Sharp Rise in Stocks Including Rainbow Robotics Invested by Samsung

Doosan Robotics, a Major IPO, Scheduled for Listing in Late Next Month

Hanwha Robotics, Hanwha Group's Collaborative Robot Company, Also Set to Launch

As Doosan Robotics, considered a major player in this year's initial public offering (IPO) market, prepares for its listing, robot-related stocks are stirring in the domestic stock market. While the secondary battery theme has slowed down, investments in the robot industry by major domestic conglomerates such as Doosan, Samsung Electronics, and Hanwha are gaining momentum, attracting increased attention from investors.

According to the financial investment industry, Doosan Robotics, in which Doosan holds about 68% of the shares, will conduct a demand forecast from the 11th to the 15th ahead of its listing. This will be followed by a public subscription for general investors over two days, on the 21st and 22nd. The company has proposed a desired public offering price range of 21,000 to 26,000 KRW. Accordingly, the market capitalization is expected to reach up to 1.7 trillion KRW. The scheduled listing is set for early next month.

Doosan Robotics posted sales of 23.7 billion KRW and an operating loss of 9.9 billion KRW in the first half of this year. Since it is still in the investment phase, the timing of turning a profit is of interest. The securities industry offers a positive outlook, suggesting that the profit generation timing could be earlier than expected, considering the growth trend of the collaborative robot industry. Na Seung-doo, a researcher at SK Securities, said, "Although the listing is being pursued under the unicorn special case, considering the increased demand for collaborative robots caused by the global labor supply imbalance after COVID-19, the timing of achieving profitability is likely to be brought forward. The proportion of freely tradable shares immediately after listing is about 25%, and considering the recent strong trend in the artificial intelligence and robot sectors, short-term supply and demand pressure is expected to be minimal."

In the industry, it is expected that Doosan Robotics will take over the rising baton in the second half of the year following Rainbow Robotics, which reversed the KOSDAQ chart trend in the first half, supporting the strong trend of the domestic robot industry. Rainbow Robotics was ranked 92nd in market capitalization on the KOSDAQ market as of December 29, 2022, but its stock price surged sharply this year following Samsung Electronics' investment, climbing to 7th place in market capitalization, surpassing HLB, SM, and Pearl Abyss. During this period, its market capitalization grew from 578.2 billion KRW to 3.6576 trillion KRW, increasing 6.3 times in just eight months.

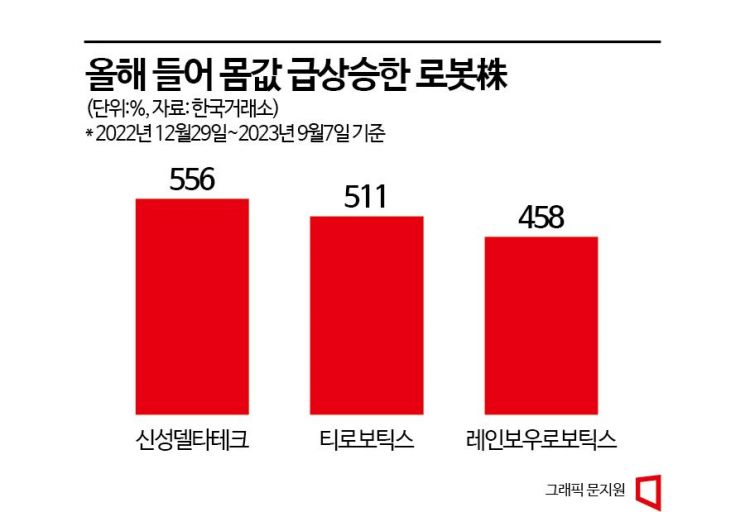

Not only Rainbow Robotics but also robot-related stocks such as Shinseong Delta Tech and T Robotics have shown steep stock price increases, standing out in the market. Compared to the end of last year, Shinseong Delta Tech's stock price has risen about 560%, and T Robotics about 510%. Rainbow Robotics also recorded an increase of about 500%, placing all three stocks among the top performers in stock price growth among all domestic listed companies this year. Robot-related exchange-traded funds (ETFs) are also very strong. KODEX K-Robot Active, listed in November last year, closed at 15,390 KRW the previous day, nearly 70% higher than at the beginning of the year.

The securities industry views the strong trend in robot-related stocks as differentiated from so-called 'theme stocks' that flare up temporarily. It is not merely about expectations for a 'future industry.' The market changes are clear, with growing robot demand due to labor shortages and rising labor costs, as well as the establishment of related infrastructure. Yang Seung-yoon, a researcher at Eugene Investment & Securities, emphasized, "In the context of structural social changes such as population decline, automation demand will continue to grow, and with advancements in AI and robot-related technologies, a wider variety of robots will be utilized. The robot industry is not a short-term theme but a mid- to long-term trend."

Aggressive investments by large corporations in related fields also support this. Following Samsung and Doosan, Hanwha Group is reportedly planning to launch Hanwha Robotics, a collaborative robot company, next month. Hanwha Group plans to spin off its collaborative robot and mobile businesses and establish Hanwha Robotics through a joint investment with its subsidiary Hanwha Hotels & Resorts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)