Up to 30% Tax Credit on Video Content Production Costs

Excluding Games and Electronic Publications

The government has significantly increased the tax credit rate for video content production costs to secure the global competitiveness of the K-content industry. However, the gaming industry, which contributes the most to content industry exports, and the publishing industry, which provides original IP (intellectual property) for video production, have been excluded from the tax credit targets, leading to growing dissatisfaction.

According to the recently finalized '2023 Tax Law Amendment' on the 7th, the tax credit rate for video content production costs will be expanded from the current '3% for large corporations, 7% for medium-sized enterprises, and 10% for small businesses' to '5% for large corporations, 10% for medium-sized enterprises, and 15% for small businesses.' The amendment also includes additional credits for video content with significant industry ripple effects, such as the Netflix drama "Ojingeo Geim" (Squid Game), allowing large corporations to receive up to 15%, medium-sized enterprises up to 20%, and small businesses up to 30% in tax credits.

The gaming and publishing industries are not entirely pleased with this news because the tax benefits are limited only to 'video content' production costs. These industries argue that providing tax benefits solely to video content constitutes 'industry discrimination.'

A representative from the Korea Game Industry Association stated, "Requests for tax support from domestic game companies have been consistently made, but there are no specialized support measures tailored for game production. The government says it is difficult to introduce specialized tax support measures exclusively for games, which can be seen as industry discrimination. To enhance the global competitiveness of our country's content, support for the gaming sector should not be neglected," emphasizing the point.

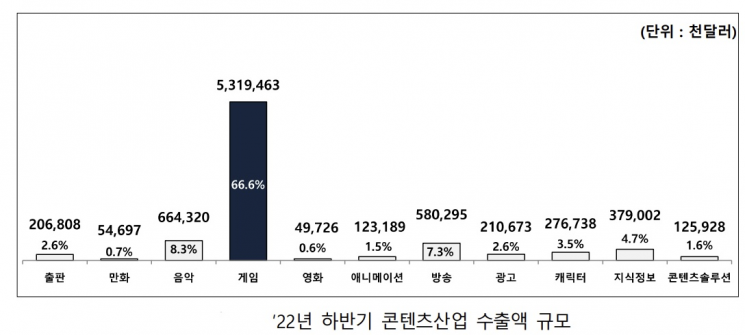

In fact, games contribute the most to domestic content exports. According to the 2022 second half and annual content industry trend analysis report published by the Korea Creative Content Agency, last year’s content export amount was $13.3798 billion (17.0196 trillion KRW), of which the game industry export amount was $8.97338 billion (11.4761 trillion KRW), accounting for 67.4% of the total content exports last year.

The publishing industry is also expressing dissatisfaction. A representative from the Korea Publishers Association said, "We have proposed tax credits for book production costs since 2017, but it has never been officially discussed. The publishing industry has been excluded from various government support benefits. While paper prices have increased several times over the past decade, the average price of new books has only increased by 3% annually," lamenting the situation.

Given that video content based on webtoons and novels has been performing well in the global OTT market recently, their opinion is that original creators should be treated equally as fellow content producers.

Reflecting these industry voices, related legislation has been continuously proposed. The 'Partial Amendment to the Restriction of Special Taxation Act' recently proposed by Lee Byung-hoon of the Democratic Party includes changing the name of video content to cultural content and raising the tax credit rates for digital comics, games, electronic publications, and others.

Independent lawmaker Hwang Bo-seung-hee also pointed out, "The awareness that cultural rights are one of the basic human rights is spreading. There are opinions that tax support should be expanded not only for video content but also for music, games, publishing, comics, and overall cultural content," and proposed a similar amendment to the Restriction of Special Taxation Act along with Lee.

However, the government holds a skeptical stance on expanding tax credits. A Ministry of Economy and Finance official said, "We revised the tax law to support video content, which greatly contributes to the creation of Hallyu culture and to spread Hallyu. Compared to video content, comics and games are judged to have lower effects on enhancing the image of Korean culture and attracting tourists to filming locations. Therefore, policy review is needed regarding applying tax credits to production costs," the official explained.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)