that savings banks have a relatively higher need for capital expansion compared to domestic banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.