Investigation Underway on Company Fund Support, Unfair Pressure, and VVIP Customized Design

Lee Bok-hyun, Governor: "Both Sales and Asset Management Firms Thought It Was Money from High-Ranking Officials"

On the 4th, Lee Bok-hyun, Governor of the Financial Supervisory Service, is responding at the National Assembly's Political Affairs Committee.

On the 4th, Lee Bok-hyun, Governor of the Financial Supervisory Service, is responding at the National Assembly's Political Affairs Committee. [Photo by Yonhap News]

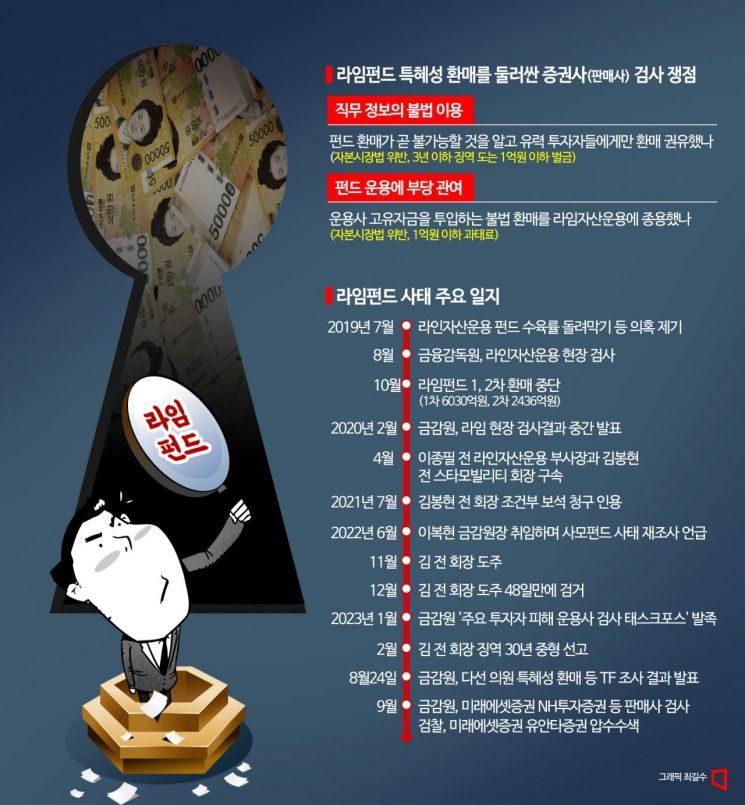

Following the Financial Supervisory Service's (FSS) announcement of additional inspection results regarding the 'Lime Fund preferential redemption suspicion,' and the subsequent re-inspection of the distributors (securities firms), the prosecution has intensified the aftermath of the Lime Fund scandal by conducting raids targeting these firms. On the 4th, Lee Bok-hyun, Governor of the FSS, appeared at the plenary session of the National Assembly's Political Affairs Committee and stated, "This preferential redemption of the Lime Fund clearly constitutes a violation of the Capital Markets Act," while Kim Sang-hee, a member of the Democratic Party of Korea, was pointed out as a beneficiary stemming from illegal activities.

The core of the redemption issue lies in Lime Asset Management's use of company funds. Another contentious point is the background behind Mirae Asset Securities, the distributor, recommending redemption during the process when Representative Kim Sang-hee recovered her investment just before the Lime Fund redemption was suspended. The fact that the Lime Fund product invested in by Representative Kim had more favorable redemption conditions compared to products subscribed to by general investors has also fueled the preferential treatment controversy.

Why Did Lime Use Company Funds? ... Issues of Undue Pressure and Quid Pro Quo

The FSS examined 63 open-ended funds managed by Lime Asset Management and confirmed that among them, 31 funds had 223 individuals redeeming a total of 306.9 billion KRW. All these transactions occurred in September 2019, one month before Lime Asset Management suspended redemptions. Of the 31 funds, 27 redeemed using their own funds, but four funds, including Lime Martini No. 4 (involving 29 people), used other fund monies or proprietary funds to make payments. The FSS viewed the shifting of losses from these funds to others and the redemption granted exclusively to specific parties despite the impossibility of redemption as preferential treatment.

The first issue regarding preferential redemption is the reason behind Lime Asset Management's use of company funds. According to the FSS investigation, between August and September 2019, just before Lime Fund's large-scale redemption suspension announcement, four Lime funds faced asset impairment and liquidity shortages, leading to insufficient funds to respond to redemptions. Lime used 12.5 billion KRW from other fund monies and 450 million KRW of proprietary funds to fulfill redemptions. This is illegal under current law and Lime's responsibility. Among the 29 recipients of illegal redemptions (including corporations) were Representative Kim, the National Agricultural Cooperative Federation, and Korea Zinc.

Lime Funds mainly held assets difficult to sell on the market, such as convertible bonds (CBs) of listed companies or private placement bonds of unlisted companies, making redemption challenging. Therefore, it is counterintuitive that the management company voluntarily absorbed the fund's impaired assets. The 'Lime Martini No. 4' fund, subscribed to by Representative Kim through Mirae Asset Securities, is an open-ended long-short fund. It is composed of domestic stocks and structurally different from funds like Lime Pluto or Thetis, which had a high proportion of illiquid assets such as CBs or private placement bonds. However, it included about 20% illiquid assets like CBs and redeemable convertible preferred stocks (RCPS) of unlisted companies. Governor Lee stated regarding Lime Martini No. 4, "It is an open-ended fund, but redemption was impossible at that time," countering Representative Kim's claim that it was an open-ended fund mainly holding marketable assets and could be redeemed anytime. He added, "(The declaration of Lime's inability to redeem) came 2-3 weeks before when everyone was demanding their money back," and said, "If proprietary funds remained, they could have been used to compensate innocent victims," emphasizing that the violation of the Capital Markets Act is clear.

An industry insider said, "It needs to be clarified why the management company bore the sacrifice of using proprietary assets to absorb impaired assets and redeem investments," adding, "Whether there was any quid pro quo or undue pressure leading to exceptional redemption for specific investors will be a major issue in this preferential treatment suspicion." Another insider stated, "Lime's use of other funds and proprietary funds to redeem some investors is illegal," and "Since it caused losses to other customers unrelated to Lime Funds, it constitutes an unsound business practice under the Capital Markets Act."

However, while preferential redemption to specific investors is indeed preferential treatment, some believe that criminal liability may not be imposed on Lime. Investigations need to confirm whether the investors who received preferential redemption used certain information or exerted undue pressure during the redemption process. A lawyer commented, "The key issue will be whether Lime Asset Management was subjected to undue pressure from political circles and whether there was any quid pro quo leading to redemption for specific investors using company funds." Governor Lee asserted, "What is certain is that both the distributors and the management company knew that the fund's money belonged to high-ranking officials," and added, "Withdrawing money from proprietary assets to cover customer assets is illegal even without involving investigative agencies."

Did Securities Firms Unduly Intervene?

Initially, the FSS's inspection focus on preferential redemption was on the management company, Lime, but after Representative Kim stated that "the redemption was at the recommendation of the fund distributor, Mirae Asset Securities," the investigation expanded to securities firms. The FSS began inspecting securities firms that sold Lime Funds, including Mirae Asset and NH Investment & Securities, over preferential redemption suspicions. The prosecution also joined the investigation. The Financial and Securities Crime Joint Investigation Team of the Seoul Southern District Prosecutors' Office conducted raids on Mirae Asset and Yuanta Securities.

Whether securities firms engaged in illegal acts during the process of using illegal funds to redeem only certain investors, including Representative Kim, has emerged as another key issue. There is growing controversy over whether securities firms gave special treatment to so-called VIP clients.

The prosecution and financial authorities are investigating whether securities firms used insider information during the redemption process or exerted pressure on Lime Asset Management. Mirae Asset claimed that it took preemptive measures (redemption recommendations) just before the large-scale redemption suspension period (October 2019) after predicting losses in the Lime Fund in advance. The National Agricultural Cooperative Federation stated that, unlike Representative Kim, it applied for redemption based on its own judgment without receiving redemption recommendations from the distributor NH Investment & Securities.

The financial authorities and prosecution plan to focus on whether there was 'illegal use of job-related information.' Under the Capital Markets Act, securities firm employees must not use 'non-public information obtained through their duties' for the 'benefit of a third party' without justifiable reasons. If Mirae Asset employees learned specific information about Lime's redemption suspension timing first and then recommended returning money to Representative Kim and others in advance, this would apply. Whether Mirae Asset recommended redemption to other investors who subscribed to Lime Funds besides Representative Kim is also a sensitive issue. If securities firms encouraged Lime Asset Management's illegal redemption for influential investors, it would constitute 'unsound business practices' and be subject to sanctions. An industry insider said, "The key investigation point will be whether Lime Asset Management, usually in a dominant position, was pressured by distributors (large securities firms) to provide illegal preferential redemptions using company funds."

Meanwhile, the fact that the Mirae Asset employee who recommended redemption to Representative Kim was revealed to be her high school junior has drawn attention to their personal relationship. In response to a question from Yoon Chang-hyun, a member of the People Power Party, asking, "What if there was a special relationship between Mirae Asset's responsible PB and the multi-term lawmaker (Representative Kim Sang-hee), and information was shared in advance leading to redemption requests?" Governor Lee replied, "Although hypothetical, there is a possibility of establishing joint illegal acts." Regarding the overall suspicion of prior information sharing and exchanges between PBs and powerful individuals, Governor Lee said, "The transaction itself is clearly illegal," and added, "The conspiracy with other related parties is under investigation by the prosecution."

Controversy Over Customized VVIP Funds

Victims who did not receive their investments back due to Lime's redemption suspension declaration are raising their voices, claiming that the Lime Martini No. 4 fund, which Representative Kim subscribed to, itself was preferential treatment. This aligns with the controversy surrounding Thetis No. 11, sold earlier by Daishin Securities.

The nature of these funds as 'preferential funds for a select few' lies in their subscribers and structure. Lime Martini No. 4 is an open-ended fund allowing redemption applications twice a week, with investors receiving their money five business days after applying for redemption. The problem is that general investors who invested in open-ended funds, like Representative Kim, mostly could only apply for redemption once a month and had to wait a month after application to receive their money. Jung Gu-jip, co-representative of the Lime Fund Fraud Victims Countermeasure Committee, criticized, "It was a Lime Fund fundamentally different in lineage from products subscribed to by the general public."

Kim Jeong-cheol, lead attorney at Law Firm Woori, also claimed that Lime Martini No. 4 was a fund created for specific individuals. Besides redemption conditions, the fund had only 16 subscribers. At that time, Lime Funds were sold with the maximum standard of 49 subscribers, but this fund had only 16, all of whom redeemed their investments just before the redemption suspension crisis.

Thetis No. 11, which sparked controversy as a fund for a select few, consisted of only six investors. Thetis No. 11, sold by Daishin Securities, allowed daily redemptions, with investment money deposited four days after application. The sales commission rate was set at 0.04%, with redemption fees and performance fees at 0%.

Considering that other Lime Funds deducted up to 70% of profits as sales commissions and performance fees, many pointed out that this was a genuine preferential fund. The six subscribers included former Lime Asset Management Vice President Lee Jong-pil, company A believed to be effectively operated by Lee, Choi Min-seok, Executive Director of Korea Zinc and third-generation heir of Youngpoong Group founder Choi Ki-ho, and his family (four members). Executive Director Choi is the son-in-law of former Prime Minister Kim Boo-kyum. Essentially, five of the six subscribers were family members of former Prime Minister Kim's second daughter. The remaining subscriber was company A, a special-related party influenced by former Vice President Lee. There are many suspicions that former Vice President Lee designed a customized VVIP fund involving company A for the family of candidate Kim's second daughter. Daishin Securities and former Vice President Lee were also revealed in the prosecution's investigation to have tried to return investment funds to former Prime Minister Kim Boo-kyum's son-in-law and daughter’s family before the Lime Fund scandal.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.